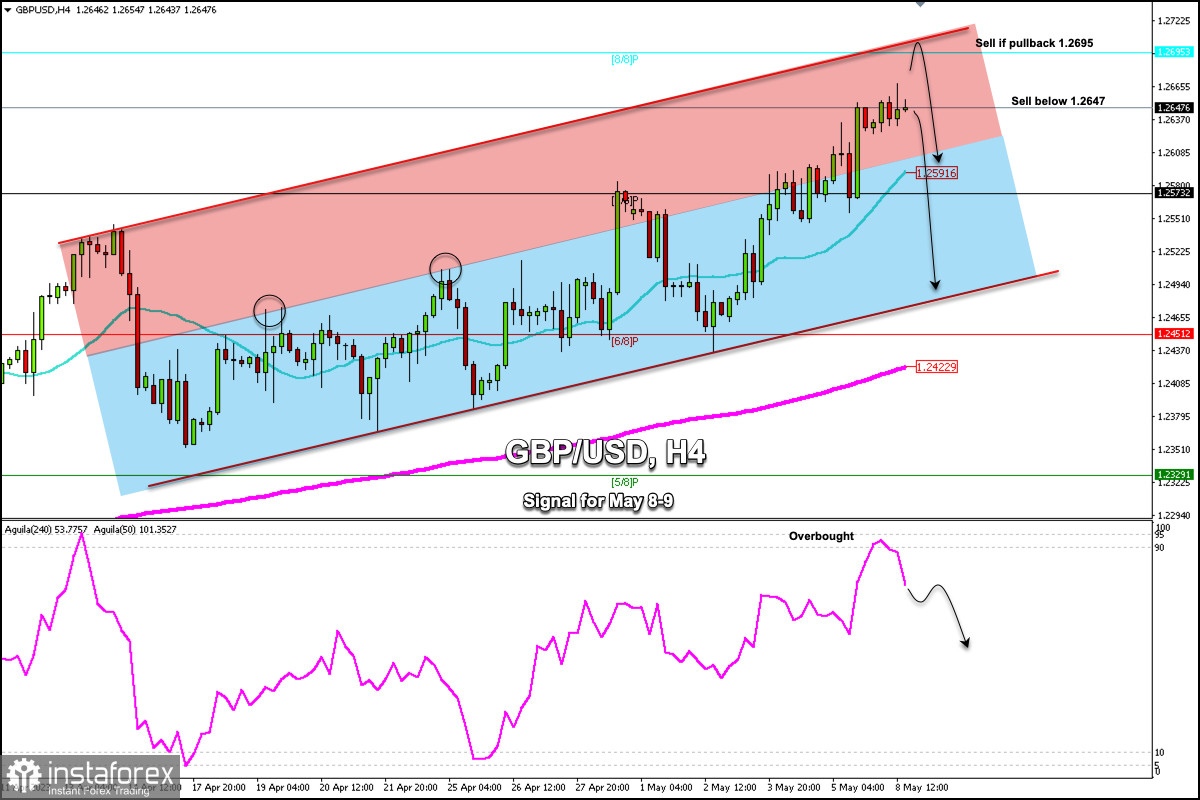

Early in the American session, the British pound was trading around 1.2647 after reaching a high of 1.2668 during the European session. We expect the British pound to continue its technical correction in the coming hours as it is showing signs of overbought.

The last candles in H-4 charts showed a signal of a possible technical correction for the next few days.

If the GBP/USD pair falls below 1.2666, a bearish movement could occur and the price could reach the support zone of the 21 SMA located at 1.2591. A sharp break below this last support could accelerate a decline to the 1.25 zone, which coincides with the bottom of the bullish channel.

According to the 4-hour chart, we can see that the British pound is trading within an uptrend channel formed on April 13. The latest movement observed is that the pound is showing signs of exhaustion. For the uptrend to resume, it must settle above 1.2670. Otherwise, it will be showing a correction for the next few hours to the psychological level of 1.25.

Fundamentally, the upside potential of GBP/USD looks limited, at least for now, as investors prefer to wait for the US inflation data, scheduled for Wednesday.

On Thursday, analysts expect a 0.25% increase in the interest rate in the United Kingdom. This data has already been priced in by the market. If Bailey is decisive in his speech, it could favor the British pound. Otherwise, we could see a fall in the GBP/USD pair to levels of 1.24.

Our trading plan for the next few hours is to sell below 1.2647 with targets at 1.2591 and 1.2490. The eagle indicator is giving a negative signal which supports our bearish strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română