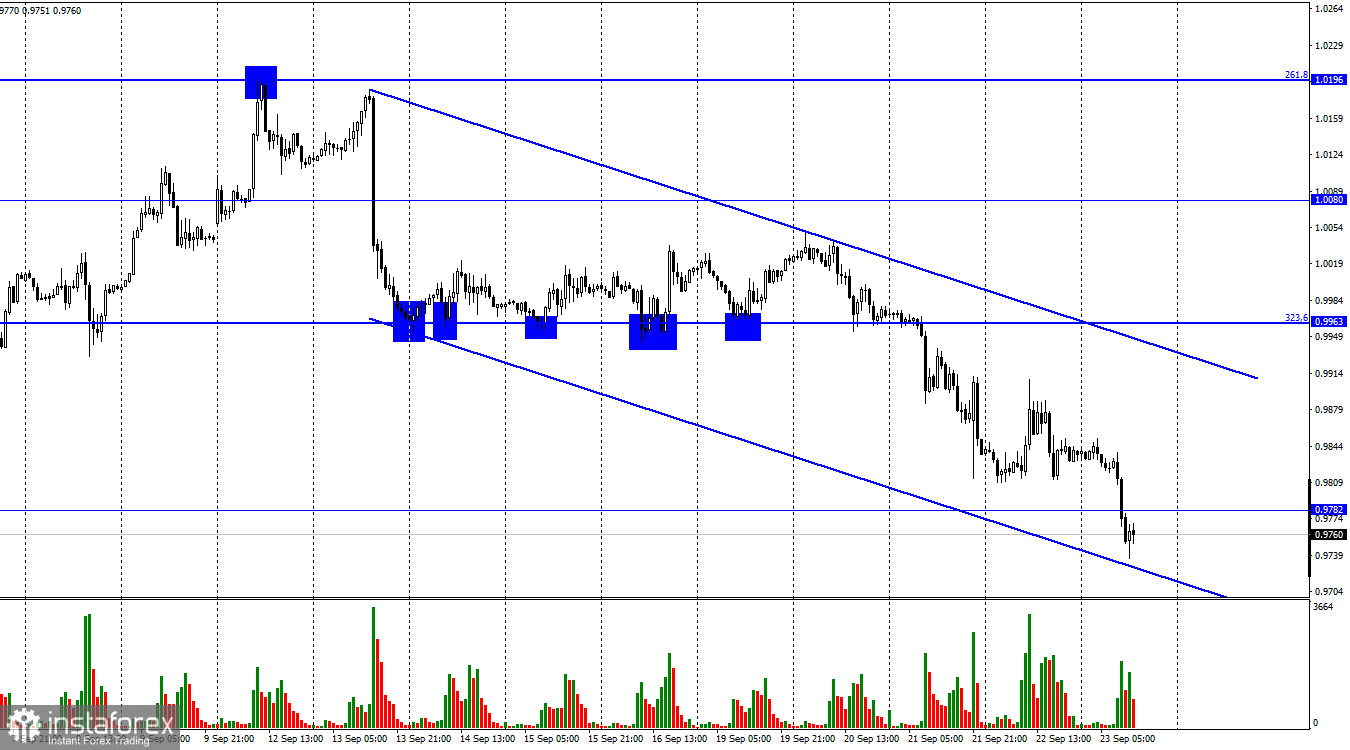

The EUR/USD pair continued the process of falling on Thursday and secured below the level of 0.9782. Thus, the fall in quotes can now be continued toward the next corrective level of 423.6% (0.9585). What can I say if the European currency is falling almost every day? Today, traders do not need an information background to resume selling the euro currency. The indices of business activity in the European Union turned out to be slightly weaker than expected, and the euro is flying into the abyss again, losing about a hundred pips in a few hours. However, I believe that it is not about business activity. The most important factor in the fall of the euro now is not even the results of the meetings of the ECB or the Fed but the deterioration of geopolitics. This week, a partial mobilization was announced in Russia, which many experts already call "just a mobilization." If someone thought this was a joke or only the chosen ones would be called, then, in reality, summonses to military enlistment offices have begun to be distributed on the streets. The number of Russians seeking to leave the country has increased significantly.

All this suggests that this is not a joke, and such a huge number of mobilized (according to official statements of the government, about 300 thousand) are unlikely to be called up to go through exercises just in case. This event gives me a reason to assume that the Ukrainian-Russian conflict will flare up with renewed vigor in the near future. New sanctions against Russia may follow from the Western world, which Moscow is no longer afraid of. At the same time, the flow of weapons to Ukraine from the West may increase, and I don't even want to think about how this whole conflict may end, given the regular statements of Moscow and Western leaders about their readiness to press the "red button." Traders feel the situation is tense and try to transfer their assets to the safest instruments. The dollar is among the currencies, so new mass purchases have begun.

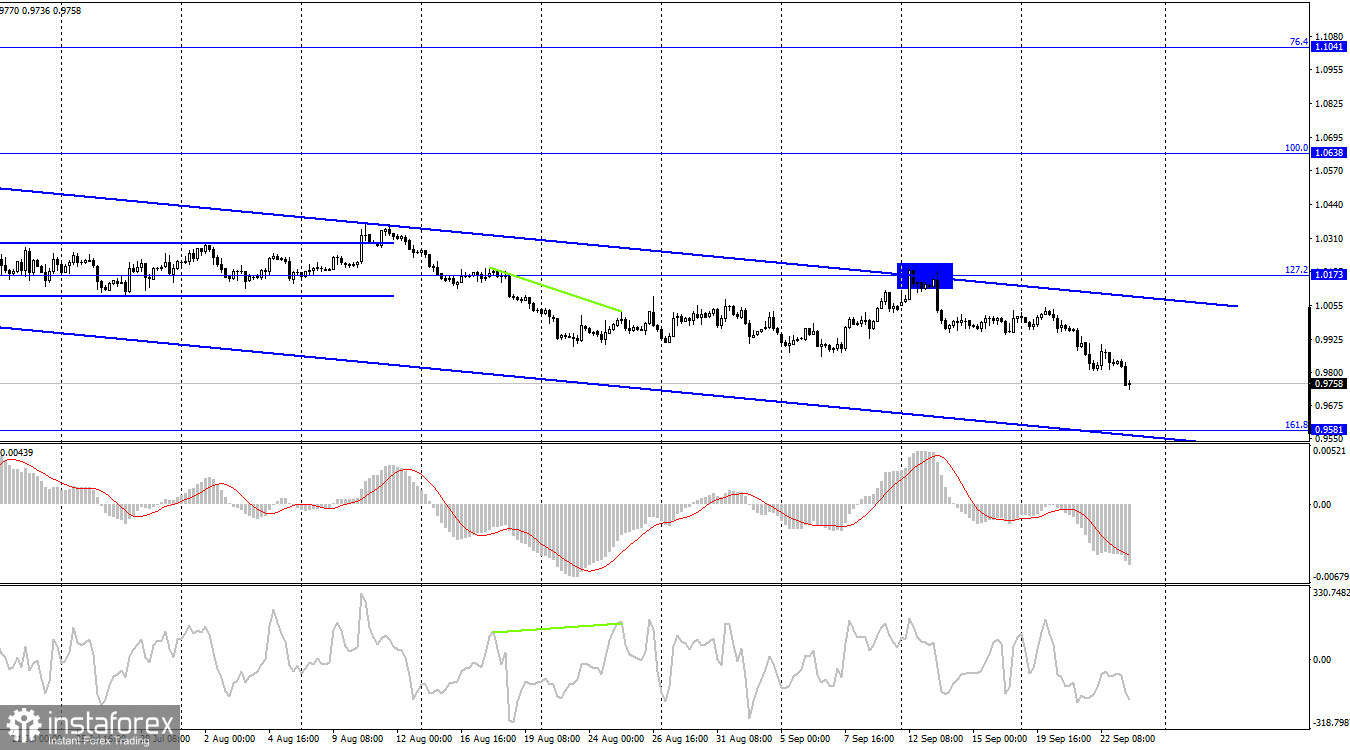

On the 4-hour chart, the pair performed a rebound from the corrective level of 127.2% (1.0173), a reversal in favor of the US currency, and continues to fall towards the corrective level of 161.8% (0.9581). The downward trend corridor continues to characterize the mood of traders as "bearish." Closing the pair's rate above the corridor may change the mood of traders to "bullish" for a long time, but this option is fantastic so far.

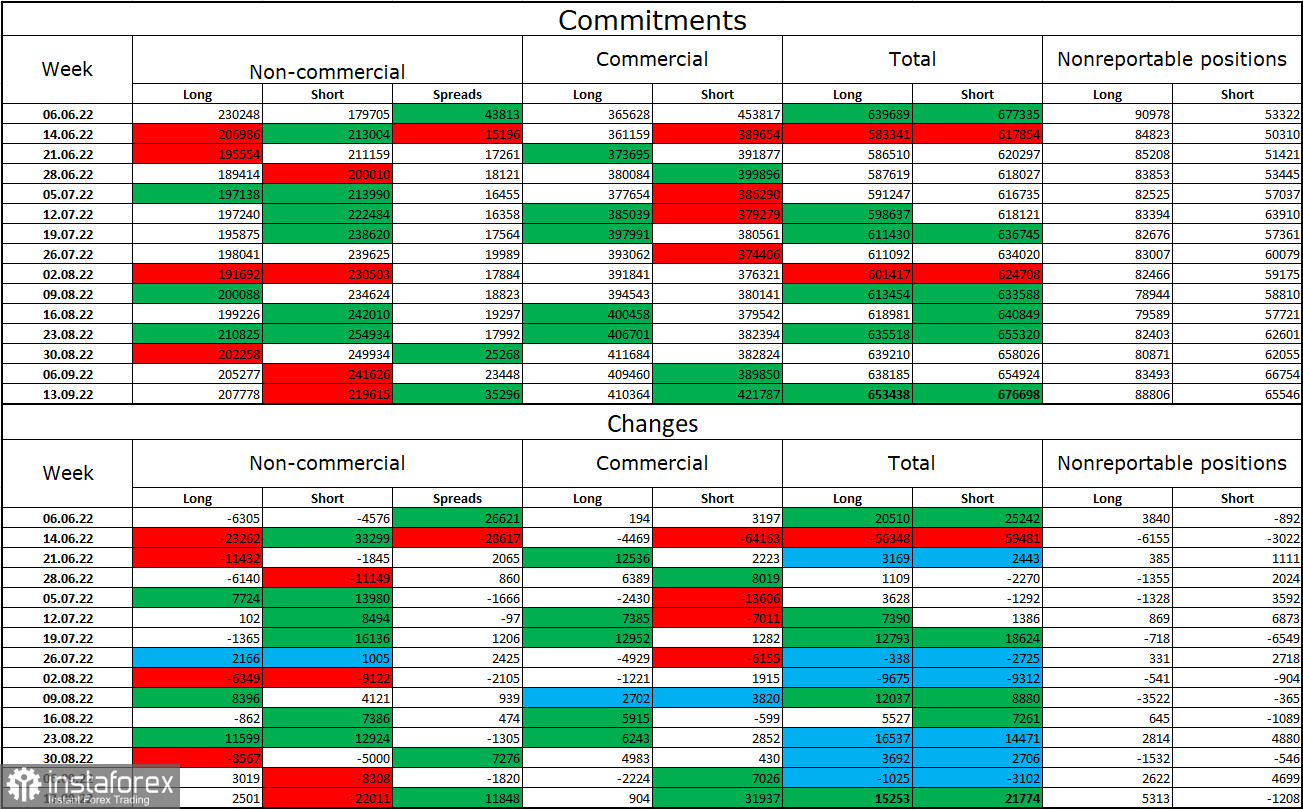

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 2,501 long contracts and closed 22,011 short contracts. This means that the "bearish" mood of the major players has weakened, and the total number of long contracts concentrated in the hands of speculators is now 207 thousand, and the number of short contracts – 219 thousand. The difference between these figures is shrinking, but the European currency continues to fall. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but bull traders are not willing to buy euros yet. The euro currency has not been able to show strong growth in the last few months. Therefore, I would now bet on an important downward trend corridor on a 4-hour chart. I recommend expecting the growth of the European currency after the closing of the quotes above it.

News calendar for the USA and the European Union:

EU – index of business activity in the service sector (08:00 UTC).

EU – index of business activity in production (08:00 UTC).

EU – composite index of business activity (08:00 UTC).

US – index of business activity in the service sector (13:45 UTC).

US – index of business activity in the manufacturing sector (13:45 UTC).

US – composite index of business activity (13:45 UTC).

On September 23, the calendars of economic events of the European Union and the United States contain three identical entries. European data has already caused a new fall in the euro (although not only that). The influence of the information background on the mood of traders today may be average in strength.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the level of 1.0173(1.0196) on the 4-hour chart with a target of 0.9900. Now, these positions can be held with the goals of 0.9782 and 0.9581. I recommend buying the euro currency when fixing quotes above the level of 1.0173 on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română