The euro-dollar pair yesterday updated a 20-year price low, reaching 0.9814. The last time the price was in this price area was in July 2002. And although the EUR/USD bears failed to enter the area of the 97th figure, the downward trend has developed. The lower limit of the price range has shifted once again, moving away from the parity level.

Today we are seeing corrective growth. Quite logical price behavior after an impulse decline to new price lows. It is obvious that the sellers do not risk holding short positions at the bottom of the 98th figure yet. Traders took profits, triggering an upward pullback. But in general, yesterday's round ended in favor of the dollar. The only question is how long the Fed will be able to support its protege.

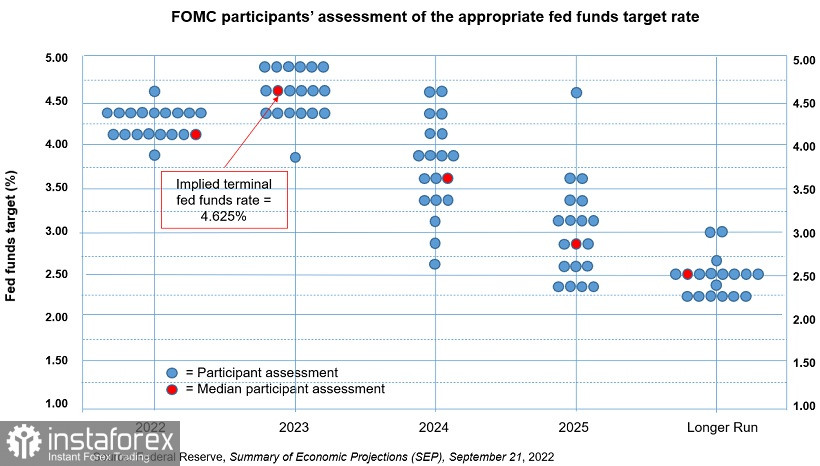

The results of the September Fed meeting exceeded the expectations of most experts, thanks to which the greenback strengthened its position throughout the market. On the one hand, the regulator made a widely anticipated decision by raising interest rates by 75 basis points. This is the baseline scenario that has been factored into current prices. On the other hand, the dollar received support from point forecasts, which reflected the hawkish mood of the Fed. According to the published dot chart, the median forecast for the federal funds rate at the end of next year rose to 4.6%. Whereas in June, the "FOMC points" (Dot Plot) showed the upper bar at 3.8%. By the end of 2024, Fed officials see the rate at 3.9%, while the previous (June) estimate was at 3.4%.

All this suggests that the Fed will maintain a "moderately aggressive" pace of monetary tightening, at least for the foreseeable future. Recall that after the last report on the consumer price index, the market started talking about the fact that the regulator might decide to increase the rate by 100 points. The probability of realization of this scenario was estimated at 38%. However, Fed Chairman Jerome Powell made it clear that such a scenario is unacceptable: a 75-point move is optimal under the current conditions, and a change in this value is only possible in the direction of reduction.

According to Powell, "at some point," the Central Bank will tighten monetary policy "at a less significant pace." At the same time, he stressed that the Fed has not yet decided on the size of the rate increase at the next (November) meeting.

In fact, Powell tied the pace of monetary policy tightening to the pace of acceleration/deceleration of inflation. According to him, there is no predetermined trajectory—appropriate decisions will be made from meeting to meeting. The pace will depend on the incoming economic data, primarily inflation indicators. The head of the Fed stressed that the central bank wants to see "convincing evidence that inflation is starting to cool down."

Judging by the latest data on the consumer price index, there are no signs of cooling inflation. And if the next inflation report comes out in the green, there is no doubt that the Fed will again raise the rate by 75 points in November. At the same time, Powell repeated the main theses he voiced at the economic symposium in Jackson Hole. The main message is that the US regulator will continue to raise interest rates and keep them high, even if it hurts households and businesses. Powell reiterated the sad fact that Americans will have to put up with a slowdown in economic growth and a weakening labor market "in the name of fighting inflation."

At the same time, the head of the Fed noted the weakening of US economic growth after a significant recovery last year. In particular, he focused his attention on the housing market, saying that activity in the residential real estate sector has "significantly weakened." He also said that the situation in the labor market "remains very tense," and "price pressure remains throughout the economy." The risks of rising inflation still remain: as Powell noted, "the regulator still considers inflation risks skewed upwards."

Such statements testify to the hawkish mood of the members of the Fed. Point forecasts serve as another confirmation of this.

All this suggests that short positions on the pair are still relevant. Any corrective upward pullbacks should be used as a reason to enter sales. From a technical point of view, the EUR/USD pair on the D1 timeframe is on the lower line of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku indicator, which shows a bearish signal Parade of Lines. All these technical signals also indicate the priority of the downward movement. The first and, so far, main target of the downward trend is located on the lower line of the Bollinger Bands indicator on the weekly chart—at around 0.9780.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română