On the hourly chart, the GBP/USD pair, even without a reversal in favor of the American currency, continues to fall. Yesterday, the price consolidated below the Fibo level of 423.6% - 1.1306, which allows us to expect that the fall may continue towards 1.1150 and 1.1000. The descending trend line shows that traders' sentiment remains bearish. GBP was falling last night, and most likely will continue falling this afternoon, before the meeting of the Bank of England. The British pound has a chance to evade a bigger collapse. To do that, the British regulator should raise the rate by at least 0.75%, as the market is now waiting for a 0.50% increase. In that case, traders will be baffled by the unfulfilled forecasts and start buying the pound. I do not think the demand for the British currency will be long and strong as just yesterday a new factor appeared - geopolitics.

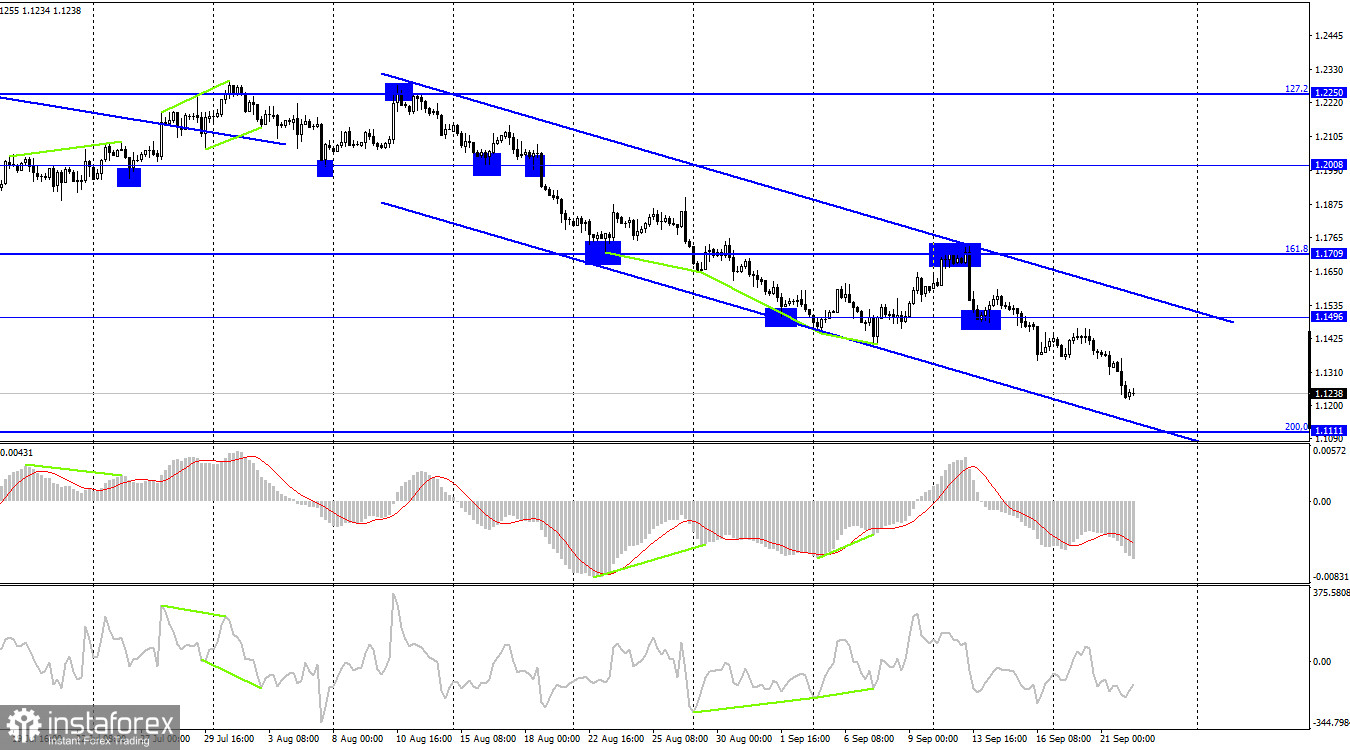

Russia has announced a partial mobilization, which means that the conflict in Ukraine will not end soon. The pound was falling yesterday morning when this news came out. Notably, it has been falling without any news in recent weeks. The information background for the GBP is getting worse every day. If the Bank of England raises the rate only by 0.50% today, it seems that traders will consider such a step insufficient to effectively combat high inflation and new sell-offs are likely to follow. Thus, the British currency has some chance to evade a sharp drop but still cannot count on strong growth. If the pair fixes above the trend line, it may change traders' sentiment to bullish for some time but the current information background is worsening. It hardly will allow the pound to show strong growth. On the 4-hour chart, the pound is trading within the downtrend channel again, which also supports the fall of the British pound.

On the 4-hour chart, the pair has consolidated below the level of 1.1496, which allows traders to expect a fall down to 200.0% Fibo - 1.1111. There are no upcoming divergences in any indicator today but any bullish divergence in such a strong trend is at most a 100-150 pips pullback. Bearish divergences do not occur during a decline. The downtrend channel confirms bearish sentiment in the market.

COT report:

Last week, the sentiment of non-commercial traders became much more bearish than it was the week before. The number of long contracts decreased by 11,602, and the number of short contracts increased by 6,052. Thus, the overall sentiment of big players remains bearish, and the number of short contracts still exceeds the number of long ones. After the new report, I am even more skeptical about the possible rise of the pound. Big players continue to hold short positions on the pound for the most part and their sentiment has gradually been changing to bullish in recent months. Now we see the build-up of sales again. Meanwhile, the pound keeps falling strongly. It will take a long time to change the traders' sentiment to bullish. At the same time, it is not clear when this process will start.

Economic reports in the US and the UK:

UK - Interest Rate Decision (11-00 UTC).

UK - Monetary Policy Summary (11-00 UTC).

US - Unemployment Claims (12-30 UTC).

On Thursday, the economic calendar has one major event in the UK, and one not-so-important report in the US. The influence of the information background on the sentiment of traders may be very strong today.

GBP/USD forecast and recommendations for traders:

You can sell the pound if the price closes below 1.1496 with a target of 1.1111 on the 4-hour chart. As for now, these trades can be kept open or closed at will. Meanwhile, it is better to refrain from buying the pound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română