The long-awaited meeting of the Fed justified the forecast of a 0.75% rate hike and was characterized by a hawkish tone and decisive plans of the central bank.

As expected, this dealt a blow to the cryptocurrency market as a whole on Wednesday. Nevertheless, technically at the moment, everything does not look terrible. Yes, this does not give significant grounds for optimism, but there has not been a tangible collapse.

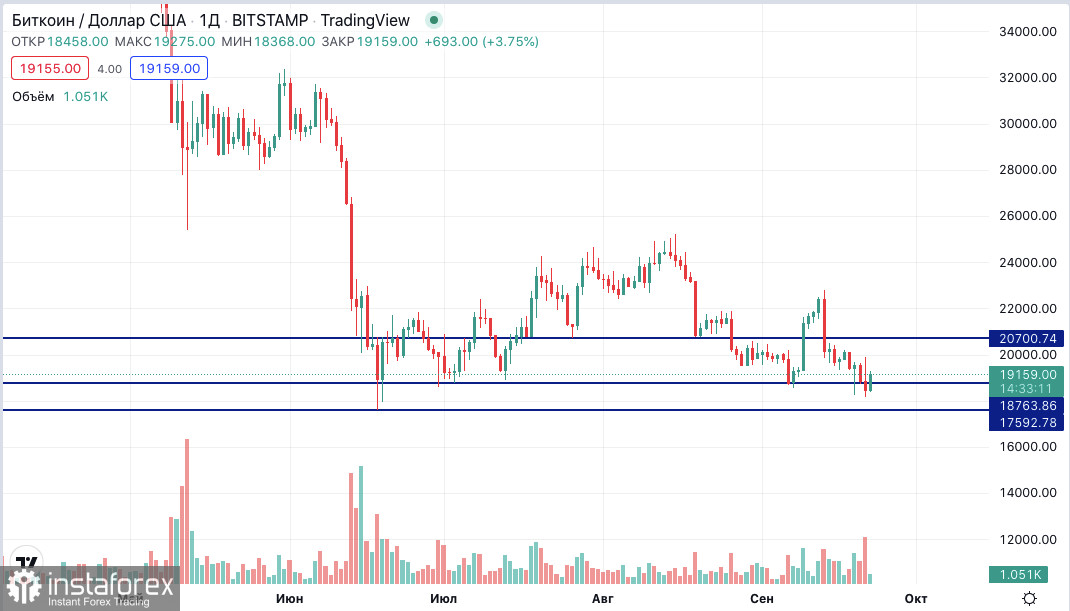

The level of the July lows for Bitcoin is still being tested for strength, and so far, it remains a false breakout. And the critical boundary for the main cryptocurrency, as we remember, remains the June lows at around $17,600 per bitcoin. The price must consolidate below this boundary before a new target to the downside can be asserted.

Let's see what the Fed's rhetoric might point to the next collapse in the markets for risky assets and cryptocurrencies in particular.

The Fed will continue to fight inflation aggressively

The US Federal Reserve on Wednesday, as expected, raised the interest rate by three-quarters of a percentage point, widening its range to 3.00–3.25%.

The level reached represents a huge increase from March, when the federal funds rate was close to zero. And subsequent upside projections represent the most rapid change in central bank policy since the 1980s.

Bitcoin price fluctuated Wednesday for several hours after the news and then fell along with US stocks in the afternoon. But today, some of the losses have been restored.

The drop in Ethereum was not as severe, but still the price dropped by more than $50. Following the Fed's announcement of a rate hike, the prices of these cryptocurrencies fell by more than 4%.

Members of the Federal Open Market Committee (FOMC) have raised interest rates by 75 basis points three times in a row, indicating how strong inflation pressures have become in America. Obviously, the broader cryptocurrency market doesn't like this.

The Fed is ready to act, hurting the markets

As inflation causes the Fed to raise interest rates, inflation-related economic data is of great importance for the digital asset market.

We have already had the opportunity to see that cryptocurrencies have recently reacted poorly to the Fed's rate hike report. For example, after the U.S. Bureau of Labor Statistics released inflation data for August, BTC prices fell 5%, and Ethereum prices lost 7% over the next 24 hours.

"We have got to get inflation behind us... I wish there were a painless way to do that; there isn't," Powell said.

Powell's words highlight the difficult situation for the central bank. Inflation remains persistently high and is proving difficult to contain.

However, the extent of the fall in the value of the cryptocurrency this year is still unclear. Even in the absence of unfavorable news about inflation and the Fed's rate hike, some experts believe that Bitcoin is still headed for a significant decline to $10,000 this year.

"I don't foresee crypto, especially BTC and ETH, bucking the Fed's influence any time soon," said crypto analyst Riyad Carey, adding that this is "another reminder that crypto moves at the whims of the Fed."

Michael Saylor redeems the fall

Meanwhile, Michael Saylor, Chairman and Co-Founder of MicroStrategy, said that Bitcoin could return to its November high of $68,990 "sometime in the next four years" and reach $500,000 in the next decade if its market capitalization matches that of gold.

MicroStrategy bought back the fall of Bitcoin. The software company recently added 301 BTC to its tokens.

According to Saylor, the firm has acquired $6 million worth of cryptocurrencies, giving an average price of $19,851 per token. This new move brings the firm's total Bitcoin assets to 130,000 BTC.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română