EUR/USD

Higher timeframes

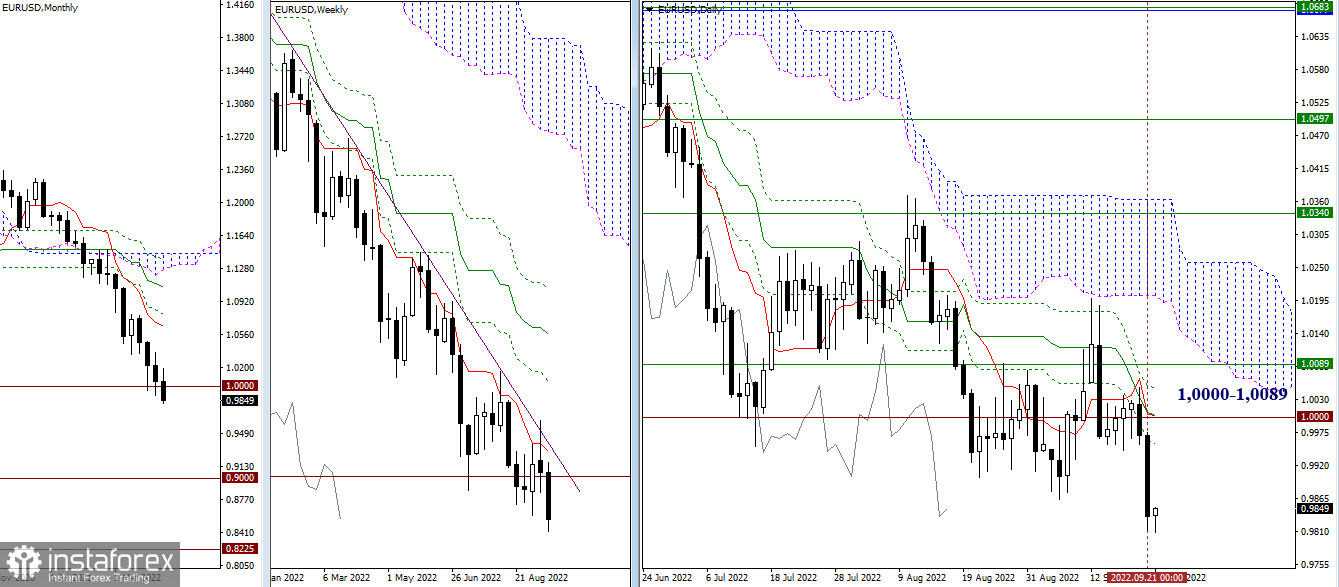

Bears were able to exit the 1.0000 area of attraction yesterday, update the low at 0.9864, and hold on to a close below this level. The continuation of the downward trend returns relevance to the following downward targets – 0.9000 (psychological level) and 0.8225 (minimum extremum of 2000). The nearest resistance is now the zone of 1.0000 – 1.0089, left behind yesterday and strengthened by many levels of the higher timeframes (psychological level + daily cross + weekly short-term trend).

H4 – H1

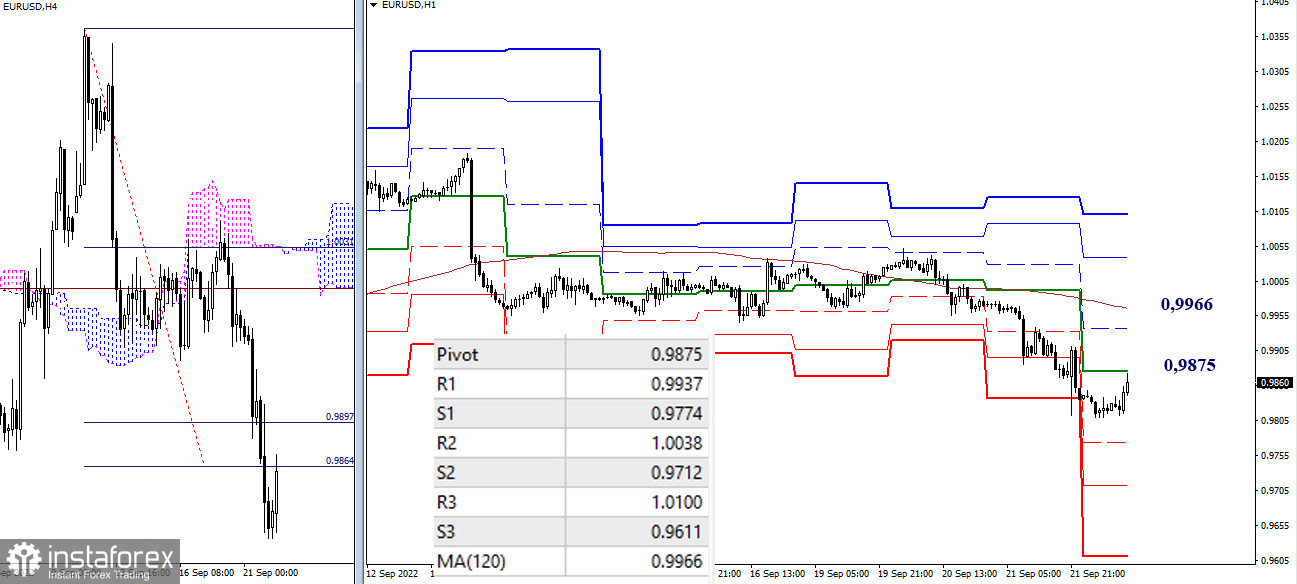

The main advantage in the lower timeframes now belongs to the bears. However, at the moment, we are witnessing an attempt to implement a corrective rise. The pair retests the broken target at H4 (0.9864–97) and interacts with the central pivot point of the day (0.9875). The next most crucial resistance will be the weekly long-term trend (0.9966). This level is responsible for the current balance of power of the lower timeframes. The resistance of the classic pivot points R2 (1.0038) and R3 (1.0100) serve as further upward targets in the current situation. If the corrective recovery is completed, the bearish sentiment will return with targets at 0.9774 – 0.9712 – 0.9611 (classic pivot points).

***

GBP/USD

Higher timeframes

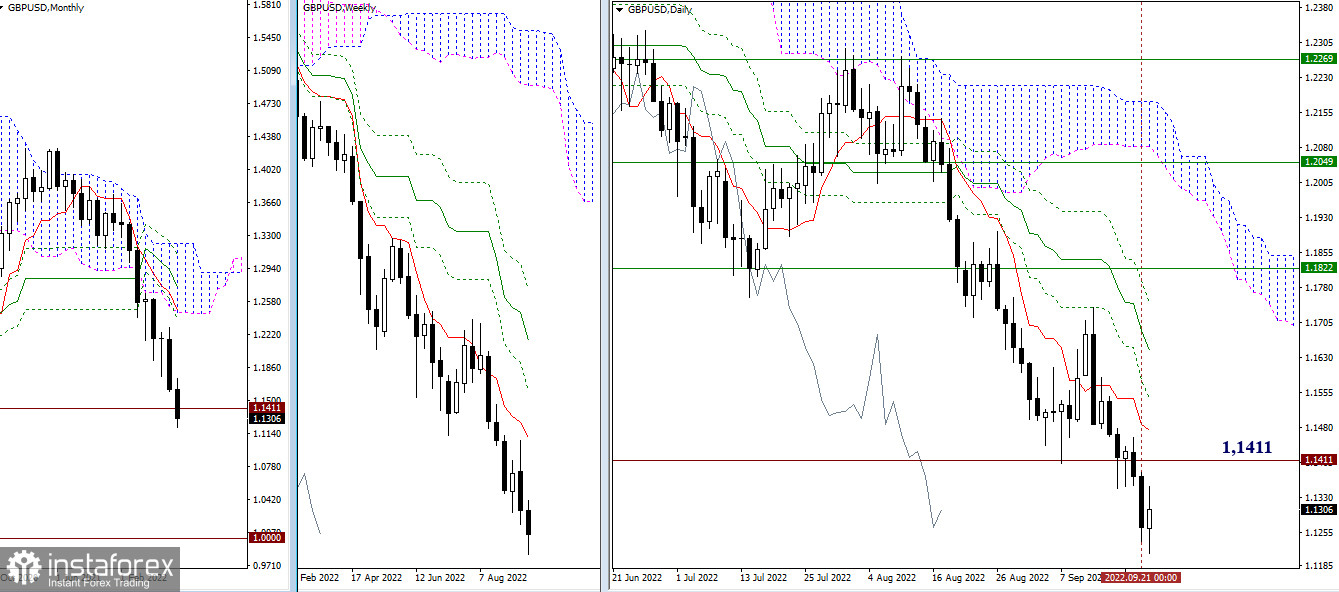

The initiative yesterday belonged to the bears, who continued the development of the downward trend movement. The breakdown of the historical low 1.1411 (2020) at higher timeframes will allow us to consider the psychological level of 1.0000 as the next target for the decline. If the bears fail to confirm the breakdown on the weekly and monthly timeframes, then attention will be directed to the return to the passed minimum extremum 1.1411 and the subsequent development of a corrective rise.

H4 – H1

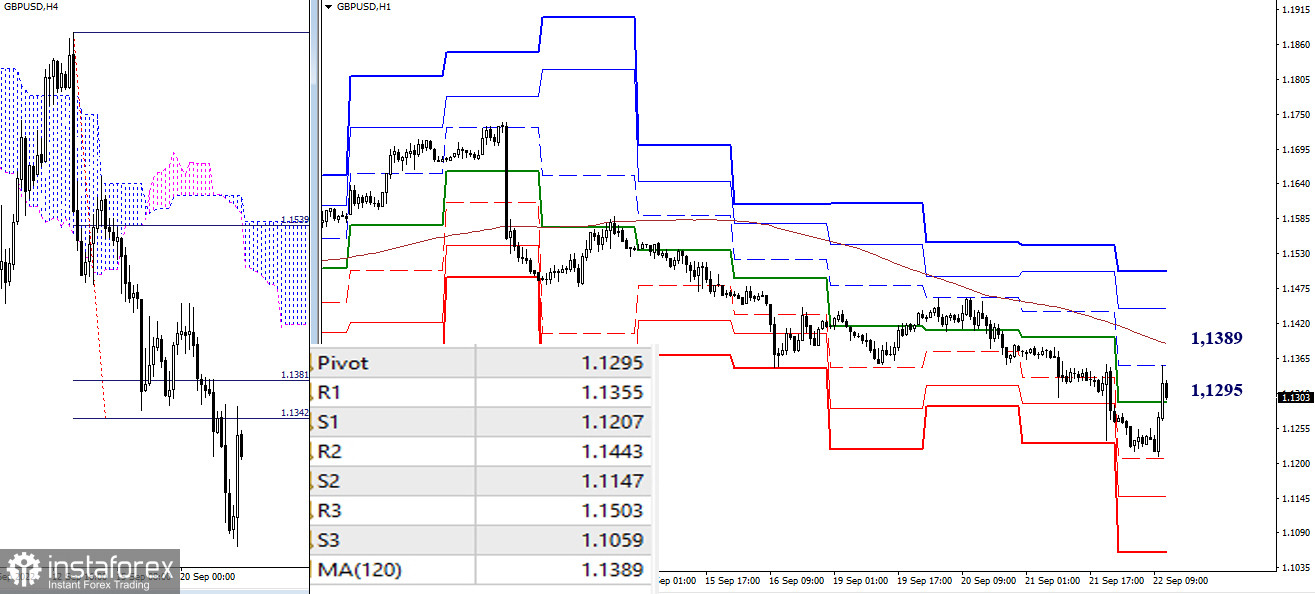

As of writing, a corrective rise develops in the lower timeframes. Overcoming the key resistance at 1.1389 (weekly long-term trend) and a reversal of the moving average will change the current balance of power in favor of strengthening bullish sentiment. The resistance of the classic pivot points R2 (1.1443) and R3 (1.1503) can become additional targets within the day. If bears return to the market, the relevance will return to the support of classic pivot points (1.1207 – 1.1147 – 1.1059 ).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1- Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română