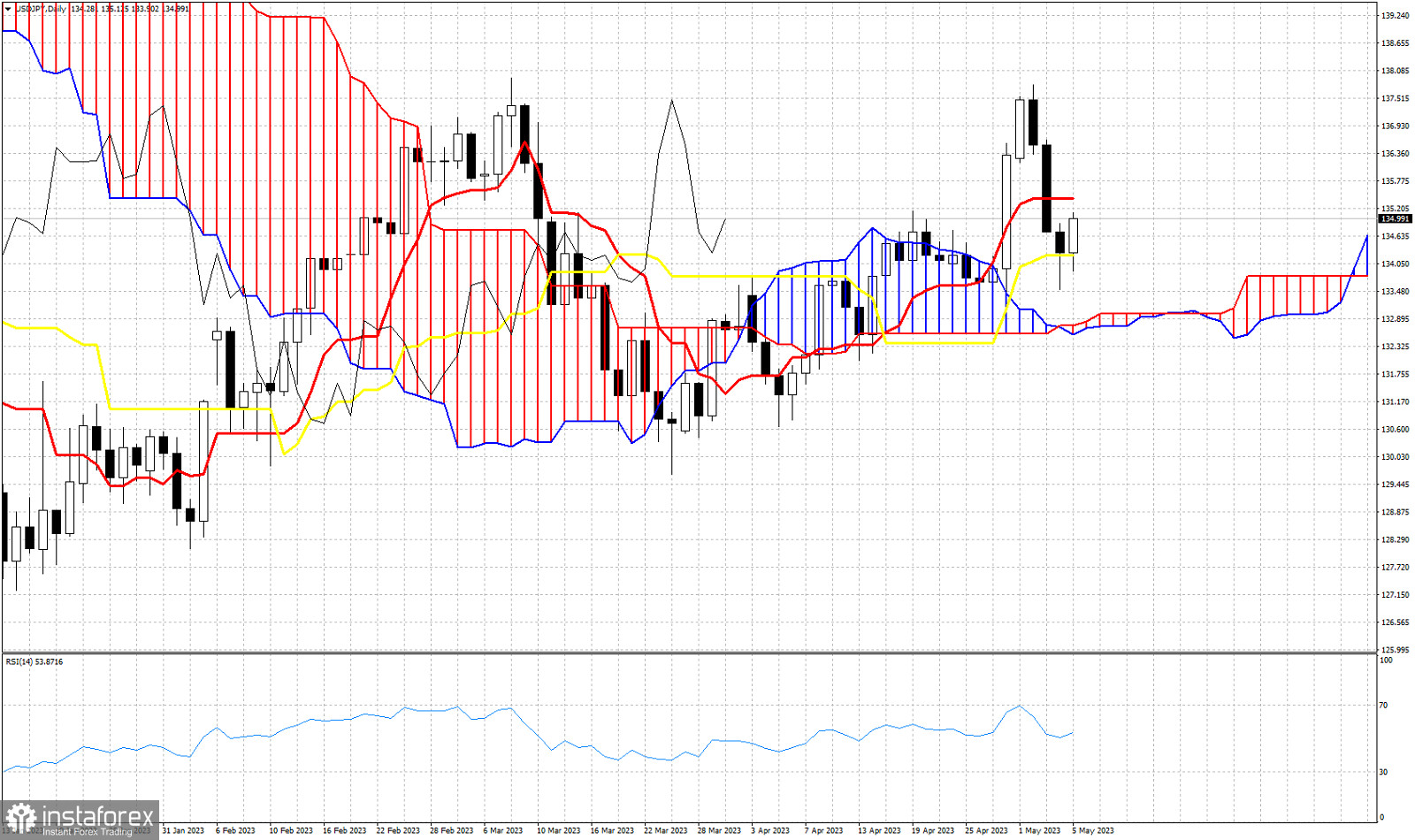

USDJPY is trading around 135 after making a low yesterday at 133.51. In Ichimoku cloud terms trend remains bullish as price is still above the Daily Kumo (cloud). Price tested the kijun-sen (yellow line indicator) yesterday and bulls have managed to keep price above it. A daily close below the kijun-sen (134.22) would be a sign of weakness and would push price lower towards the Kumo at 133. Resistance by the tenkan-sen (red line indicator) is found at 135.41. The Chikou span (black line indicator) is above the candlestick pattern (bullish). Despite the short-term weakness we saw over the previous three trading sessions, it now looks like USDJPY is reversing to the upside after bouncing off support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română