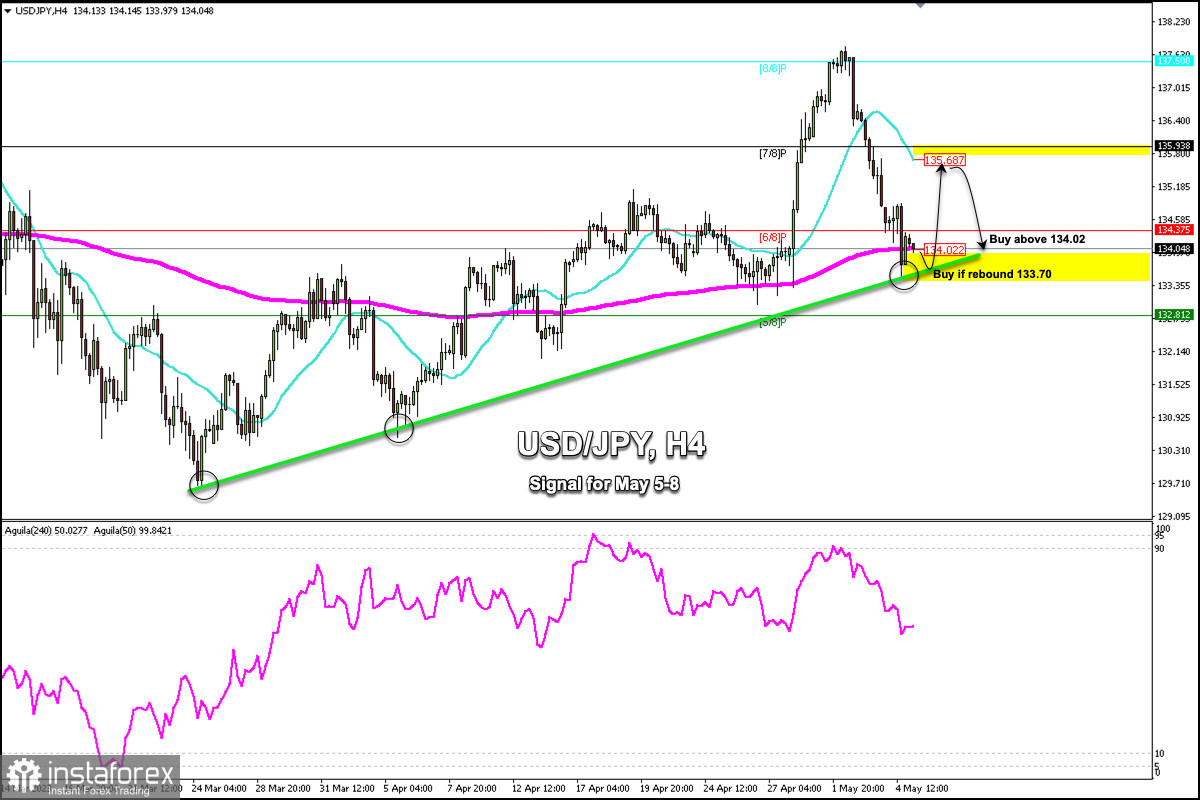

Early in the European session, the Japanese yen is trading around 134.04, below the 21 SMA and around the 200 EMA. We can see strong bearish pressure that started at the beginning of the month after reaching the 137.79 area.

According to the chart above, we can see that the USD/JPY pair maintains an uptrend channel formed since March 21. If it trades above 133.70 (uptrend channel) or above EMA 200, it could continue ascending and it could reach the 21 SMA located at 135.68 in the next few days.

On the 4-hour chart, we can see that the Japanese Yen is showing oversold levels and a technical bounce is likely to occur. In the case of consolidating above the uptrend channel, it could extend a further upward movement and reach the levels of 135.00 and up to 137.50.

USD/JPY has been trading lower for the third consecutive day. The yen is showing some strength against the US dollar, having fallen by over 400 pips from its high of 137.79 to the low of 133.50 in 48 hours. It means that investors are poised to take refuge in the Yen as well as gold.

If in the next few hours, the Japanese Yen breaks the uptrend channel sharply and consolidates below 133.40, this could mean a change in the trend and USD/JPY could reach 5/8 Murray located at 132.81 and finally, fall towards the psychological level of 130.00.

We expect that in the next few hours, the USD/JPY pair will perform a technical rebound above 133.70 or above 134.02 (200 EMA) and thus could rise to the level of 135.68 (21 SMA). Eventually, the price will climb to the area of 7/8 Murray located at 135.93.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română