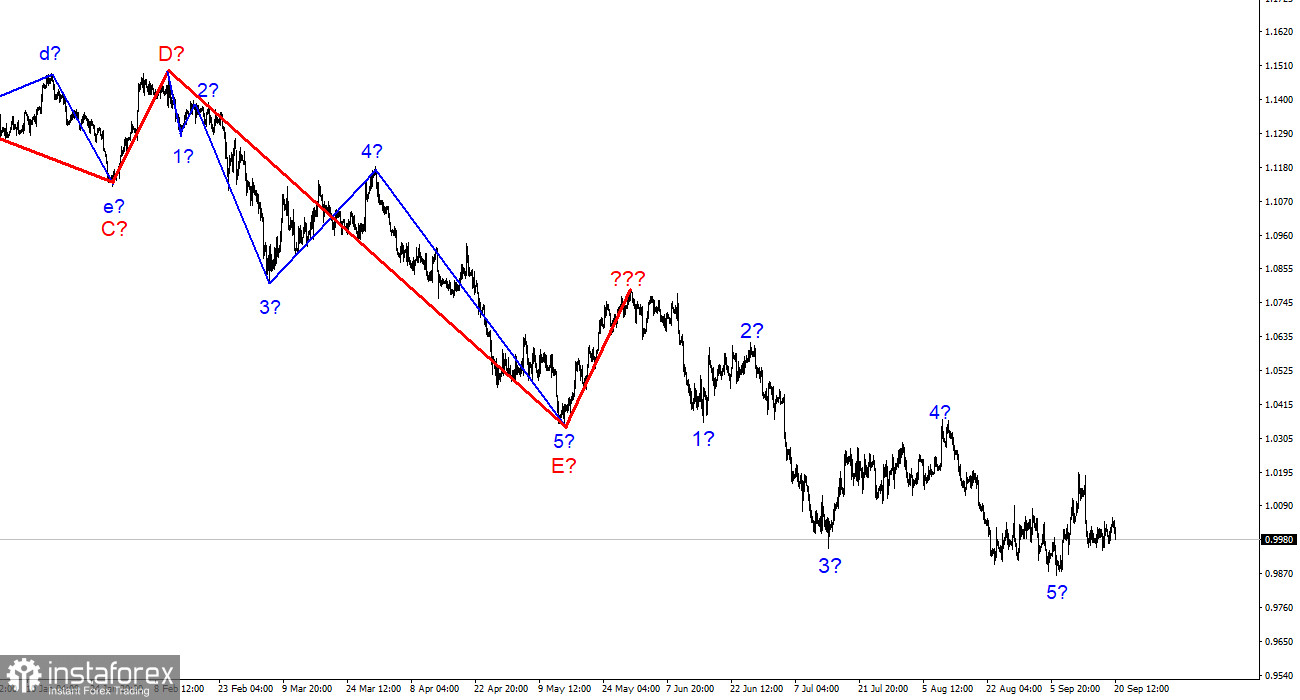

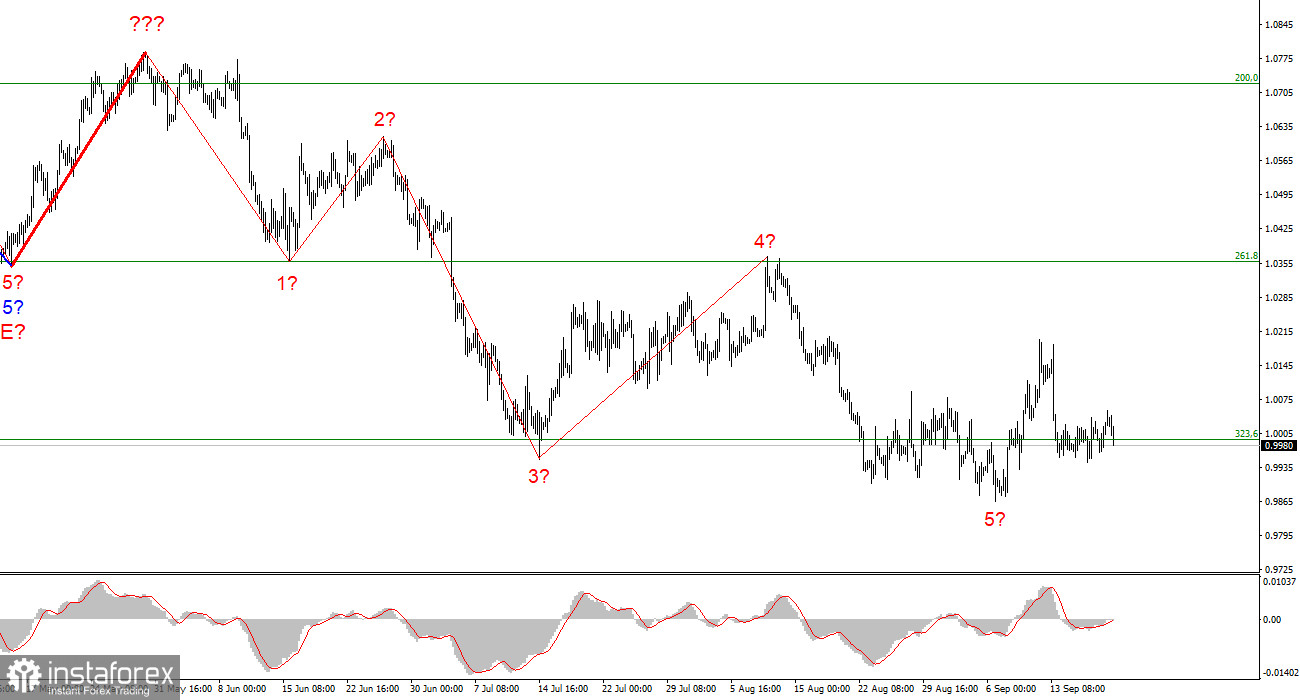

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. Given the rather strong increase in the quotes of the euro currency, it can be assumed that wave 5 has completed its construction since it is unlikely that the rising wave of the last week is part of wave 5. Thus, the working option ends a long downward trend and begins a new, ascending, minimum corrective, minimum three-wave. Since the European currency still does not show strong growth, I cannot say that there will be no more decline in demand for this currency in the near future. The option of constructing a correction section and further resuming the downward one is not excluded at all. The option of complicating the entire downward section of the trend is not excluded, which will take an even more extended form in this case. The news background for the markets remains one of the key factors, so if it gets worse, the demand for the euro may start to fall again. And it can get worse, as last Tuesday's US inflation report showed us. Nevertheless, the wave marking indicates that the market is ready to build at least three waves up.

The US economy will continue to slow down

The euro/dollar instrument increased by 10 basis points on Monday, and today it decreased by 45. And in general, the instrument has been trading horizontally for the fifth day in a row. There was no news background on Monday and Tuesday, so horizontal movement could be expected. Unfortunately, this horizontal movement greatly confuses the current wave layout. It is still unclear whether the market is preparing to build a new upward section of the trend or a strong complication of the downward one. Both options are possible, given the "bearish" mood in the market, which, even with the possible completion of wave five, has not changed to "bullish."

Meanwhile, Goldman Sachs's banking holding lowered its forecasts for the US economy for 2023. This is not much news since many banks and analytical companies provide forecasts. And all of them are now downward because the Fed keeps raising interest rates. The Goldman Sachs report says that due to the high probability of further growth in the 4-4.25% of GDP in 2023, it is likely to grow only by 1.1%, and in 2022 it will be 0%. From my point of view, this is not as bad as it could be because zero growth is not a fall, and minimal growth is not a recession. A slowdown in economic growth will happen in any case, but it should be remembered that 2021 was the year of recovery after the pandemic, and the annual GDP growth in July of this year was 12.2%. Hardly anyone expected that the market would observe such figures every quarter or year. Thus, the American economy is not in danger of a serious recession, which can support the demand for the dollar.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is not completed with a probability of 100%. Sales should be abandoned for a while, since we have five waves down at this time, and the tool can now build a corrective set of waves. I also do not advise you to hurry with purchases, since the news background may cause a new drop in demand for the European currency. The FOMC meeting will be held this week.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three- and five-wave standard structures from the overall picture and work on them. One of these five waves can be completed right now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română