EUR/USD

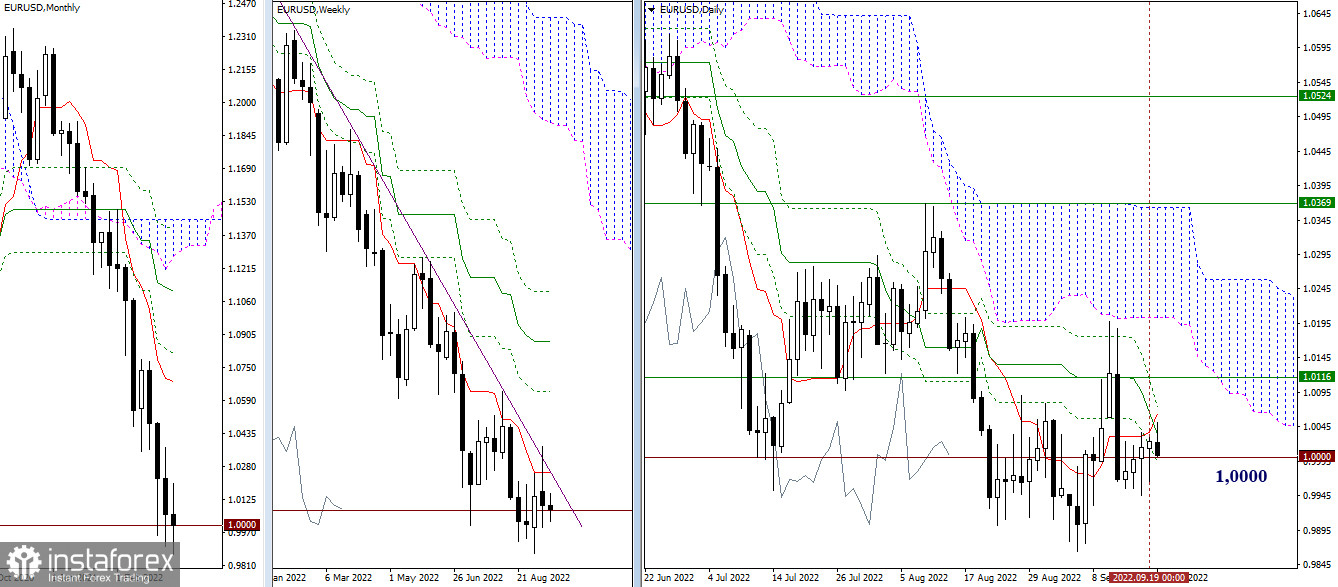

Higher timeframes

The current situation still does not express clear priorities and remains in the zone of attraction of the levels of the daily Ichimoku cross and the psychological level 1.0000. The nearest upward targets can now be noted at the levels of 1.0116 (weekly short-term trend) and 1.0203 (lower boundary of the daily cloud). For bears, new opportunities will appear when the downward trend recovers (0.9864 minimum extremum).

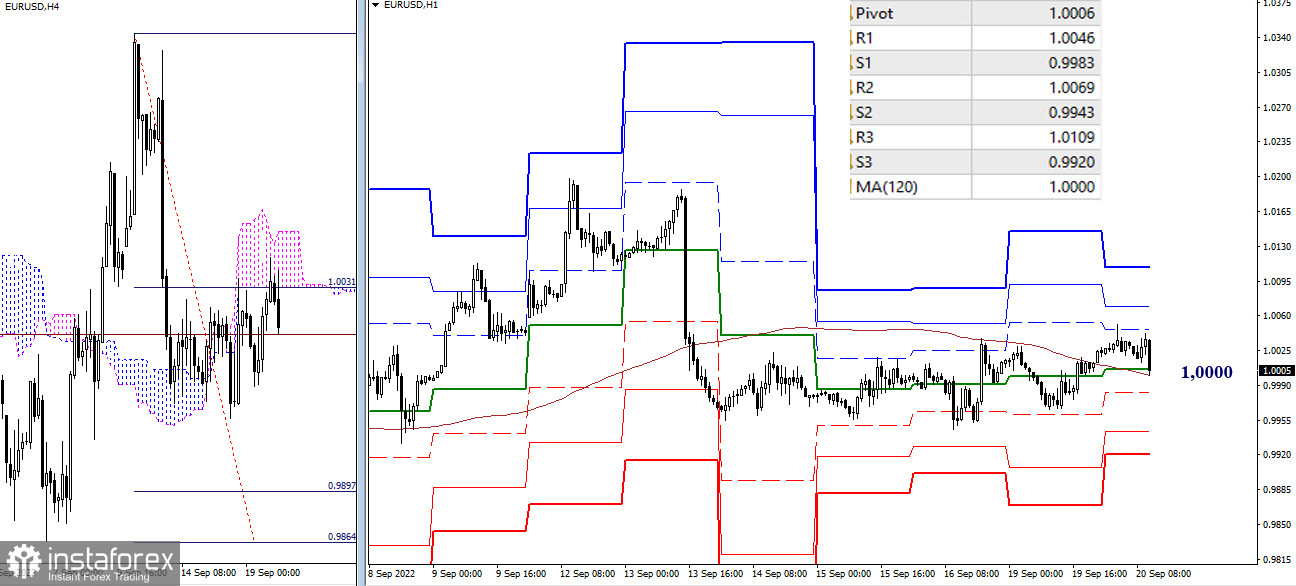

H4 – H1

On the lower timeframes, the pair managed to gain a foothold above the key levels 1.0000 - 1.0006 (central pivot point + weekly long-term trend). At the same time, the market remains in the area of consolidation of recent days. Among the reference points within the day, one can note 1.0046 - 1.0069 - 1.0109 (for bulls) and 0.9983 - 0.9943 - 0.9920 (for bears). If the pair manages to go beyond the attraction and influence of the key levels, and if the key levels leave the horizontal position, it will be possible to form and develop a new directional movement.

***

GBP/USD

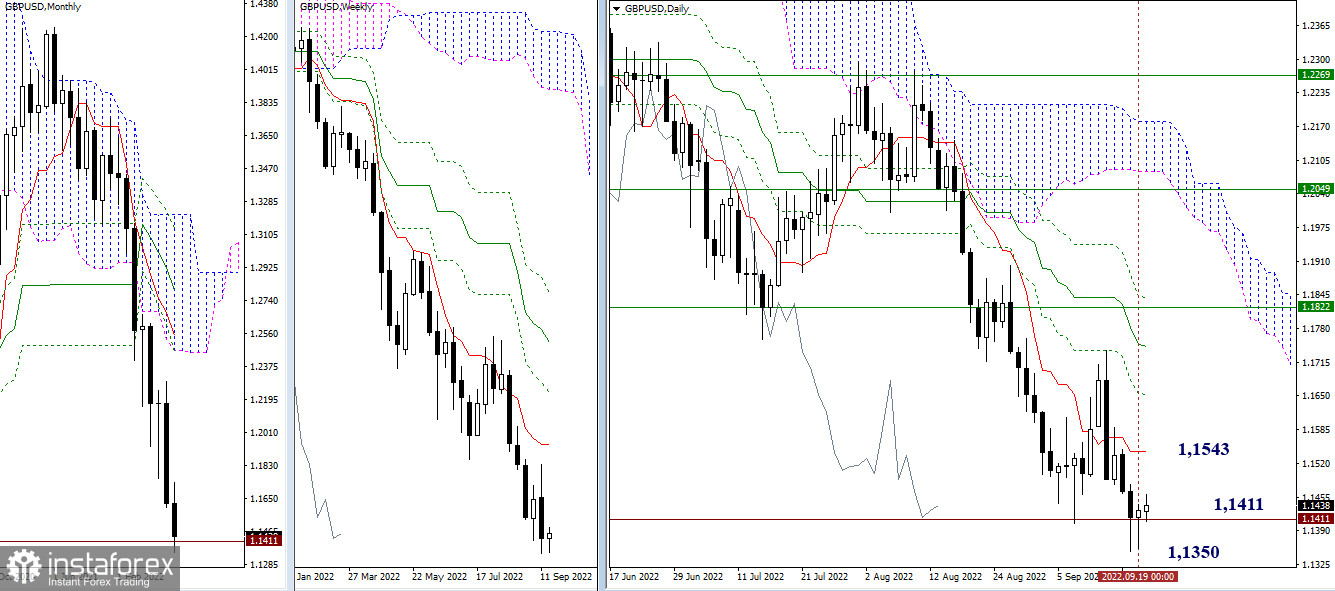

Higher timeframes

Bears failed yesterday to update last week's low (1.1350). As a result, the opponent returned above 1.1411 (2020 low). The development of the nascent upward correction is now guided by the daily short-term trend (1.1543).

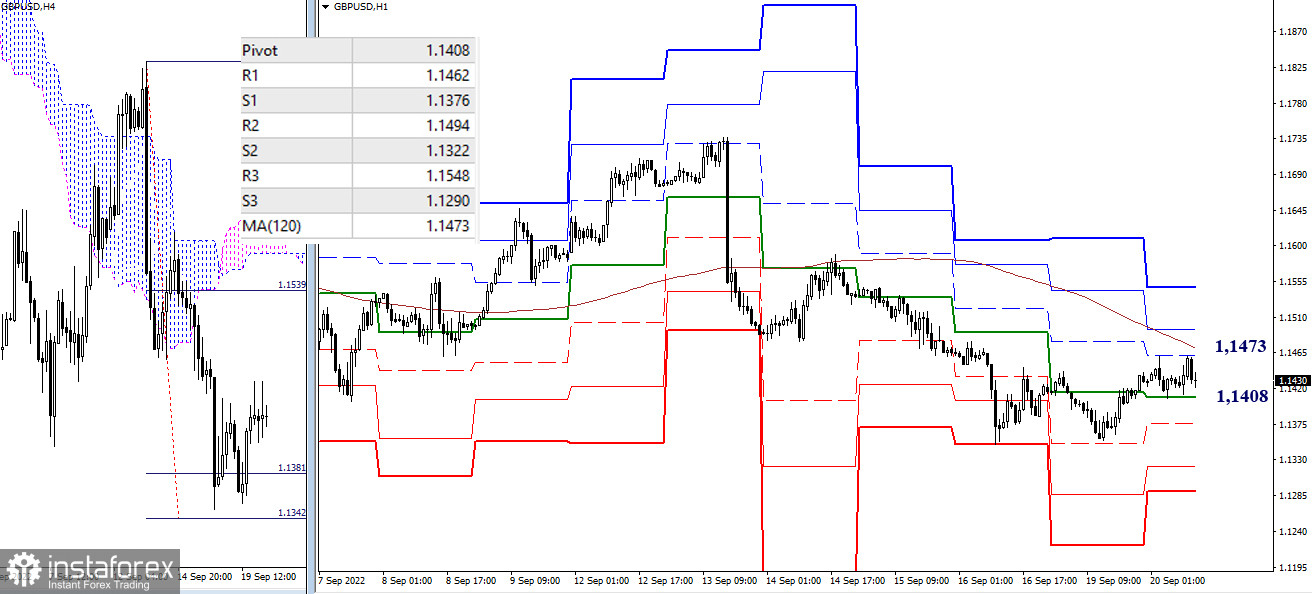

H4 – H1

On the lower timeframes, an upward correction is developing. Bulls have managed to seize the central pivot point (1.1408) and are now using it as support, so the main task is to continue the rise and break the weekly long-term trend (1.1473). Further upward reference points may be the classic pivot points R2 (1.1494) and R3 (1.1548). For bears, in case of a decline, the support of the classic pivot points (1.1376 – 1.1322 – 1.1290) may be important today.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1- Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română