EUR/USD 5M

The EUR/USD pair continued to trade in a flat on Monday, which began last week. At this time, the pair is located between the levels of 0.9945 and 1.0019, but if desired, the horizontal channel can be expanded to the boundaries of 0.9877 and 1.0072. The essence of this does not change, we have a flat and everything that follows from it. There was not a single significant report or fundamental event in the European Union and the United States on Monday. Therefore, the flat is even logical to some extent. However, let us recall that the pair has been in one or another horizontal channel for more than a month, each of which is located near the pair's 20-year lows. Therefore, it seems that the market is just waiting for the right moment to resume the downward movement, because this does not look like the end of the trend. In flat conditions, it is best to trade on a rebound from any of the boundaries of any channel or not trade at all, waiting for the resumption of the trend movement.

There were no trading signals on Monday. The pair approached the extreme level of 1.0019 only by the end of the day, but this signal, whatever it was, was formed very late, so it was not worth working out. According to our recommendations, no deals should have been opened on Monday.

COT report:

The Commitment of Traders (COT) reports on the euro in the last few months clearly reflect what is happening in the euro/dollar pair. For half of 2022, they showed a blatant bullish mood of commercial players, but at the same time, the euro fell steadily at the same time. At this time, the situation is different, but it is NOT in favor of the euro. If earlier the mood was bullish, and the euro was falling, now the mood is bearish and... the euro is also falling. Therefore, for the time being, we do not see any grounds for the euro's growth, because the vast majority of factors remain against it. During the reporting week, the number of long positions for the non-commercial group increased by 2,500, while the number of shorts decreased by 22,000. Accordingly, the net position grew by about 24,500 contracts. This is quite a lot and we can talk about a significant weakening of the bearish mood. However, so far this fact does not give any dividends to the euro, which still remains "at the bottom". The only thing is that in recent weeks it has done without another collapse, unlike the pound. At this time, commercial traders still do not believe in the euro. The number of longs is lower than the number of shorts for non-commercial traders by 12,000. This difference is no longer too large, so one could expect the start of a new upward trend, but what if the demand for the US dollar remains so high that even the growth in demand for the euro does not save the situation for the euro/dollar currency pair?

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. September 20. No news, markets are waiting for the Fed meeting.

Overview of the GBP/USD pair. September 20. The British pound is unwilling to react to a future rate hike by the Bank of England.

Forecast and trading signals for GBP/USD on September 20. Detailed analysis of the movement of the pair and trading transactions.

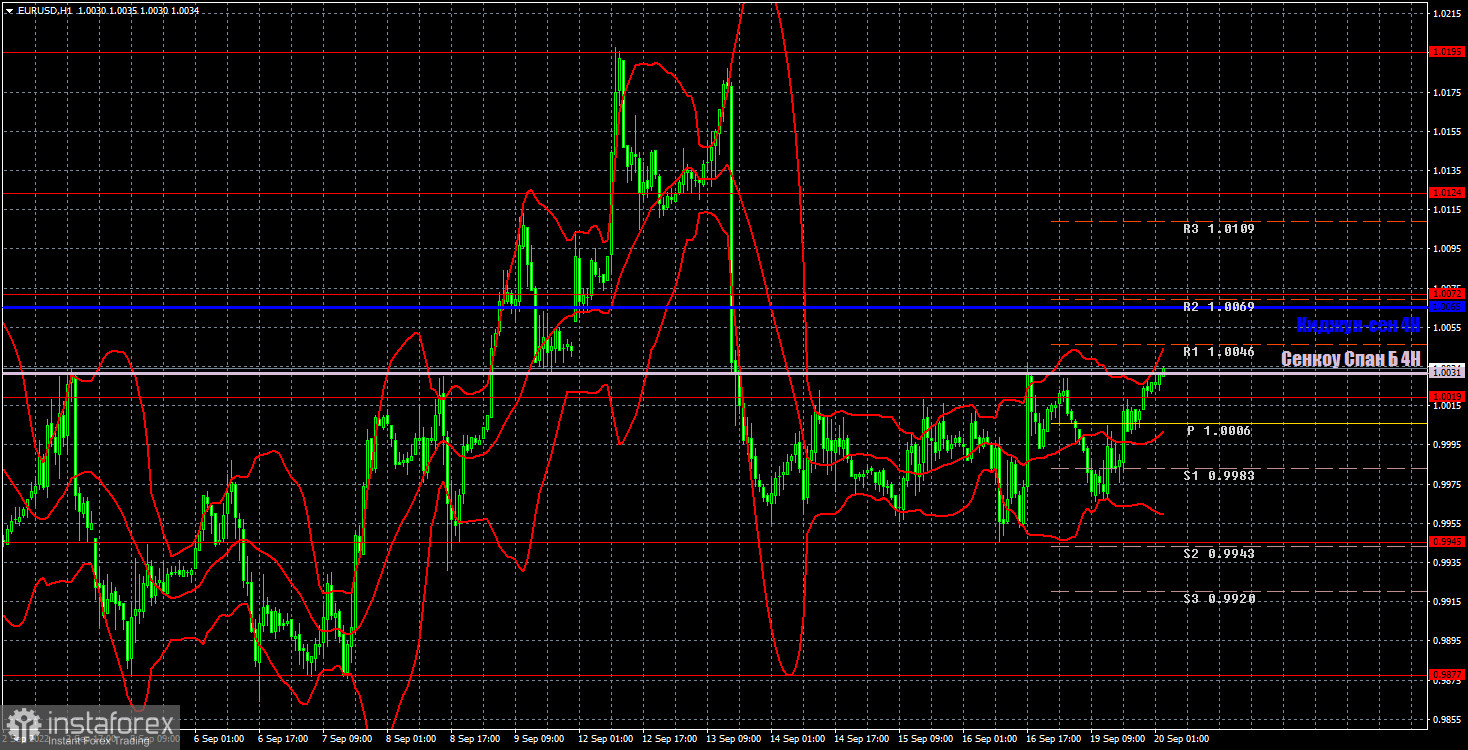

EUR/USD 1H

The outlook for the bears remains very good on the hourly timeframe, despite the flat. They manage to stay near 20-year lows for a long time, not allowing the pair to even correct. The fact that the European Central Bank raised the key rate for the second time, as we see, did not have any positive effect on the euro. Thus, we are waiting for the resumption of falling quotes. And at the same time the results of the Federal Reserve meeting. We highlight the following levels for trading on Tuesday - 0.9877, 0.9945, 1.0019, 1.0072, 1.0124, 1.0195, 1.0269, as well as Senkou Span B (1.0031) and Kijun-sen lines(1.0065). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. There will be no interesting events in America, and the speech of ECB President Christine Lagarde will take place in the European Union. It can be quite interesting, but it's what Lagarde has to say that matters, not the actual speech itself. Therefore, the market's reaction will depend on whether Lagarde will report anything important.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română