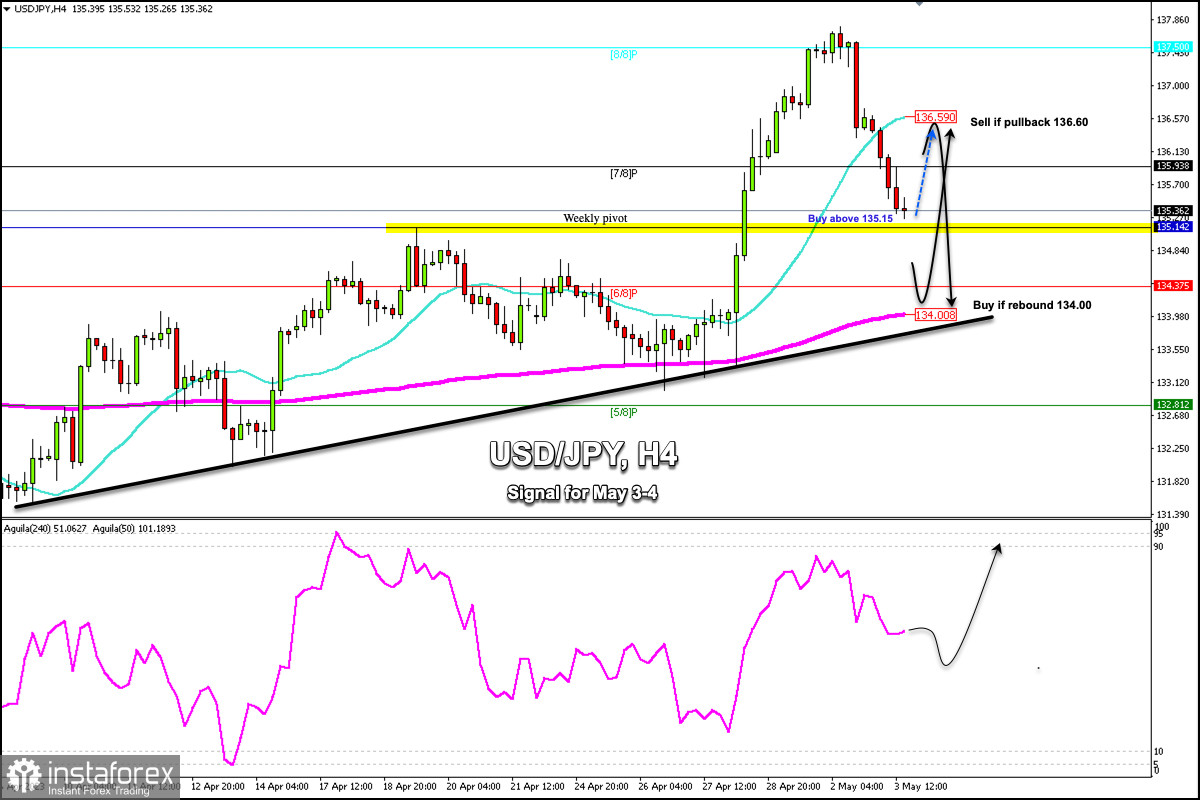

Early in the American session, USD/JPY it is trading around 135.36, below the 21 SMA, and below 7/8 Murray (135.93).

On the 4-hour chart, we can see that the Yen reached a high of 137.77 on May 2. Around this area is the 8/8 Murray line which acted as a strong resistance. Since then, the USD/JPY pair has accumulated more than 250 pips of fall.

According to the Fibonacci indicator of the last bullish movement, 61.8% is located at 134.79. This level should provide support and a technical bounce could occur in the next few hours.

The weekly pivot point is located around 135.14 which could offer strong support to the Japanese Yen and could give us the opportunity to buy above this area with targets at 136.59 (21 SMA).

On the other hand, in case the USD/JPY pair falls and breaks the psychological level of 135.00, we could expect a bearish acceleration towards 6/8 Murray located at 134.37. If bearish pressure prevails, the instrument could fall towards the 200 EMA located at 134.00. Around this zone, it crosses an uptrend channel formed since April 8th.

In case of a technical rebound, the Yen could reach the 21 SMA located at 136.50 which could be seen as a clear signal to sell with targets at 135.14 and 134.00 (200 EMA).

Our training plan for the next few hours is to wait for a technical bounce around 135.15 (weekly pivot) to buy with targets at 136.60. The Eagle indicator is giving a positive signal, signaling a technical rebound in the coming hours.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română