There is a lot of doom and gloom in the gold market as prices ended the previous week at their lowest level since April 2020. For many analysts, a break below $1,675 would spell the end of gold's three-year upward trend.

Along with the fall in gold prices, Wall Street analysts and retail investors turned bearish, highlighting the downside risks in the near term.

Last week's gold sell-off is a continuation of a trend that began in early March as markets react to the Federal Reserve's aggressive monetary policy moves to curb inflation, which remains stubbornly high.

Markets are almost ready for a 75 basis point rate hike; however, surprisingly resilient inflation in August, with the US CPI rising to 8.3% from an expected 8.1% gain, has left markets priced in at a slim chance of a full 1% move.

Rising hawkish expectations supported the US dollar near its 20-year high and lifted 10-year bond yields to 3.5%, the highest level since April 2011.

Under these conditions, many analysts say that gold prices have suffered a lot of technical damage and it will be difficult for the precious metal to find any bullish momentum anytime soon.

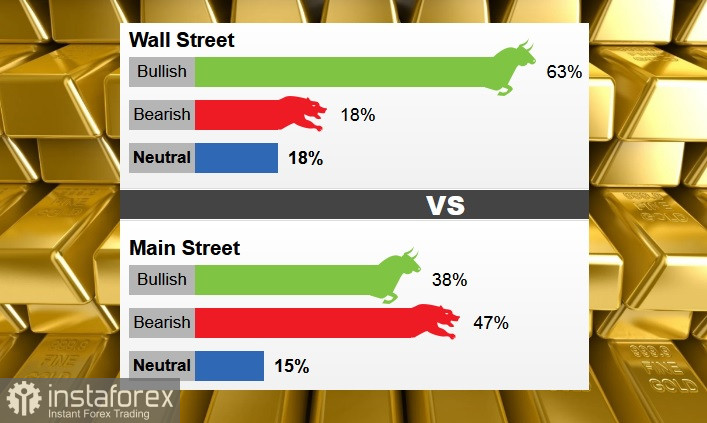

Last week, a total of 22 market specialists took part in a Wall Street survey. Fourteen analysts, or 63%, said they are bearish this week. At the same time, four analysts, or 18%, were optimistic or neutral.

In the retail sector, 1,045 respondents took part in online surveys. A total of 395 voters, or 38%, called for gold to rise. Another 489, or 47%, predicted a fall in gold. The remaining 161 participants, or 15%, voted for a sideways trend.

Bannockburn Global Forex Managing Director Mark Chandler said his next gold price target is between $1,615 and $1,650 and does not rule out a fall to $1,500 by next year.

It is unlikely that the Fed will raise interest rates by 1% this week, the markets still expect further aggressive actions before the end of this year. Chandler noted that markets now see the final federal funds rate at 4.50%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română