Ethereum moves to the PoS protocol. Graphics card prices are plunging. Abu Dhabi Global Market's financial regulator, the Financial Services Regulatory Authority (FSRA), has recently unveiled six principles that will guide its approach to "virtual asset regulation and supervision." In this article, we will also analyze the charts of ETH and BTC.

Although not legally binding, the principles must be viewed as an addition to the recently published framework, according to the FSRA. Abu Dhabi Global Market, a UAE-based financial center, says the principles are intended to "support engagement with other like-minded regulatory agencies in and outside the UAE."

The regulator notes that the six principles are potentially the basis "for regulatory cohesion across jurisdictions."

"Each principle is a declaration of the FSRA's risk appetite in the areas of regulation, authorization, financial crime, supervision, enforcement, and international cooperation. When viewed holistically, these expectations are calibrated to ensure the appropriate balance between confidence in our ecosystem, risk sensitivity, customer protection, and attracting new entrants," the FSRA explained.

As shown in the document outlining the key attributes of each approach to regulating virtual assets, the first principle calls for the creation of a robust and transparent regulatory framework. The second principle is about maintaining high standards when granting authorization. The FSRA asserts that another crucial factor that should guide virtual asset regulation is the prevention of financial crime and money laundering.

The rest of the principles are more or less clear and general at their core.

Now let's analyze the chart of BTC. Yesterday, the flagship cryptocurrency plunged below $20,000. However, in the course of today's Asian session, bulls managed to recoup losses. The focus is now on $20,540 resistance. The quote could jump to $21,140 in case of a breakout through the barrier. In order to extend the uptrend, the price should break above the resistance levels of $21,840 and $22,520. If pressure on bitcoin remains strong, which is highly likely, bulls should protect $20,007 support, because in case of a breakout through the mark, the asset could plunge to $19,520 with the target at $19,100.

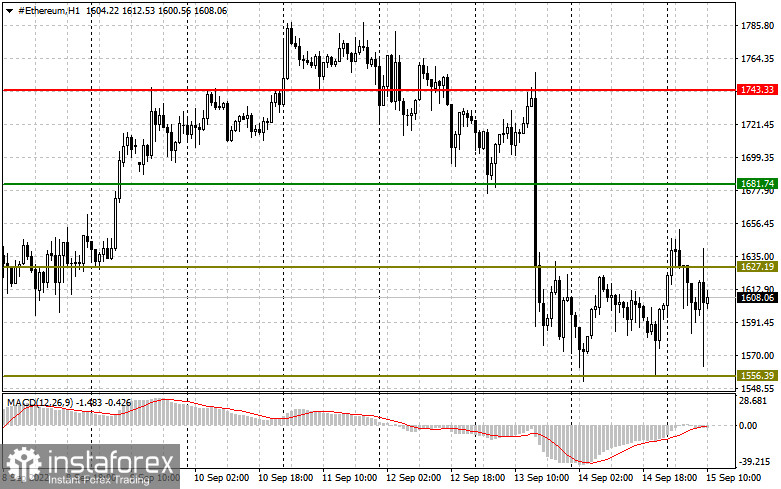

Ethereum is shifting to the PoS protocol and traders' reaction remains to be seen. Volatility is highly likely to soar once the ETHPOW fork occurs. The closest target is now seen at the resistance level of $1,620, which is strong enough to be broken through. In case of a breakout through the mark, a reversal to the upside will take place with targets standing at $1,681 and $1,743. If pressure on the instrument increases, bulls should protect the level of $1,560, as this is the only way to maintain control over the market. Should the price break through the barrier, ether will plummet to $1,495 with the target at $1,418.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română