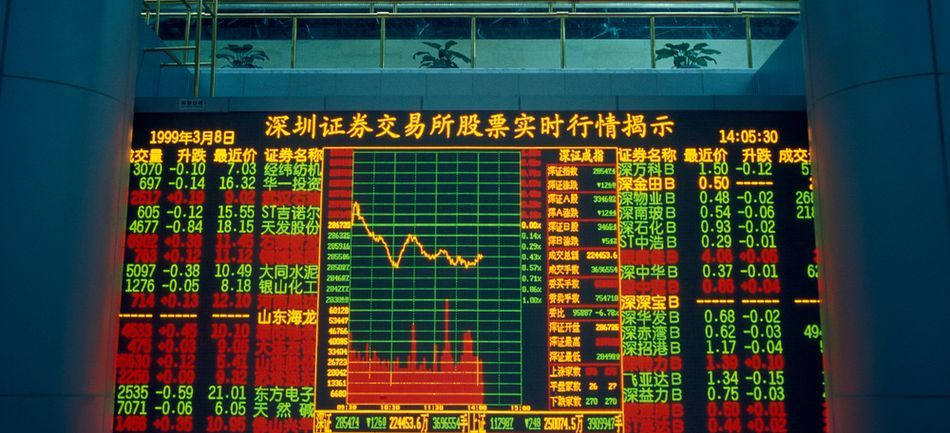

Major Asian indexes have dropped on Wednesday, with some indexes sliding down by 2.8%. The Shanghai Composite and the Shenzhen Composite lost 1.02% and 1.5%, respectively, while the KOSPI declined by 1.29%. Other indexes suffered greater losses, with the Hang Seng Index falling by 2.63%, the S&P/ASX 200 decreasing by 2.41%, and the Nikkei 225 dropping by 2.79%.

Asian indexes declined following a slump in the US stock market – earlier, US indexes fell amid concern over an interest rate hike by the Federal Reserve. Most experts predict the Fed to increase the rate by 0.75%, while some even forecast a 1% increase. The next meeting of the Federal Reserve will begin next week, and its results will be published on September 21.

According to the latest US CPI data, inflation in the US reached 8.3% in August, below July's 8.5%. However, it did not match forecasts, which predicted inflation to decrease to 8.1%. The latest data suggests that the Federal Reserve will continue to tighten its monetary policy to push inflation down.

In Japan, the worst performers on the Nikkei 225 were Keyence (-4.9%), Softbank Group (-4.2%), Fanuc (-4%), Advantest (-3.9%), and Fast Retailing (-3.7%). Nissan Motor and Toyota Motor lost 1.2% and 1.3%, respectively.

In Hong Kong, the worst-performing stock on the Hang Seng Index were Techtronic Industries (-10.7%), Baidu (-5%), and Sunny Optical Technology Group (-4.5%).

Some Chinese equities advanced on Wednesday, with CNOOC rising by 1.8%, Orient Overseas gaining 0.4%, and Sands China edging up by 0.1%. In Australia, new home sales decreased in August for the second month in a row and slumped by 1.6% over the month.

On the S&P/ASX 200, the biggest losers were Block (-5.3%), Cero (-5%), WiseTech Global (-3.8%), Commonwealth Bank (-3.3%), and National Australia Bank (-3.3%).

Shares of BHP and Rio Tinto, Australia's two biggest companies, declined by 1.6%.

In South Korea, stocks on the KOSPI also posted losses, with Samsung Electronics and Hyundai Motor falling by 1.9% and 1%, respectively.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română