There is a slight lull in the futures market for US stock indices after yesterday's collapse, which occurred due to inflation, which forced investors to reconsider the prospects for interest rates and economic growth. Another jump in inflationary pressure in the United States, which was recorded in August this year on an annualized basis, led to a sharp sell-off of risky assets. Against this background, it is expected that representatives of the Federal Reserve System will probably continue to actively prepare the markets for an increase in interest rates in the United States next week.

Indices on Tuesday showed the biggest drop in more than two years: the S&P 500 fell by more than 4% and the Nasdaq 100 — by more than 5%. Today, the dollar index retreated after the highest jump in three months on Tuesday, and the yield on 10-year treasury bonds rose, approaching a ten-year high.

Despite the sharp drop in the indices, there is no reason to panic. The S&P index has lost only all the growth achieved in the previous four sessions, which was caused by expectations of a slowdown in inflation, which would allow the Federal Reserve the opportunity to soften its tightening. Today we are waiting for the August producer price index, which may also affect many traders who expect inflation to continue to decline.

As noted above, interest rate futures already consider an increase of three-quarters of a percentage point, while some are betting on the possibility of raising the key interest rate by a whole point at once. The yield on two-year Treasury bonds, the most sensitive to policy changes, rose by two basis points after rising by 22 basis points on Tuesday, further exacerbating the inversion of the yield curve compared to 10-year bonds.

Many are now betting on a real easing of inflationary pressure only by the end of this year, which will allow the Fed to think again about a softer landing and an economic downturn.

Asian markets' stocks and bonds fell after the sell-off on Wall Street, and European indices show versatile dynamics.

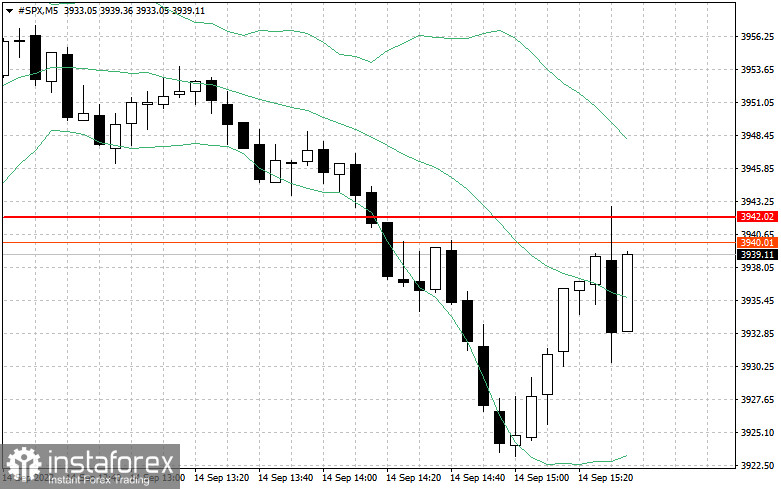

As for the technical picture of the S&P500, after the collapse, the bulls are already trying to find something around $3,940, but there is not enough positive in the market. To build an upward correction, it is necessary to overcome the level of $3,968, which will pave the way to $4,003. Only a breakdown of this range will support a new upward momentum, already aimed at the resistance of $4,038 and $4,062. The furthest target will be the area of $4,091. In the event of further downward movement, the breakdown of $3,942 will lead to $3,905, which will push the trading instrument back to a minimum of $3,872, from where there is a direct road to the area of $3,835, where the pressure on the index may weaken slightly.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română