The report on the growth of British inflation, published today, turned out to be very controversial, so it could not provide significant support to either the bulls or the bears of the GBP/USD pair. The pound is trying to win back yesterday's losses, but the corrective counterattack looks rather uncertain.

In general, if you look at the weekly chart, you can come to the obvious conclusion that GBP/USD sellers are still in control of the pair. The upward corrective impulses are due only to the weakening of the US currency. The pound is under the yoke of its own problems, which do not allow it to seize the initiative. Today's release has complicated an already difficult puzzle.

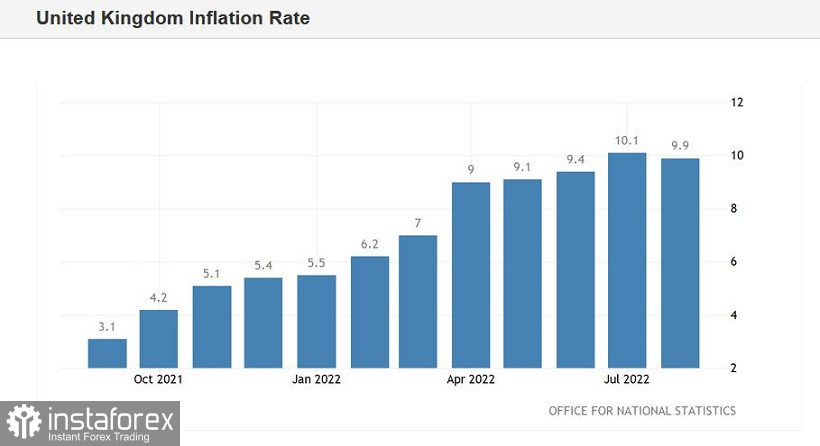

Thus, the general consumer price index unexpectedly appeared in the red zone. In annual terms, it came out at around 9.9%, with the forecast of growth up to 10.2% (July result - 10.1%). On a monthly basis, the headline CPI stood at 0.5%, with growth forecast to 0.6%. In other words, the first barely perceptible signs of a slowdown in the spike in headline inflation have appeared. The structure of the report suggests that food prices have made the biggest contribution to maintaining a high level of headline inflation. In August, this component jumped to a 14-year high (13% YoY). Compared to July, food and non-alcoholic beverages rose in price by 1.5% last month (this is the strongest growth rate in this category since 1995).

Core inflation is picking up. The main index, excluding volatile energy and food prices, rose to 6.3%. But the producer price index came out in the red zone—both in monthly and annual terms. Producer price index showed similar dynamics.

Thus, inflation has slowed down a little compared to July, but it is still at its maximum (more than 40 years) level.

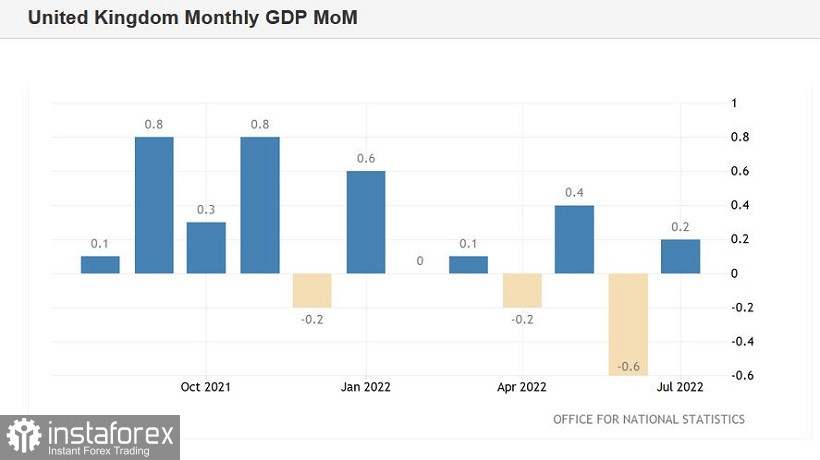

Today's release should be considered comprehensively, taking into account the two previous reports published this week. On Monday, data on UK GDP growth were released, and on Tuesday—the main indicators in the labor market.

Thus, the volume of UK GDP in July increased by only 0.2% MoM, while most experts expected a more significant increase by 0.5%. In annual terms, the indicator came out at the zero level. The volume of industrial production declined altogether by 0.1% MoM. The volume of production of the processing industry increased minimally (0.1%). All published components were in the "red zone," falling short of the forecast levels.

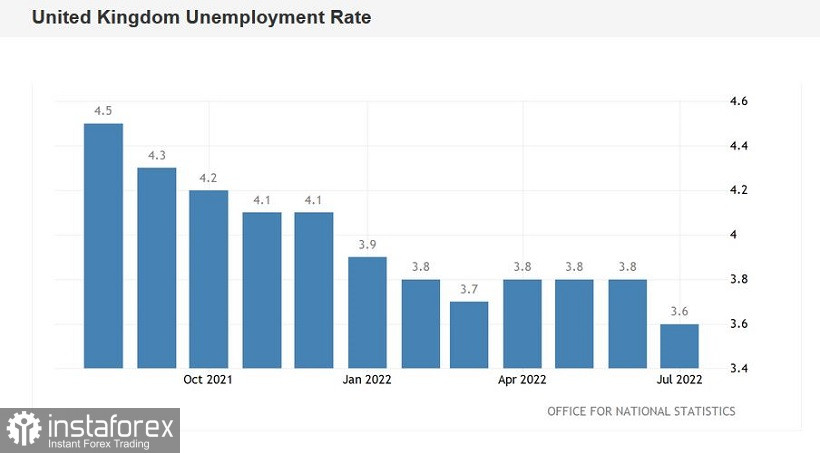

The labor market reflected a more positive picture. The unemployment rate decreased (to 3.6%), while wages increased (by 5.5% with bonuses, by 5.2% without them). By the way, according to the data published today, the RPI index (retail prices) jumped by 12% year on year (it showed similar dynamics in July). As you know, this index is used by employers in the UK when negotiating wages.

Among all components of the report in the field of labor market, only the increase in the number of claims for unemployment benefits let us down. Instead of the predicted decline, it rose by 6,000. But in general, the release was on the side of the British currency.

All of the above macroeconomic reports were published on the eve of the Bank of England meeting, which was supposed to take place this week, but due to the death of Queen Elizabeth II, it was postponed to September 22.

The published figures suggest that the BoE will face a dilemma—whether to raise interest rates by 75 or 50 basis points.

Notably, UK interest rate futures point to an 80% chance of a 75-point scenario. But at the same time, the vast majority of economists polled by Reuters (40 out of 47) are confident that the rate will be increased by 50 points. Only seven experts allowed the option of a 75-point increase.

This suggests that until September 22, the pound will be under background pressure, given the ongoing intrigue. The published reports did not help GBP/USD traders decide on the vector of price movement. By and large, the British currency follows the dollar, which was supported yesterday by a strong inflation data.

The existing fundamental background today does not contribute either to the development of a large-scale correction or a downward trend. In my opinion, the GBP/USD pair will trade in the range of 1.1470–1.1590 in the short term, that is, between the lower line of the Bollinger Bands indicator on the four-hour chart and the upper boundary of the Kumo cloud on the same timeframe. In such conditions, it is advisable to open short positions when the corrective impulses are attenuated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română