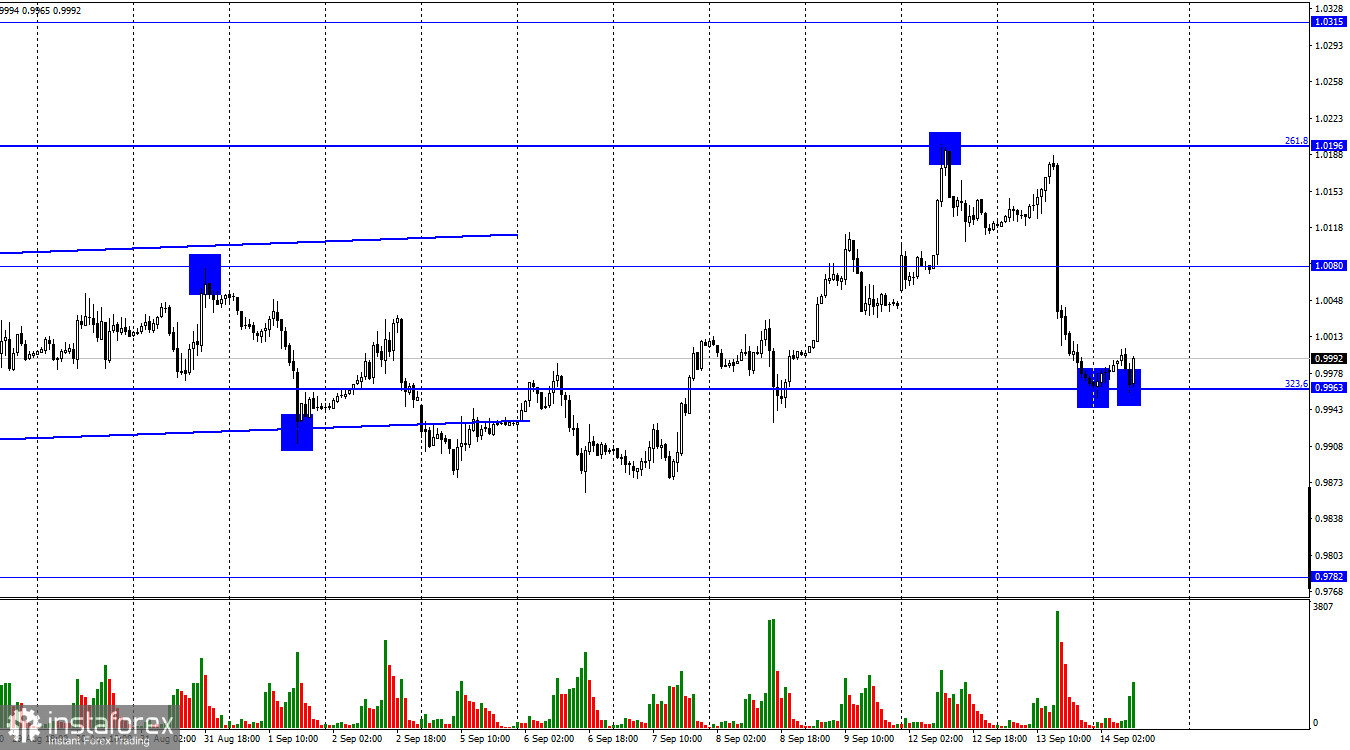

The EUR/USD pair performed a reversal in favor of the US currency on Tuesday and literally, within a few hours, fell to the corrective level of 323.6% (0.9963), almost from the level of 1.0196. The fall was very strong, and the entire "blame" for it lies with the US inflation report. Many analysts have already analyzed this report both yesterday and today. There is nothing complicated either in it or in its meaning for August. I fully agree that the Fed is likely to raise the rate by 0.75% at the next meeting since the rate of decline in the consumer price index began to slow down after a month. Therefore, a new push is needed so that inflation accelerates in the opposite direction, to 2%. At the same time, I agree with the opinion that, in fact, the report was not so bad. FOMC representatives have repeatedly stated that it is necessary to further raise the rate, that its final value may be higher than 4%, and that the period of high rates may drag on for a long time.

This means that the Fed is already ready for a slow return of inflation to the target level and the need to constantly stimulate its decline. If traders reacted so violently to the 0.2% slowdown in inflation, then what will happen when the Fed raises the rate several more times this year? It turns out that bear traders will return to the market, and the US dollar will grow for several more months. At least now, I can draw such a conclusion. On the hourly chart, the pair's quotes have already completed two rebounds from the Fibo level of 323.6%, which may work in favor of the European currency and some growth. But I don't think yesterday's collapse was just a reaction to one report. If the bears got rid of the euro so massively and bought up the dollar, then they are ready for this in the future. Now I think that the pair's decline will continue. The Fed will hold a meeting next week and may see new "flights" of the pair and movements that do not fit into the terminal window.

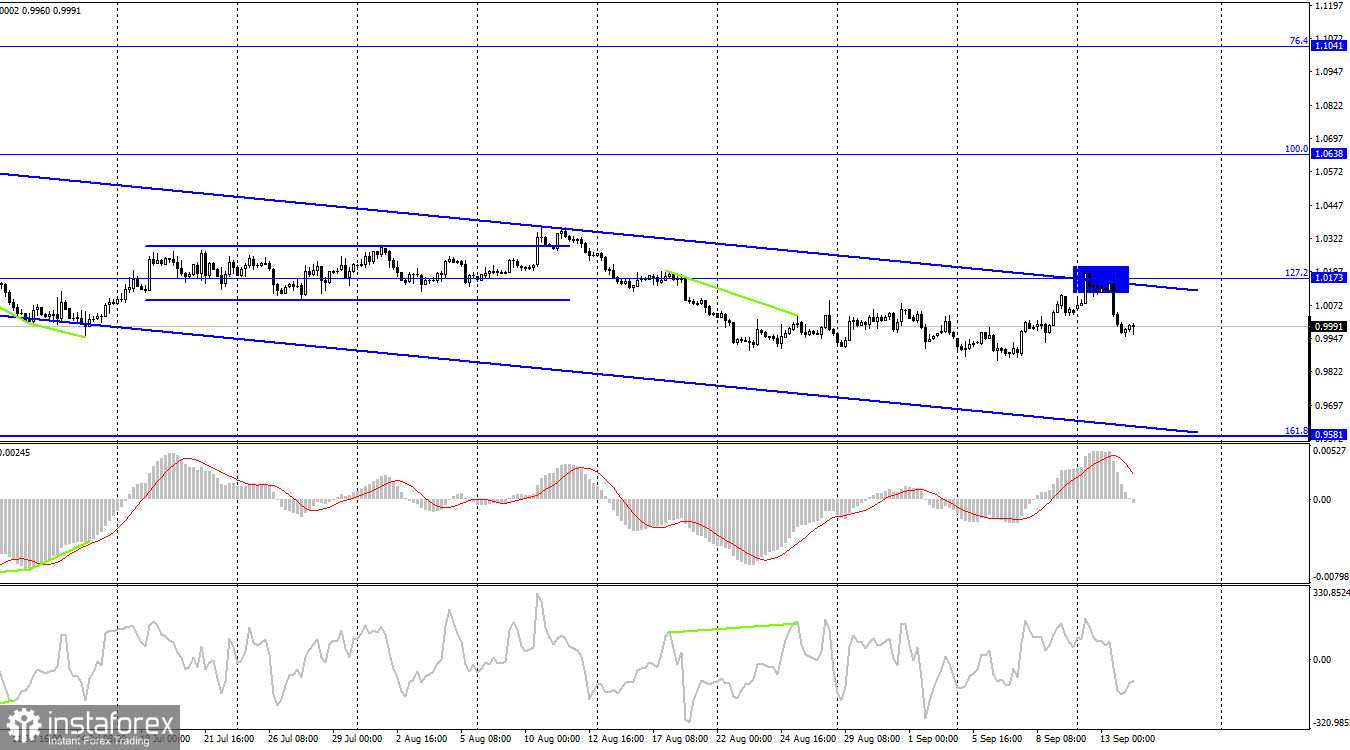

On the 4-hour chart, the pair performed a rebound from the corrective level of 127.2% (1.0173), a reversal in favor of the US currency, and began to fall towards the corrective level of 161.8% (0.9581). Thus, the downward trend corridor continues to characterize the mood of traders as "bearish." Closing the pair's rate above the corridor can change the mood of traders to "bullish" for a long time, but another attempt ended in failure.

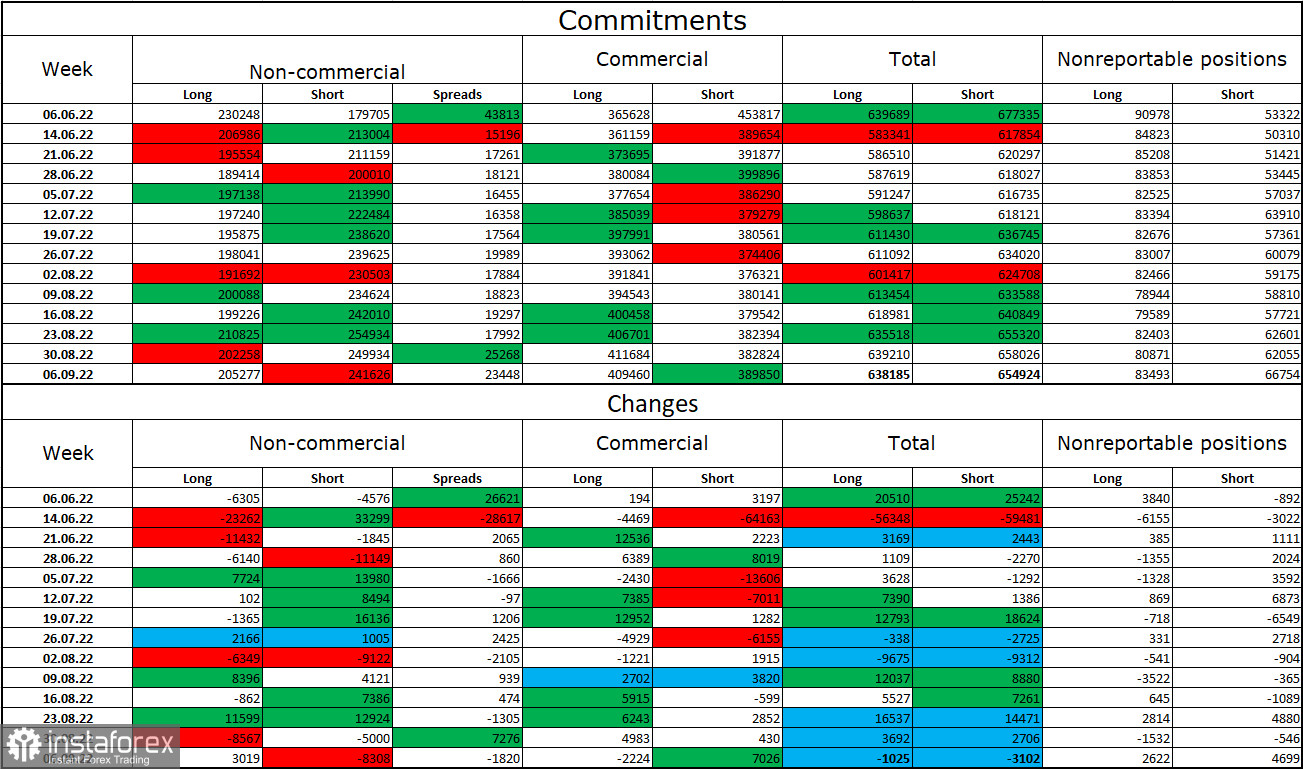

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 3,019 long contracts and closed 8,308 short contracts. This means that the "bearish" mood of the major players has weakened, and the total number of long contracts concentrated in the hands of speculators now amounts to 205 thousand, and short contracts – 241 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown that there is still no strong strengthening of the bulls' positions. The euro currency has not been able to show strong growth in the last few months, and maybe it will start after the ECB meeting. Graphical analysis is of great importance now because it is quite difficult to determine the exact time of the change in the mood of traders. If buy signals are received, it will mean, to a greater extent, that traders are ready to buy.

News calendar for the USA and the European Union:

EU - volume of industrial production (09:00 UTC).

US - producer price index (PPI) (12:30 UTC).

On September 14, the calendars of economic events in the European Union and the United States contain one entry each. Both reports are no more important than yesterday's, so the influence of the information background on the mood of traders today may be weak.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair when rebounding from the level of 1.0173(1.0196) on the 4-hour chart with a target of 0.9900. Now, these positions can be held. I recommend buying the euro currency when fixing quotes above the level of 1.0173 on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română