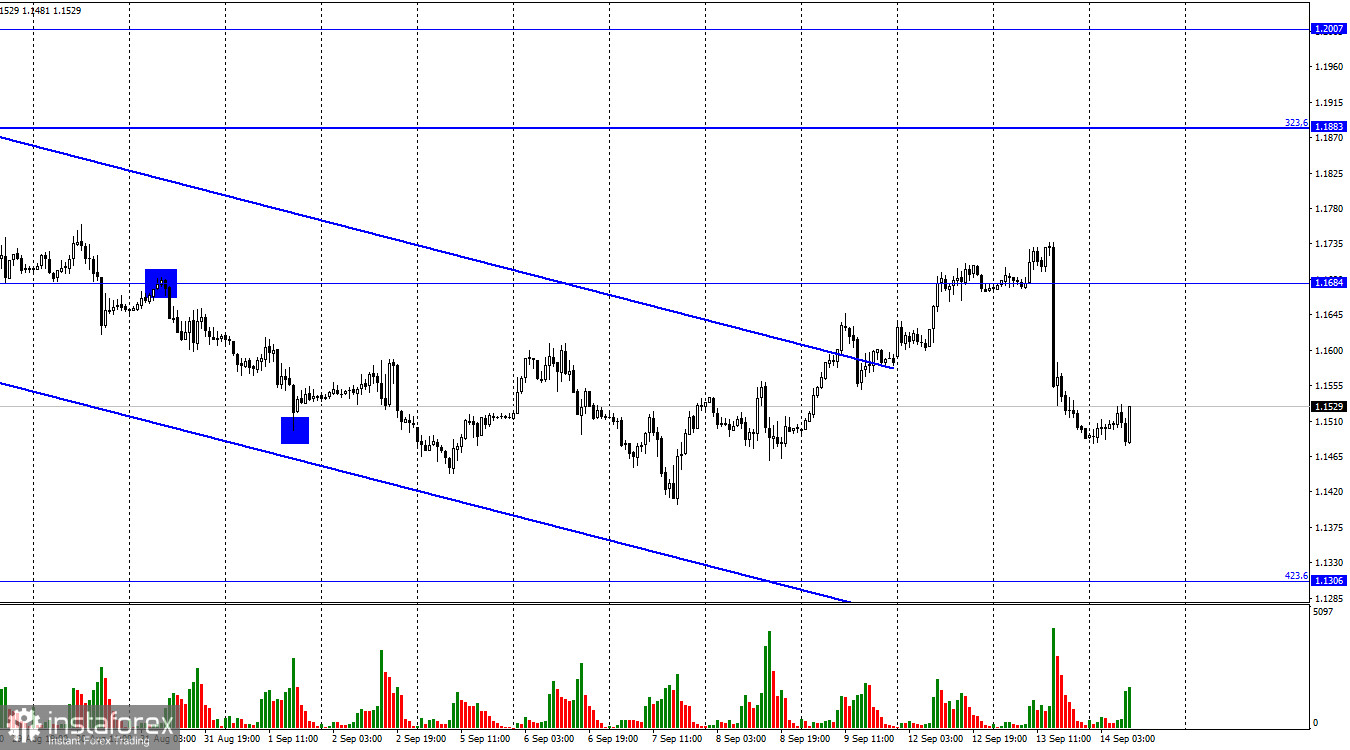

Good afternoon, dear traders! On the hourly chart, the GBP/USD pair fell drastically yesterday, almost touching 1.1306, the Fibonacci correction level of 423.6%. However, it did not reach this level. Notably, earlier, the pair was also unable to break through this level. It is located far below the current 40-year low. Therefore, it will be difficult for bears to push the pair below it. However, yesterday, the pound sterling collapsed by 200 pips following the US inflation report for August. This morning, traders were again caught off guard by the UK inflation figures for August. The UK Consumer Price Index slowed down for the first time to 9.9% on an annual basis. Analysts had expected the reading to total10.2% or 10.6%. It appears inflation has started to decline. Yet, it was only a one-month decline of 0.2% in annual terms.

The Bank of England raises the interest rate not as fast as the Fed. As a result, the regulator needs to increase the pace of monetary tightening. It turns out that the current inflation report does not provide any clues. The BoE has to stick to aggressive tightening to see a long-term slowdown in inflation. Traders resumed purchases of the pounds sterling following this report. They are now anticipating an aggressive rate increase next week. Today, the pair may add solid gains. Yet, in my opinion, the US inflation report is more important for investors than the UK one. I wouldn't be surprised if the British currency resumes a downward movement in the near future. Besides, inflation rose by 0.5% in monthly terms, which was almost in line with expectations. The Core CPI index totaled 6.3%, which was also in line with forecasts. The Producer Price Index tumbled to 13.7% from 14.4%. Hence, inflation is likely to begin to slow down. However, it will mainly depend on the BoE's future steps.

On the 4-hour chart, the pair retreated from 1,1709, the Fibonacci correction level of 161.8%. It slid down to 1.1496. A decline occurred after the release of the US inflation report. A rebound from 1.1496 took place this morning following the publication of the UK report. Hence, the pound sterling could grow to 1,1709. If it slips below 1.1496, it is likely to drop to 1.1111.

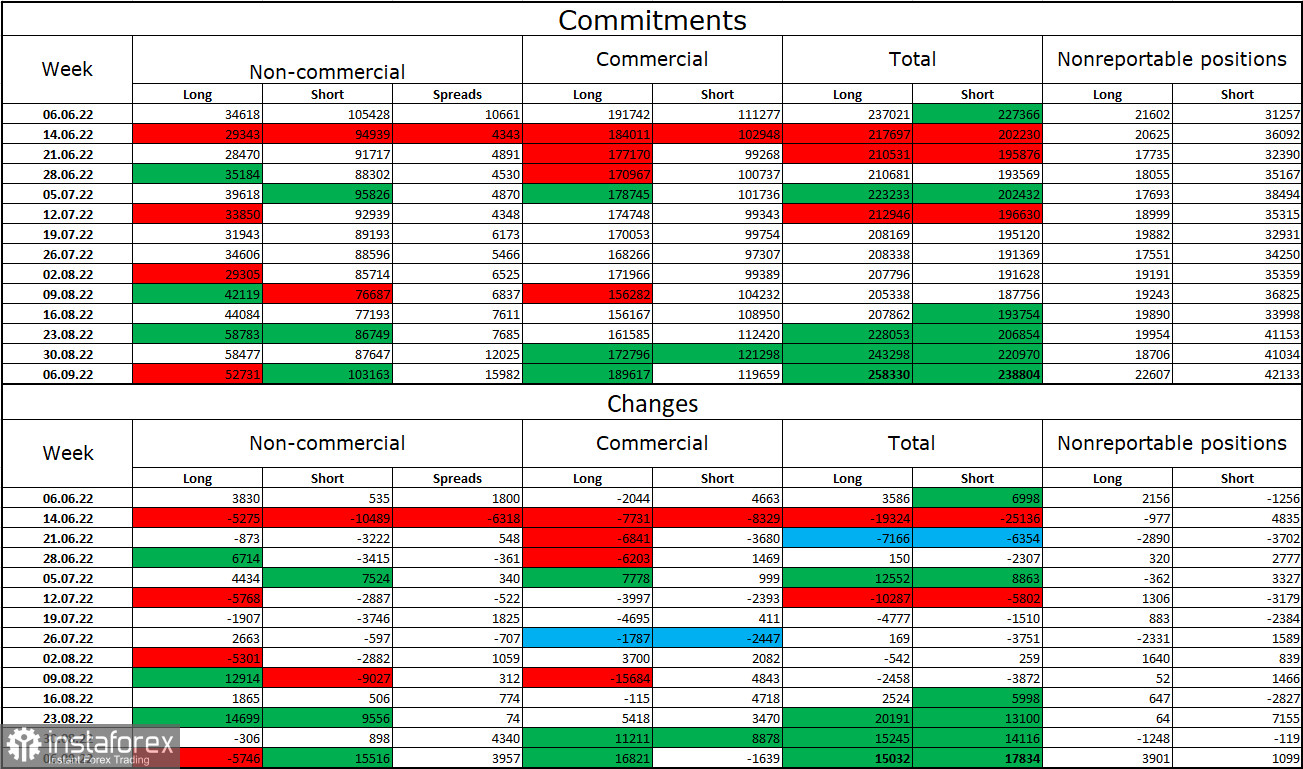

Commitments of Traders (COT):

The mood of the "Non-commercial" category of traders over the past week has become much more bearish than a week earlier. The number of Long positions decreased by 5,746 and the number of Short ones rose by 15,516. Thus, the general mood of the major traders remains bearish. The number of Short positions still exceeds the number of Long ones. After studying this COT report, I am more skeptical about the possible growth of the pound sterling. Large investors continue to open short positions on the pound sterling and their mood is gradually changing towards bullish. However, a trend reversal is unlikely to occur in the near future. The pound sterling is also showing signs of an upward reversal, Yet, a 200-300 pip increase is not enough to initiate an uptrend as the pair may perform a downward reversal as well in two or three days.

The economic calendar for US and UK:

UK – Consumer Price Index (06:00 UTC).

UK – Producer Price Index (06:00 UTC).

US – Producer Price Index (12:30 UTC).

On Wednesday, the UK has already unveiled its reports. In the afternoon, the US is going to unveil a report related to inflation. So, the influence of fundamental factors on market sentiment may be weak.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions on the pound sterling if it declines from 1.1709 on the 4-hour chart with a target level of 1.1496. The bears will achieve their goal. It is better to open new short positions if the price drops below 1.1496 with a target level of 1.1306. You should go long if the pair rises from 1.1496 with a target level of 1.1709. However, keep in mind that its growth may be short-lived.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română