EUR/USD

Higher timeframes

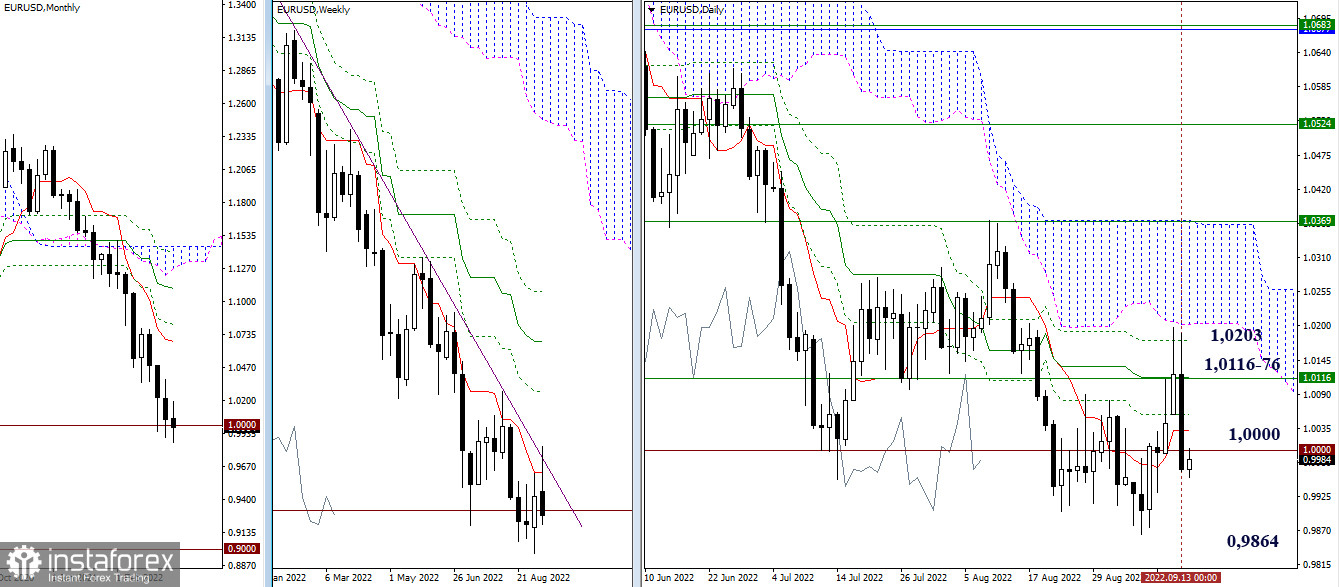

Testing of the weekly trend line and the reinforced resistance zone turned into a rebound formation yesterday. Bears regained their positions, recovering most of the current corrective rise. If the mood persists and the bearish sentiment continues to strengthen, then the bears, updating the minimum extremum (0.9864), will try to restore the downward trend. The attraction is currently exerted by the area of the psychological level of 1.0000. The most important resistance is still the zone 1.0116 – 1.0176 – 1.0203 (daily cross + lower border of the daily cloud + weekly short-term trend + trend line).

H4 – H1

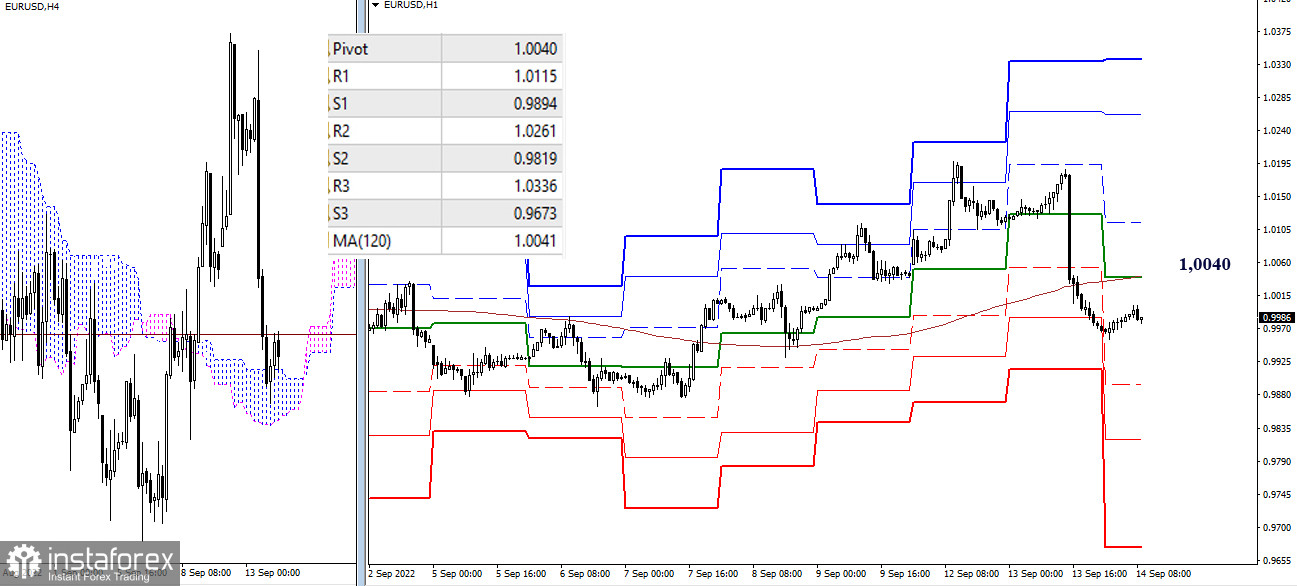

Bulls lost their advantage yesterday as the opponent managed to organize a decline below the key levels of the lower timeframes. Key levels are holding the line today, consolidating around 1.0040 (central pivot point + weekly long-term trend). Reference points for further decline within the day are now at 0.9894 – 0.9819 – 0.9673 (classic pivot points).

***

GBP/USD

Higher timeframes

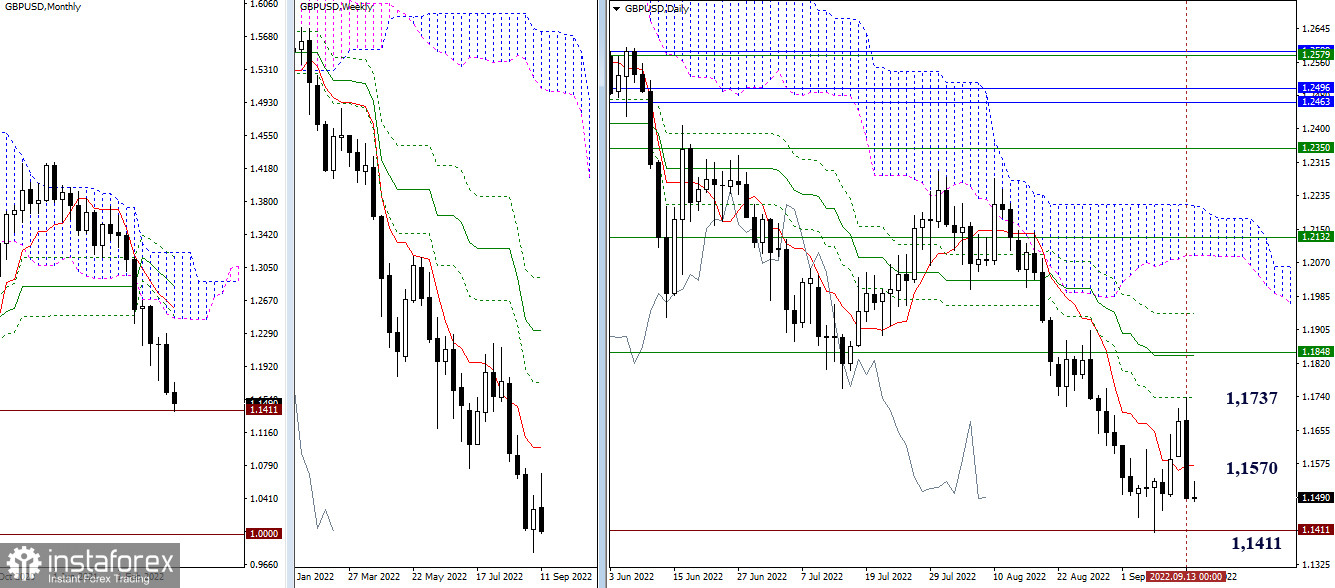

Bears dominated the market yesterday. They realized a rebound upon meeting the daily resistance (1.1737). After that, the main task for the bears is to break through the historical support (1.1411) and restore the downward trend. Next, the focus will be on lowering and testing the psychological barrier of 1.0000. If there is a slowdown now, the daily short-term trend (1.1570) may become the center of attraction and consolidation.

H4 – H1

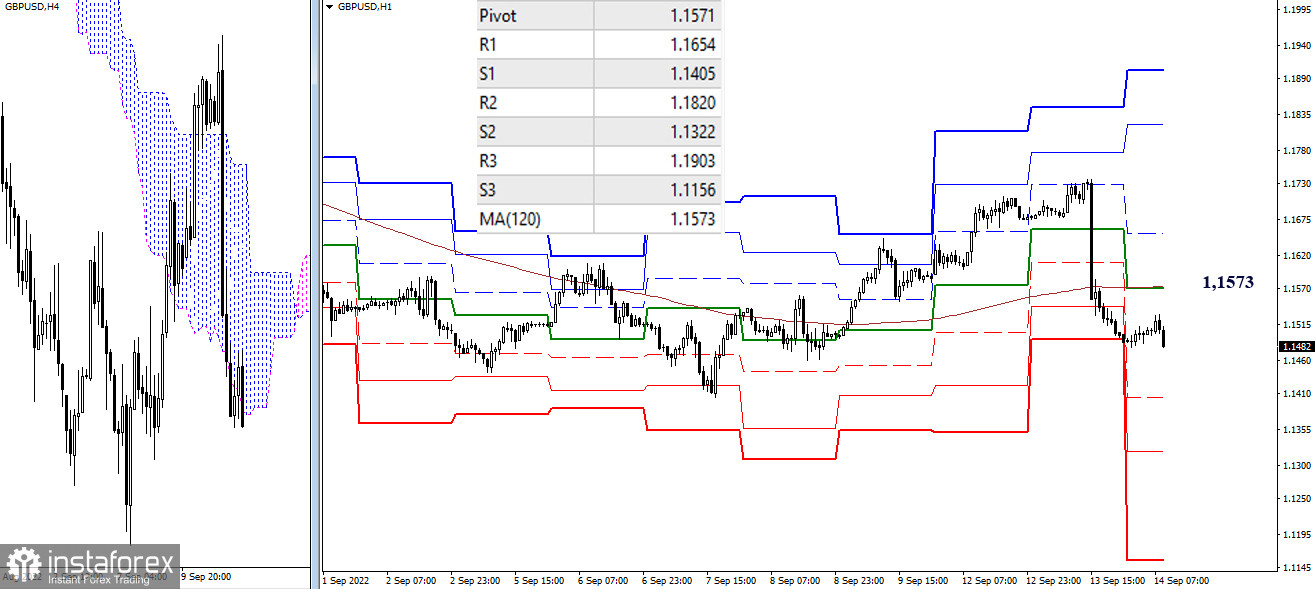

As a result of the pair's return to the key levels, the advantage of the lower timeframes again shifted to the side of the bears. Today, the key levels are resistances and are located at the turn of 1.1573 (central pivot point + weekly long-term trend). The reference points for continuing the decline within the day are the support of the classic pivot points at 1.1405 – 1.1322 – 1.1156.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română