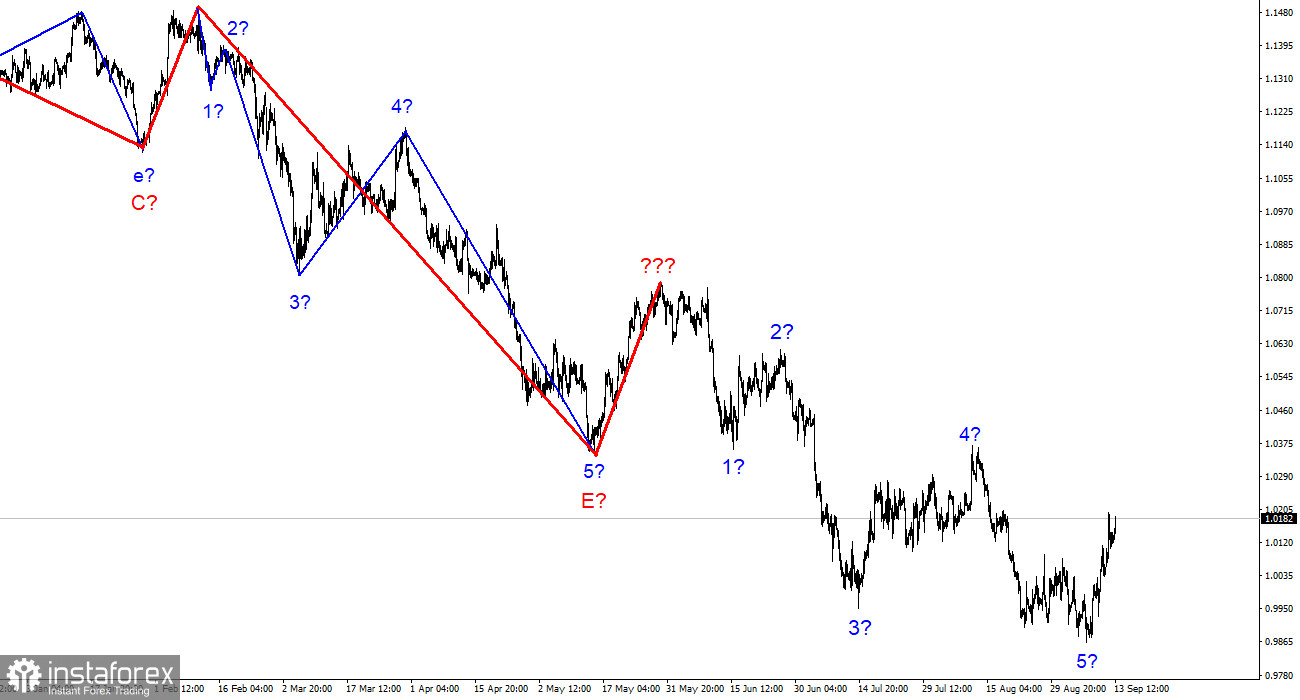

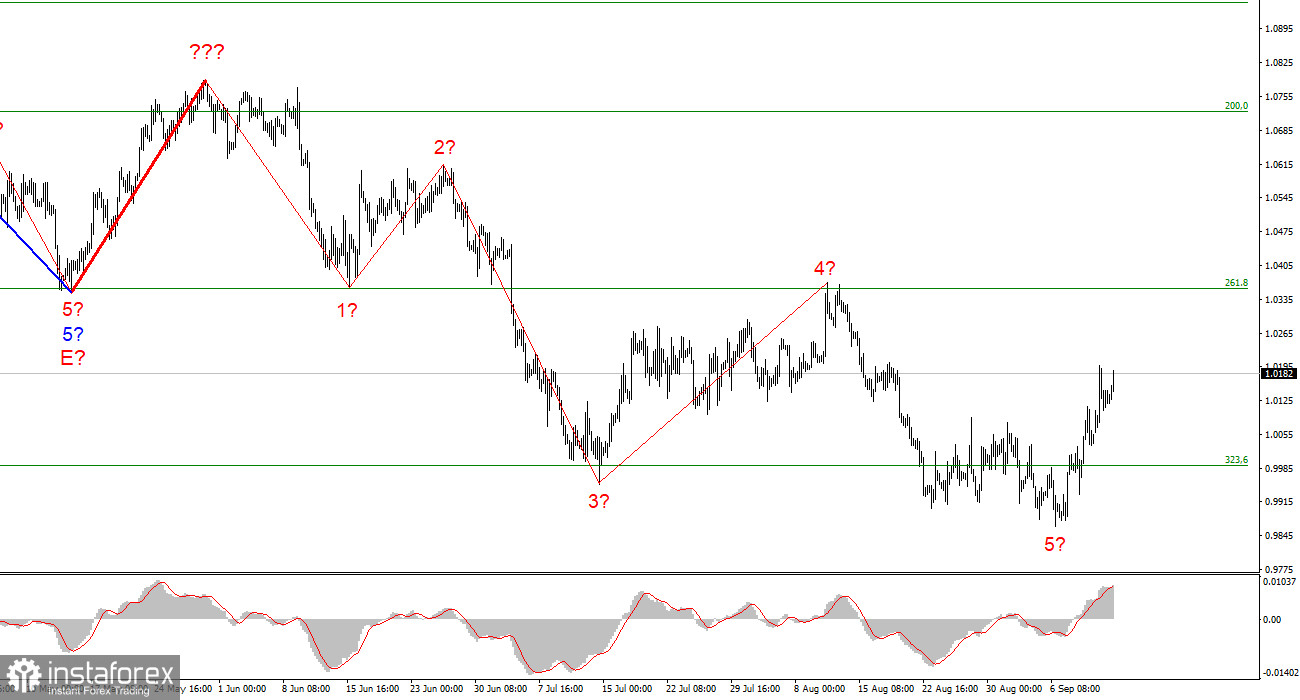

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments. Given the rather strong increase in the quotes of the euro currency in recent days, it can be assumed that wave 5 has completed its construction, since it is unlikely that the rising wave of the last few days is part of wave 5. Thus, the working option is the end of a long downward trend and the beginning of a new, ascending, at least corrective, at least three-wave. Since the European currency still does not show strong growth, I cannot say unequivocally that there will be no more decline in demand for this currency in the near future. The option of constructing a correction section and further resuming the downward one is not excluded at all. The option of complicating the entire downward section of the trend is not excluded, which in this case will take an even longer form. The news background for the markets remains one of the key factors, so if it gets worse, the demand for the euro may start to fall again. Nevertheless, the wave marking indicates that the market is ready to build at least three waves.

Is the market waiting for a weak inflation report?

The euro/dollar instrument rose by 70 basis points on Tuesday. In the near future, an inflation report for August will be released in America, and I think that the morning growth of the European currency is connected with this report, since there were no other important events today. It would be possible to note the inflation report in Germany, but this is just one country in the whole European Union. I don't think the market reacted so violently to this report. Thus, the demand for the dollar was falling ahead of the inflation report. This can mean two things. First, the markets are waiting for a weak inflation report (that is, below forecasts) and expect the Fed to slow down the pace of interest rate hikes next week due to falling inflation. The second is that the markets are waiting for a strong inflation report (above forecasts) and artificially raising the instrument to bring it down later.

Given the wave pattern, I would say that the first option is more likely. After all, the last wave is too long, so it is unlikely to belong to the 5th wave of the downward trend section. However, the second option cannot be completely excluded. I would say that a lot, if not everything, depends on today's inflation report. The market often needs a certain moment of truth to change its mood. The downward section of the trend has been building for a very long time, so now is the right time for the moment of truth. And for this, inflation needs to show a significant drop by the end of August. At the same time, it should decrease by the end of September. Therefore, we are waiting for the report, analyzing it and making the right conclusions.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is not completed with a probability of 100%. Sales should be abandoned for a while, since at this time we have five waves down and the tool can build a corrective set of waves. I also do not advise you to hurry with purchases, since the news background may cause a new drop in demand for the European currency. The FOMC meeting is already next week.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them. One of these five waves can be completed right now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română