EUR/USD continues to fall despite the current correction of almost 300 points.

If the dollar is under pressure today after the release of inflation data in the US, then EUR/USD will receive a new impetus for further growth.

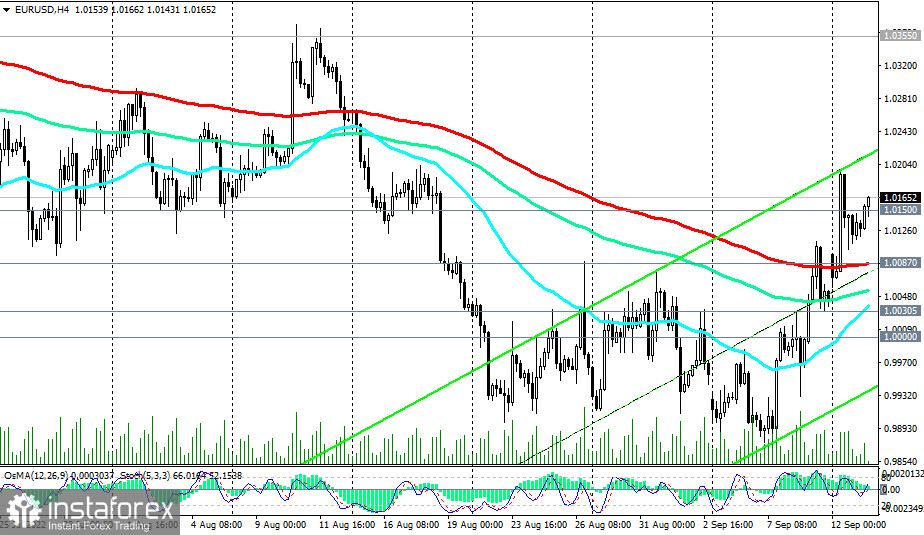

As of this writing, the price is trying to overcome the strong resistance level of 1.0150 (50 EMA on the daily chart).

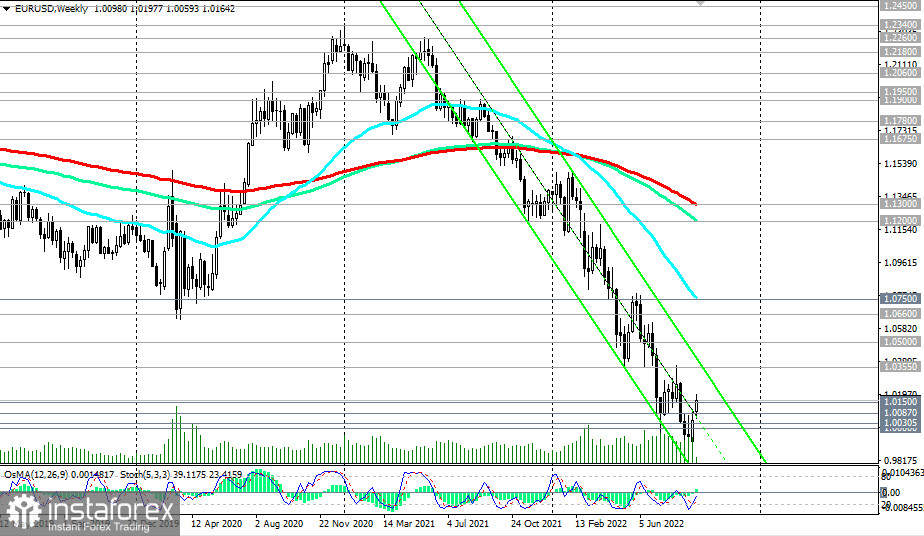

In case of successful development of a positive scenario for EUR/USD, the breakdown of yesterday's local high of 1.0198 will become a confirming signal for building up long positions with targets near the upper border of the downward channel on the weekly chart and the level of 1.0355.

In the main scenario, we expect the decline to resume. The breakdown of the crucial short-term support level 1.0087 (200 EMA on the 4-hour chart) will be a signal for the resumption of short positions, and the level of 0.9900 will be the first target of a decrease (in the range of 1–3 weeks).

Below the key resistance levels 1.0660 (200 EMA on the daily chart), 1.0750 (50 EMA on the weekly chart), EUR/USD is in the zone of a long-term bearish market.

Support levels: 1.0150, 1.0087, 1.0030, 1.0000, 0.9900, 0.9865, 0.9800

Resistance levels: 1.0198, 1.0220, 1.0300, 1.0355 , 1.0500, 1.0660, 1.0750

Trading Tips

Sell Stop 1.0110. Stop-Loss 1.0210. Take-Profit 1.0087, 1.0030, 1.0000, 0.9900, 0.9865, 0.9800, 0.9700

Buy Stop 1.0210. Stop-Loss 1.0110. Take-Profit 1.0300, 1.0355, 1.0500, 1.0660, 1.0750

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română