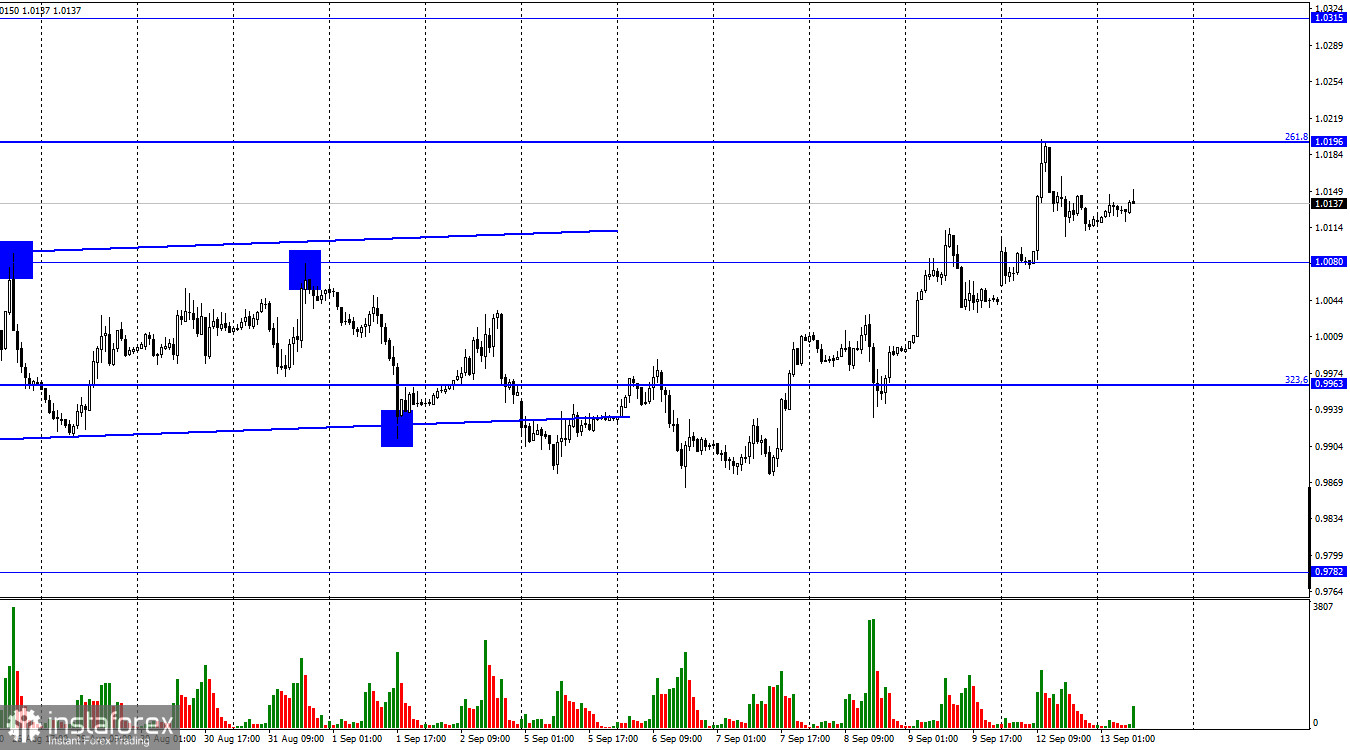

The EUR/USD pair continued the growth process on Monday and achieved a corrective level of 261.8% (1.0196). The rebound from this level worked in favor of the US currency and a slight drop, but on Tuesday morning, the growth process resumed. Today will be very interesting in terms of information background. In the morning, the German inflation indicator for August had already been released, and it quite predictably rose to 7.9% y/y. However, the most interesting thing about today is yet to come. In a few hours, the US inflation indicator will be released, and the mood of traders for the next few days, and maybe weeks, will largely depend on it. Let me explain what I mean. For traders, the inflation rate in the US is extremely important now because the Fed's decisions that will be made before the end of the year will be based on it. The US central bank continues to fight high inflation by raising interest rates. Inflation began to slow down last month, but until today's report, it is impossible to say whether it was a one-time decline or whether the indicator will now decrease every month.

Thus, if we see a new CPI decline today, the Fed may raise the rate by only 0.50% next week. If inflation slows down at the rate of its slowdown, the regulator may raise the rate by 0.75%. From my point of view, the Fed's decision next week will be "hawkish" in any case, and the US dollar may still return to the pedestal. I do not share the opinion of people who believe that a slowdown in inflation in the United States will increase demand for risky assets such as the euro currency. The fact that the euro is growing now may mean a normal correction. Thus, I recommend not rushing to conclusions but waiting for the inflation report and the results of the FOMC meeting. I also do not expect any new growth in the European currency today unless the CPI falls by more than 0.4%. We can still rely on levels that are in abundance. Let me remind you that on the 4-hour chart, the "bearish" mood of traders persists.

On the 4-hour chart, the pair increased to the corrective level of 127.2% (1.0173). The rebound of quotes from this level will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 161.8% (0.9581). The downward trend corridor continues to characterize the mood of traders as "bearish." Closing the pair's rate above the corridor can change the mood of traders to "bullish" for a long time.

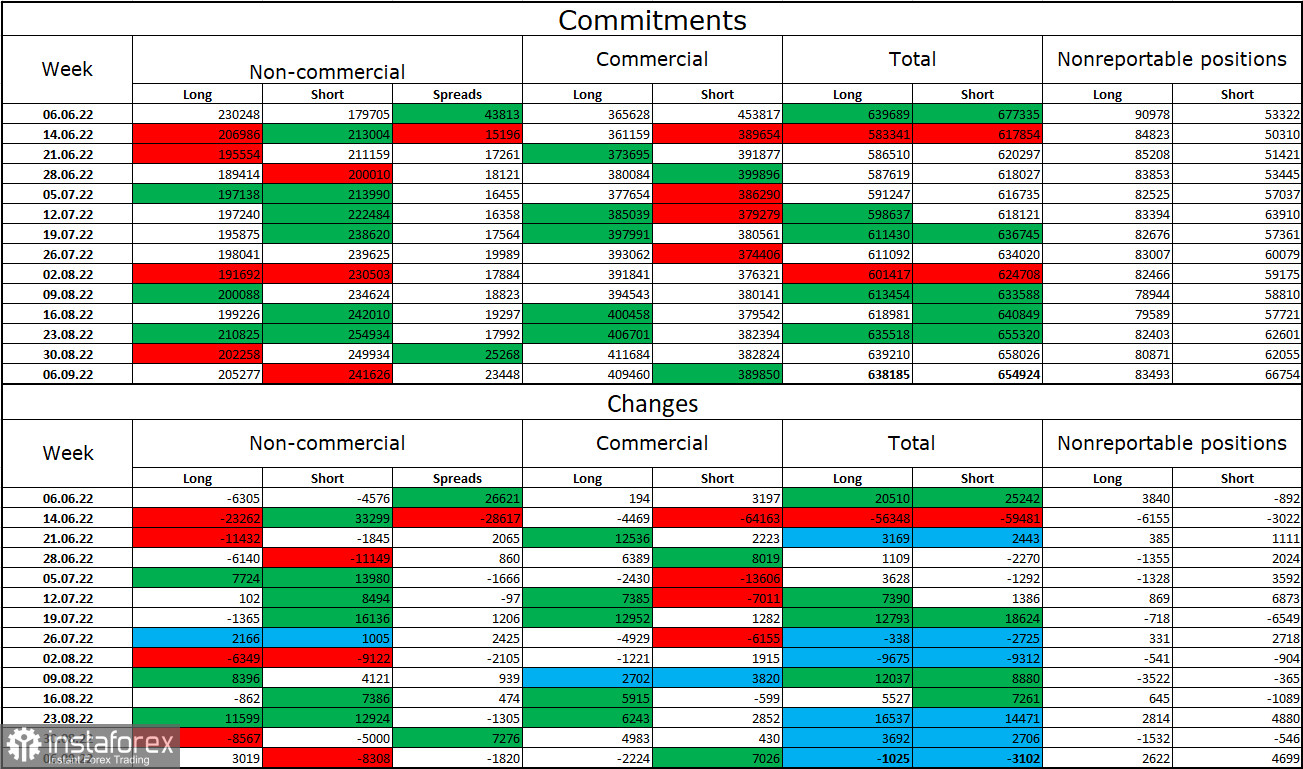

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 3,019 long contracts and closed 8,308 short contracts. This means that the "bearish" mood of the major players has weakened, and the total number of long contracts concentrated in the hands of speculators now amounts to 205 thousand, and short contracts – 241 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown that there is still no strong strengthening of the bulls' positions. The euro currency has not been able to show strong growth in the last few months, and maybe it will start after the ECB meeting. Graphical analysis is of great importance now because it is quite difficult to determine the exact time of the change in the mood of traders. If buy signals are received, it will mean, to a greater extent, that traders are ready to buy.

News calendar for the USA and the European Union:

US - consumer price index (CPI) (12:30 UTC).

On September 13, the calendars of economic events in the European Union and the United States contain one important entry for two. The US inflation report may have a very strong impact on the mood of traders on Tuesday.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the level of 1.0173 (1.0196) on the 4-hour chart with a target of 0.9900. I recommend buying the euro currency when fixing quotes above the level of 1.0173 on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română