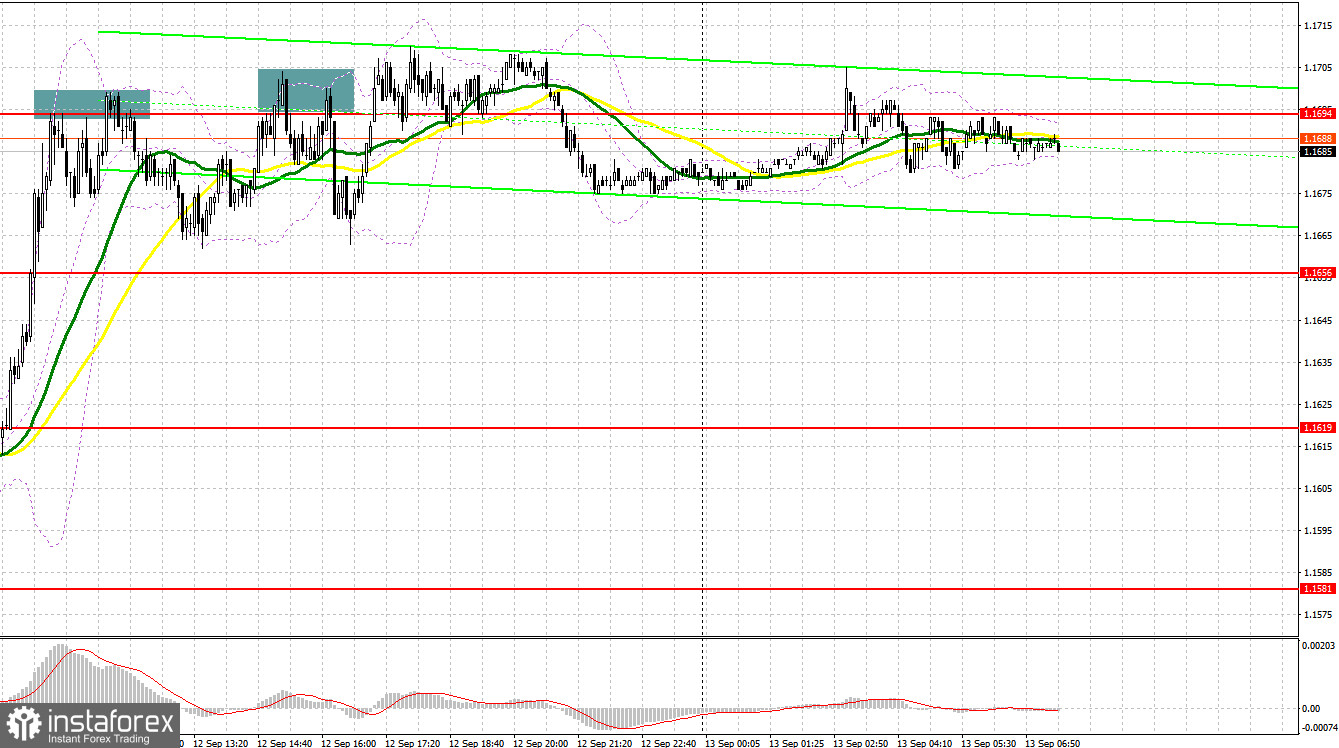

Several market entry signals were formed yesterday, but not all of them were profitable. Let's take a look at the 5-minute chart and see what happened. I advised making decisions on entering the market from it in my morning forecast. As a result of the breakthrough at 1.1642, which, to my regret, was left without a reverse downward test, the pound continued to rise and reached the next resistance at 1.1690. Forming a false breakout there resulted in an excellent short entry point, which brought about 25 points of profit on the first move. No matter how the bulls tried to get above this range in the afternoon, nothing worked. Several similar false breakouts at 1.1690 made it possible to get good entry points for selling, but it never came to a particularly large sell-off, everything was limited to movements of 20-25 points.

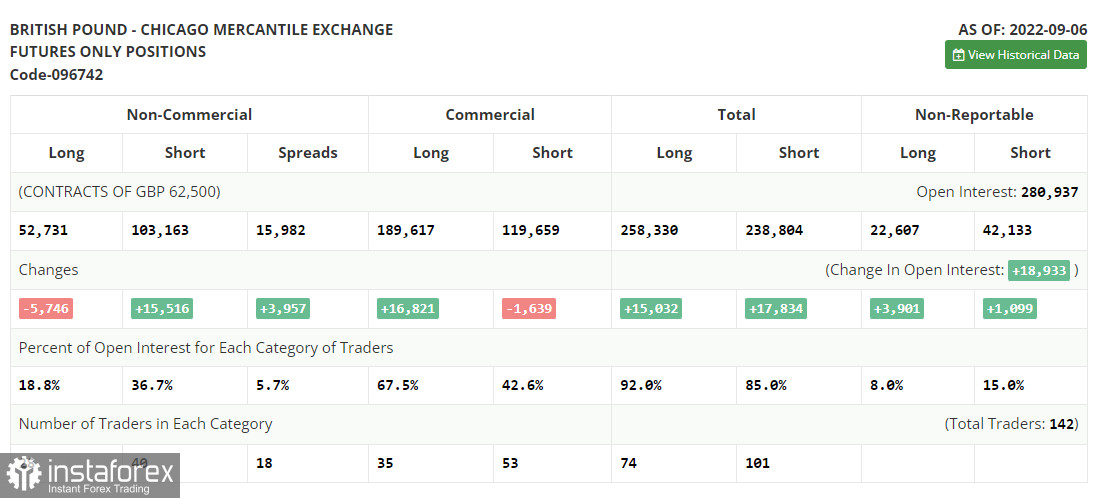

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. An increase in short positions and a decrease in long ones were recorded in the Commitment of Traders (COT) report for September 6. This once again confirms the fact that the British pound is in a major downward peak, from which it is not as easy to get out as it might seem. Last week, Bank of England Governor Andrew Bailey delivered a speech, and he did his best to inspire confidence that the central bank will continue to follow the path of defeating inflation and continue to aggressively raise interest rates. This suggests that at its next meeting the committee will probably raise rates by 0.75% at once, following the example of other central banks. However, the UK economy is getting worse and worse, and GDP is shrinking quite quickly, as evidenced by recent reports, which does not give confidence to investors. With high inflation and a looming cost-of-living crisis in the UK, it will be quite difficult for bulls to get room to take long positions as nothing good is in store for the stats ahead. The latest COT report indicated that long non-commercial positions decreased by 5,746 to 52,731, while short non-commercial positions rose by 15,516 to 103,163, which led to an increase in the negative value of the non-commercial net position to -50,423 versus -29,170. The weekly closing price collapsed from 1.1526 against 1.1661.

When to go long on GBP/USD:

Quite important statistics for the UK will be released today, but like all the others released last week, it can be completely ignored even if the numbers are weak. I advise you to pay attention to reports on the UK unemployment rate, changes in the level of average earnings, as well as changes in the number of applications for unemployment benefits. Of these three measures, earnings will be important, as households continue to lose money when adjusted for inflation and clearly disagree with government policies. Fortunately, there is hope that the new prime minister will put things in order. In case GBP/USD falls in the first half of the day after the reaction to the negative data on the UK, which is quite likely, the best scenario for buying will be a false breakout in the area of the nearest support of 1.1666, formed at the end of yesterday and where the moving averages are, playing on the bulls' side. This will lead to a rebound upwards and a breakthrough to the area of 1.1706, above which it was not possible to break through yesterday. We can only talk about building a further upward correction for the pair after getting above this range. A breakdown of 1.1706, as well as a reverse downward test will open the way to 1.1757. A more distant target will be the area of 1.1793, where I recommend taking profits.

If the GBP/USD falls and there are no bulls at 1.1666, and everything goes towards this, the pressure on the pound will increase again. This will force the bulls to leave the market again, as the risk of a return to the bearish trend will become more real. If this happens, I recommend postponing long positions to 1.1631. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately on a rebound from 1.1588, or in the low area of 1.1551, counting on correcting 30-35 points within the day.

When to go short on GBP/USD:

Protecting the nearest resistance at 1.1706 before the release of statistics on inflation in the US is almost the most important task for today. Whether the weak fundamental reports on the UK will help in this or not is a big question. In case the pair rises, forming a false breakout at 1.1706 will return pressure on the pound and create a sell signal in order to develop a bearish trend and decline to the nearest support at 1.1666, which will not pose as a big threat to bulls. A breakthrough and reverse test from below 1.1666 will provide an entry point for selling with a fall to 1.1631, but a much more interesting target will be the area of 1.1588, where I recommend taking profits. An update in this area can seriously harm the bulls' future plans to build an upward trend. But such a movement will occur only with the next inflationary surge in the United States.

In case GBP/USD grows and the bears are not active at 1.1706, then the bulls will be in control of the situation, who will have an excellent chance of returning to 1.1757. Only a false breakout around 1.1757 creates an entry point into short positions, counting on a new downward movement of the pair. If there is no activity there, there may be a surge up to the high of 1.1793. There, I advise you to sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

Indicator signals:

Trading is carried out above 30 and 50 moving averages, which leaves a chance for bears to further pull down the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.1666 will increase pressure on the pair. Surpassing the upper border of the indicator in the area of 1.1706 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română