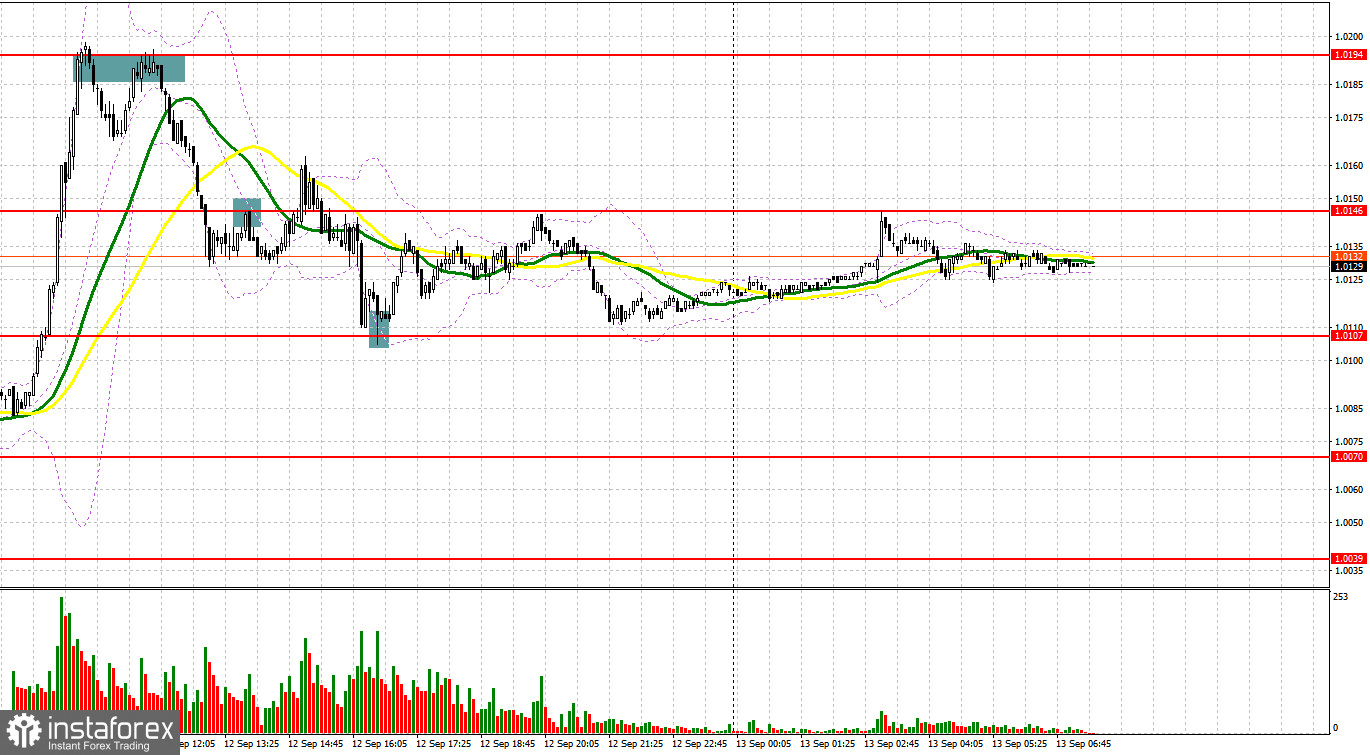

Yesterday, a few interesting entry signals were made. Let's take a look at the M5 chart to get a picture of what happened. In my previous morning review, I focused on the mark of 1.0185 and considered whether to enter the market at that level. The euro extended growth that began in the course of the European session and recovered quickly to 1.0185. After a false breakout, a sell signal was generated, and the price plunged by over 50 pips. A breakout and consolidation below 1.0146 during the North American session triggered a sell-off within the 1.0107 range. After a buy signal produced by a false breakout through the low, the pair retraced up to 1.0146.

When to go long on EUR/USD:

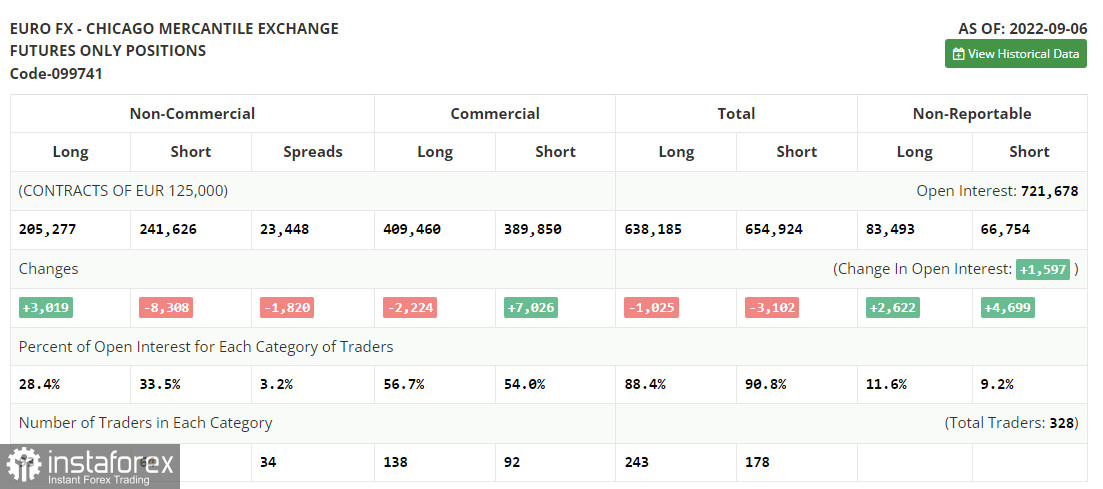

Before analyzing the dynamic of EUR/USD, let's look at the situation in the futures market and changes in the Commitments of Traders. The COT report as of September 6 logs a decrease in short positions and a sharp rise in long ones. Such changes come as no surprise as they have occurred ahead of the monetary policy meeting of the European Central Bank, at which the regulator raised the interest rate by 75 basis points. With the gap between the interest rates of the US Federal Reserve and the ECB narrowing, demand for the euro will be gradually increasing. Still, it is important to understand the tough situation the European economy is now dealing with. It is likely to struggle even more during the winter season due to sky-high energy prices. The US Federal Reserve is also planning to hike rates by 75 basis points at a meeting next week. In this case, however, a lot depends on inflation. Should consumer prices accelerate further, the US central bank will act decisively. According to the COT report, long non-commercial positions rose by 3,019 to 205,277 and short non-commercial positions dropped by 8,308 to 241,626. In a week, the non-commercial net position remained negative but advanced to -36,349 versus -47,676, indicating an impending correction to the upside. The weekly closing price was down to 0.9917 versus 1.0033.

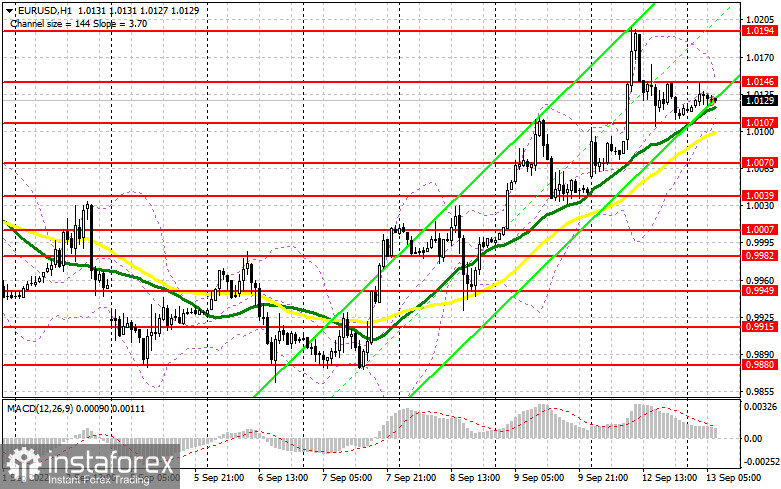

I doubt that the euro will be able to extend growth in the course of the European session given that US inflation is looming. Germany's macro reports due today – inflation, ZEW economic sentiment, and ZEW current conditions – will unlikely drive EUR/USD up. If inflation slows, the other two indices will also decrease, and pressure on the pair will increase. Should the data came disappointing, it would be wiser to go long after a false breakout through 1.0107 support only. In such a case, a correction to the upside will occur and the price will head towards 1.0146 resistance. It could hit the monthly high of 1.0194, with the target at 1.0221, if an additional buy signal is made. The most distant target stands in the 1.0243 range, where traders could lock in profits. Alternatively, if EUR/USD goes down when there is no bullish activity at the 1.0107 level, which is in line with bullish MAs, pressure on the pair will increase, and it will fall to 1.0070. I would go long from this mark after a false breakout only. Long positions at the low of 1.0039 or at 1.0007 (the level near parity) could be considered on a bounce, allowing an intraday bullish correction of 30-35 pips.

When to go short on EUR/USD:

Bearish activity increased yesterday. The return of sellers to the market depends solely on US inflation. Today, it would be wiser to go long after a false breakout through 1.0146 resistance. The price could advance to this mark if Germany's macro data come strong enough. If the quote fails to settle at 1.0146, the euro will fall to 1.0107, break through the level, and consolidate below the range. A retest of this barrier from bottom to top will create an additional sell signal, a row of bullish stop-loss orders will trigger, and the euro will head towards 1.0070. However, sellers should close short positions only if the price settles below the range, with the target at the 1.0039 low. A more distant target is seen in the 1.0007 range. Alternatively, if EUR/USD goes up in the course of the European session when there is no bearish activity at 1.0146, the pair could soar to the monthly high, and buyers will maintain control over the market. In such a case, I would consider going short at 1.0194 after a false breakout. EUR/USD could be sold at the high of 1.0221 or at 1.0243 on a bounce, allowing a bearish correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating a bullish bias.

Note: The period and prices of moving averages are viewed by the author on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The euro will go down in case of a breakout through the lower band at 1.0107 and rise if the price breaks through 1.0146, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română