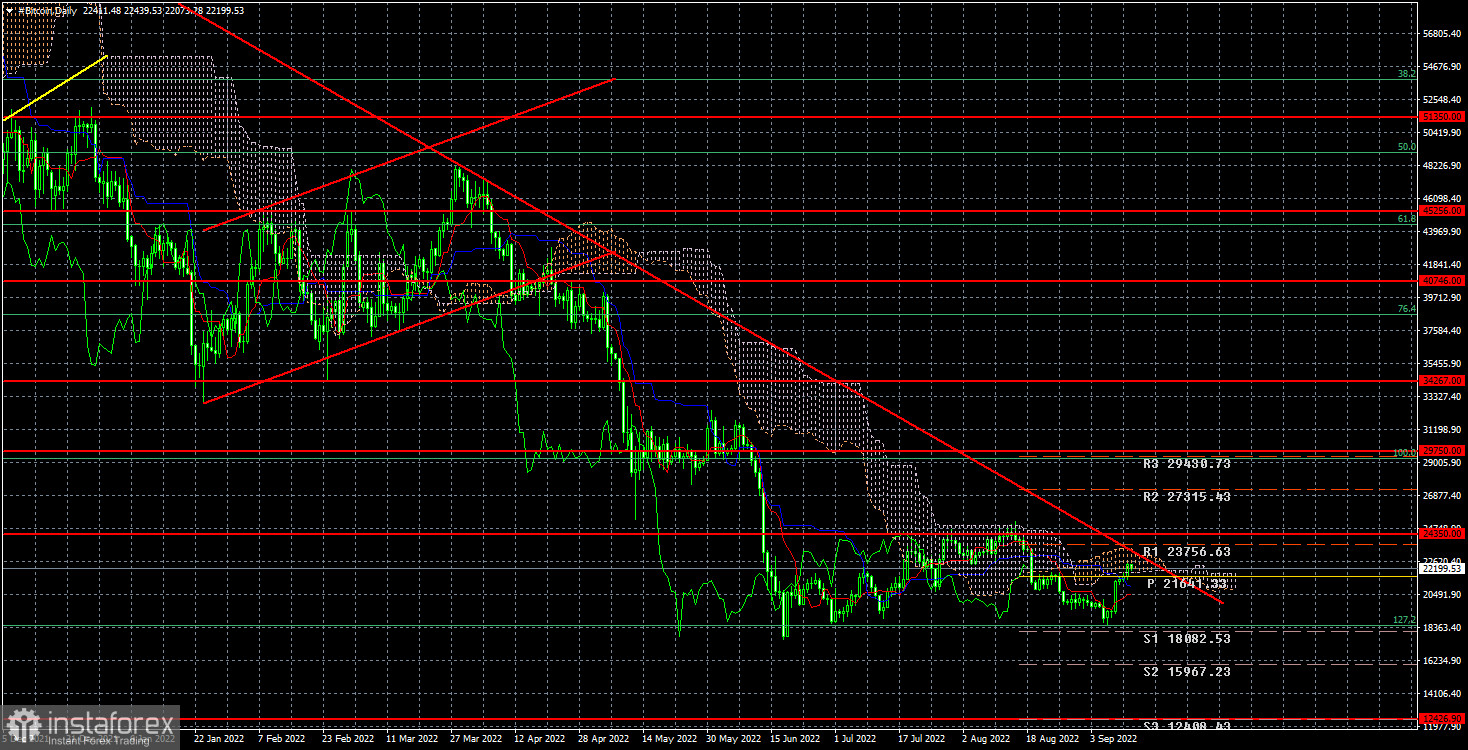

Bitcoin has been growing for the last few days. We cannot call this growth strong, as it proceeds in the same side channel as before all movements – $ 18,500-$ 24,350. After the rebound from the lower border of this channel, which is visible in the illustration below, anyone could predict the growth. Another question is what will happen to the cryptocurrency when it reaches the descending trend line, which remains to go just a little bit. At the moment, we have two technical guidelines at once.

On the one hand, bitcoin is inside the side channel, and on the other hand, below the descending trend line. And one of these benchmarks may become irrelevant in the near future. For example, a cryptocurrency can overcome the trend line but remain inside the side channel and bounce off its upper limit. In this case, the flat will remain, and overcoming the trend line will not be considered a signal to buy. In another case, bitcoin may bounce off the trend line and further overcome the lower boundary of the side channel, and then the downward trend will resume.

We believe that the probability of resuming the downward trend is very high. The Federal Reserve will hold a meeting next week, and the rate will likely be raised again by 0.75% for the third time in a row. This is a negative moment for bitcoin, and all risky assets since any tightening of the monetary policy usually lead to a fall in these assets. The Fed does not think to stop there and will continue to fight inflation. Therefore, we expect the resumption of the downward movement in the near future. It should also be noted that a report on American inflation will be released today, showing us what we can expect next week. If inflation shows a significant slowdown, we expect the Fed rate to rise by only 0.5%. If not, then by 0.75%. But in any case, this is a tightening monetary policy, so we are waiting for a new fall.

It should be noted that if the current price levels were attractive for traders and investors, then bitcoin would already be growing. Instead, it has been hovering around its annual lows for three months. This means that market participants are not considering purchases at this time, which means the fall will resume.

On the 24-hour timeframe, the quotes of the "bitcoin" could not overcome the $ 24,350 but also failed to overcome the $18,500 (127.2% Fibonacci). Thus, so far, we have a side channel, and it is unknown how much time bitcoin will spend in it. We recommend not rushing to open positions and withdrawals. It is much better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will open the way to the $12,426 level. You can also use rebound signals (from the trend line or the channel's upper border).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română