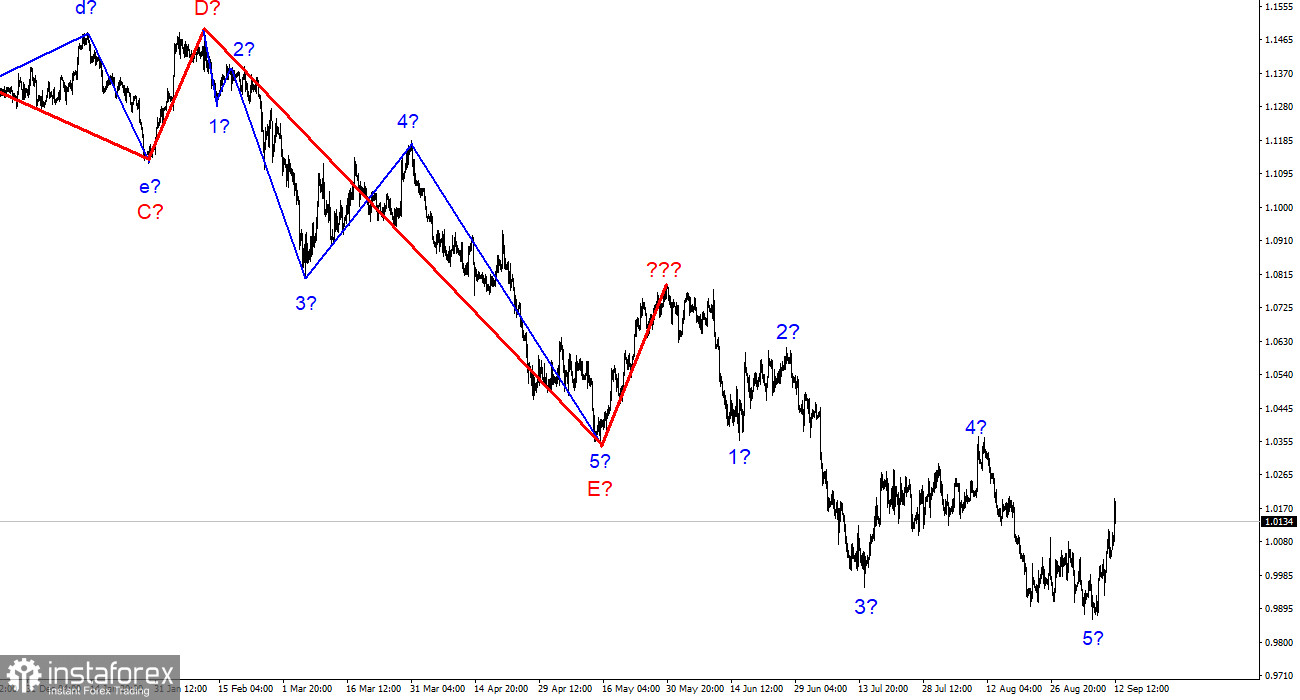

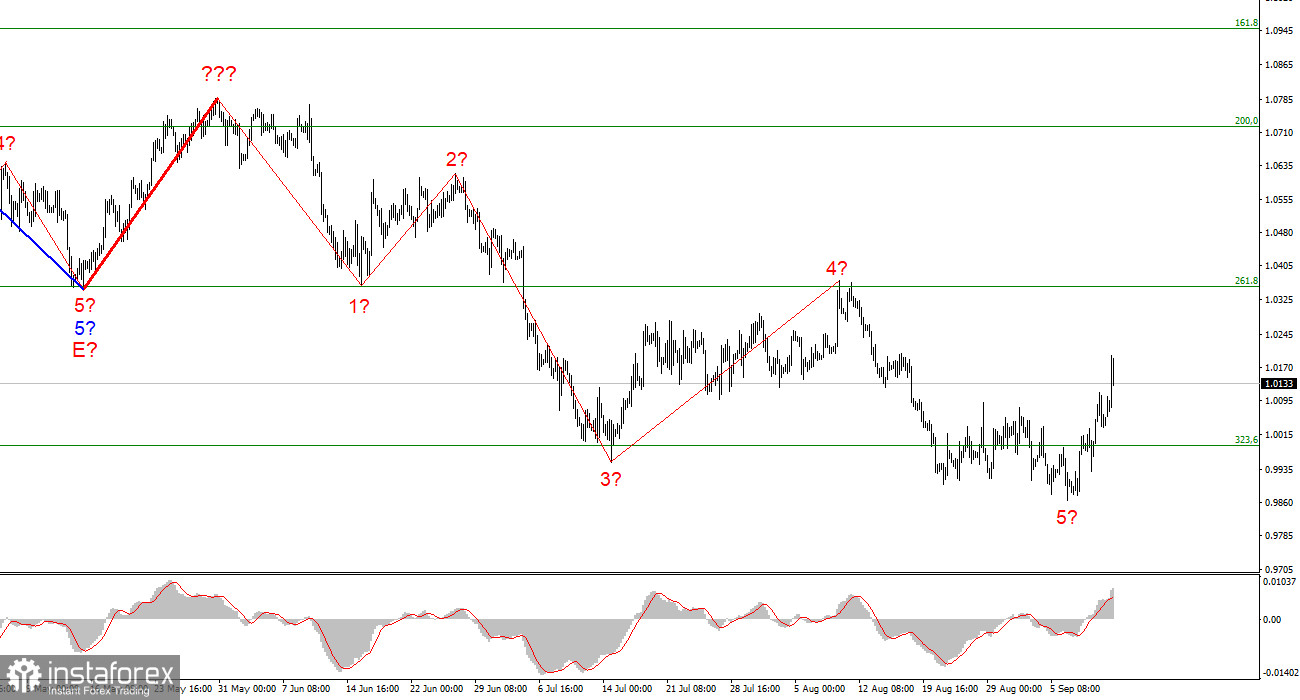

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments. Given the rather strong increase in the quotes of the euro currency in recent days, it can be assumed that wave 5 has completed its construction since it is unlikely that the rising wave of recent days is part of wave 5. Thus, the working option is the end of a long downward trend and the beginning of a new, upward, corrective minimum, three-wave minimum. Since the European currency still does not show strong growth, I cannot say that there will be no more decline in demand for this currency in the near future. The option of constructing a correction section and the further resumption of the downward one is not excluded. The option of complicating the entire downward section of the trend is not excluded, which will take an even more extended form in this case. The news background for the markets remains one of the key factors, so if it gets worse, the demand for the euro may start to fall again. Nevertheless, the wave marking indicates that the market is ready to build at least three waves up.

The situation is ambiguous; a further fall in the euro is possible

The euro/dollar instrument rose by 100 basis points on Monday. There were more, but a departure from the reached highs began in the last few hours. Thus, the market showed from the beginning of the week that it is now ready to buy euros since there was no news today. What could have caused the increase in demand for the euro currency? I believe that the market continues to react this way to strengthen the ECB's "hawkish" attitude. There are, of course, other possible reasons. For example, the price of "blue fuel" is reduced, but this problem remains open. The European Union is doing its best to reduce the price of natural gas, and any weapon is used. A proposal has already been made to set a maximum price for gas from Russia, but it is unclear how this will help the European Union itself. After all, there are gas contracts in which prices are clearly spelled out. There is a market price. There is, after all, Gazprom, which has every right not to supply gas to Europe if the price does not suit it. The calculation of the European Union is clear. Brussels will bet that if gas supplies to Europe are completed, Moscow will have nowhere to put all the gas produced. Therefore, Brussels wants to set the gas price, but Moscow is unlikely to agree to such a proposal. Therefore, if the market has experienced an attack of optimism because of the gas issue, it seems to me that it is premature. In any case, we need to see now how the new upward wave will develop. The market can increase the demand for the tool even without a news background. How many rising waves have we already seen within the current trend? This may be one of them. I would not be in a hurry with sales or purchases right now. The situation is too ambiguous.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is not completed with a probability of 100%. Sales should be abandoned for a while since we have five waves down now, and the tool can build a corrective set of waves. I do not advise you to rush with purchases either since the news background may cause a new drop in demand for the European currency.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be completed right now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română