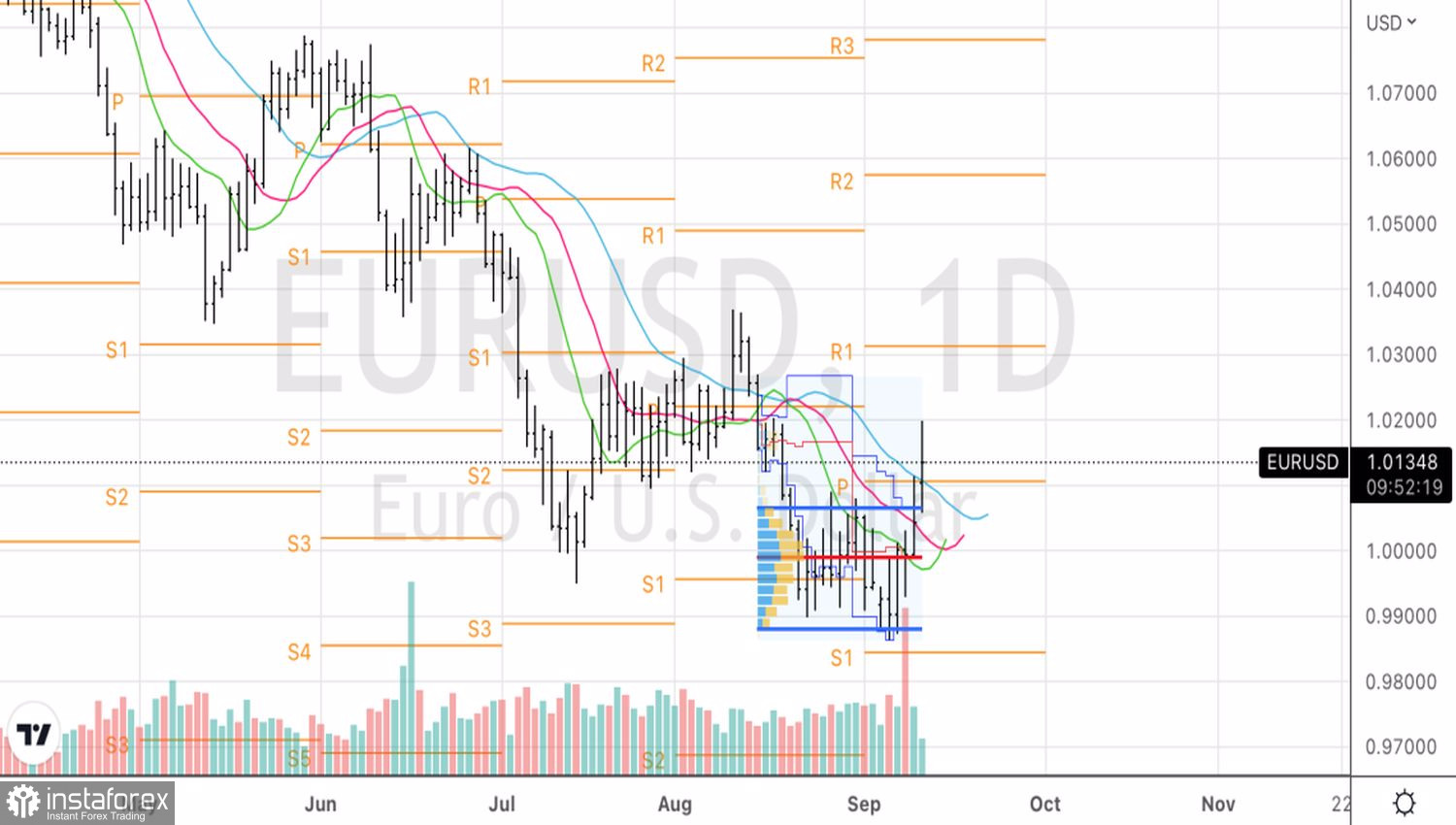

Armed with a rally in American stock indices, the "hawkish" rhetoric of ECB officials, "bulls" on EURUSD led the pair's quotes in the direction of 1.02, sincerely hoping to mark the best daily growth in six months. However, it did not happen. Belief in the US dollar is still strong in the financial markets, so its opponents had to retreat. We successfully took profit on longs, and then formed shorts on the rebound from 1.018.

Judging by the rapidly falling gasoline prices, which won back all the growth after the outbreak of hostilities in Eastern Europe, consumer prices in the US continue to slow down. Markets believe this will deter the Fed from raising the federal funds rate aggressively by 75 bps in September, although CME derivatives give a 90% chance of such an outcome of the next FOMC meeting. There is practically nowhere to go higher, and a decrease in chances will weaken the US dollar. This is what its fans fear and take profits. Closing short positions on EURUSD underlies the short-term rally of the major currency pair.

I doubt that its medium-term prospects have changed significantly. First, falling gasoline prices only lead to a temporary slowdown in inflation. In the future, this will act as a tax cut, that is, stimulate consumer activity and increase CPI. The Fed will be forced to continue the cycle. Bloomberg experts expect the federal funds rate to rise to 3.75% by the end of 2022. Cleveland Fed research shows that the ideal rate is at around 3.67% in the third quarter of this year and 4.15% in the fourth quarter of next year.

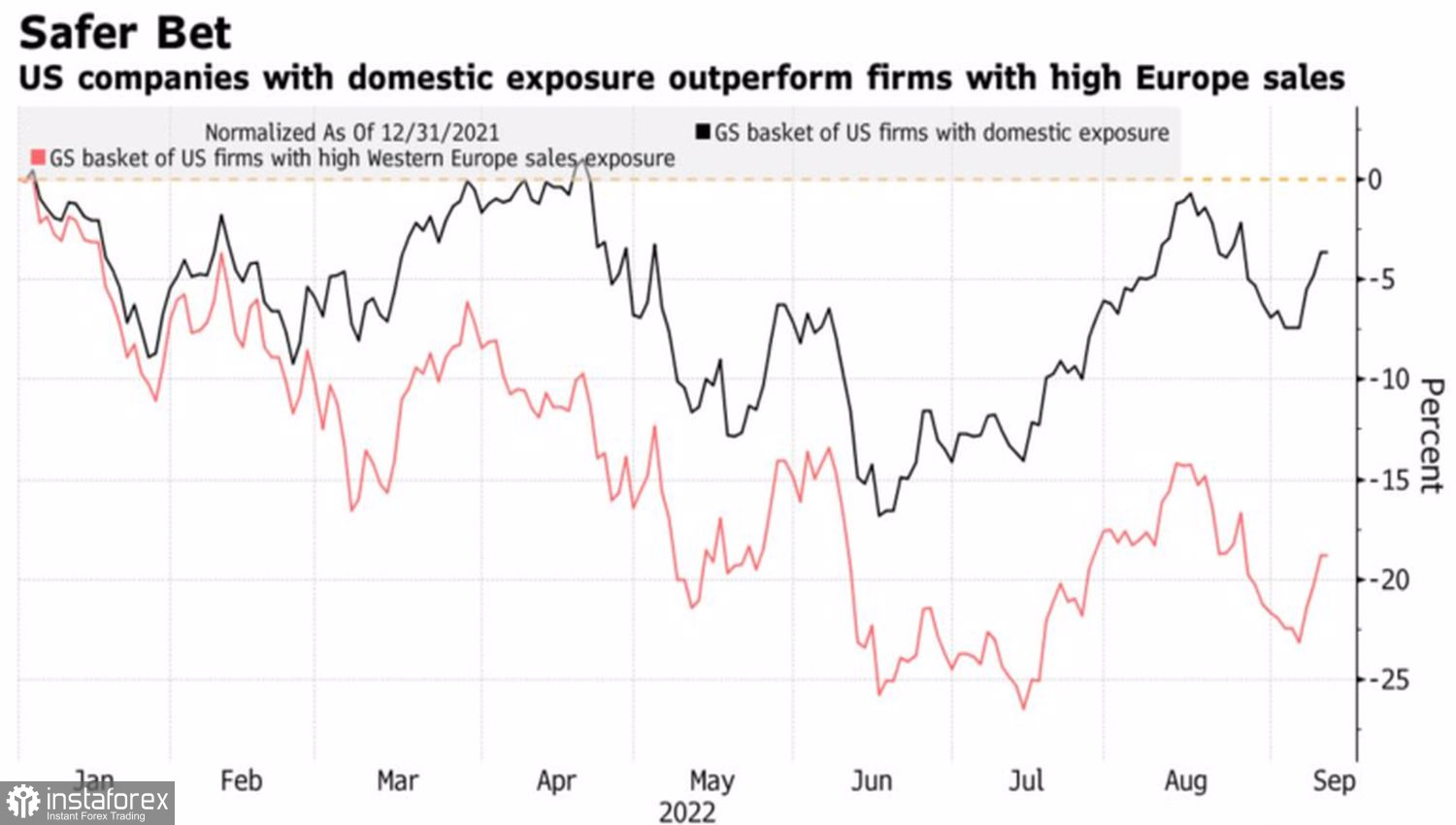

Second, despite the fact that gas prices in Europe have retraced from recent highs, they are still four times higher than in September 2021, and eigth times higher than in the US. This is one of the reasons why Goldman Sachs believes that money will continue to flow into the US stock market. The situation in Europe, according to the bank, looks terrible. At the same time, American companies that work for the domestic market win over those who operate with the external one.

Dynamics of stock portfolios of US companies operating in different markets

American exceptionalism continues to serve the dollar faithfully, so the current growth of EURUSD looks like nothing more than a correction.

Finally, the armed conflict in Ukraine is far from over. Its escalation will increase the demand for the US dollar as a safe-haven currency. The same result may occur if the worsening macro statistics for the United States brings back talk of a recession to the market. According to Bloomberg experts, its probability over the next 12 months is 50%.

Technically, on the EURUSD daily chart, the break of resistance at 1.0115, as we expected, pushed the quotes of the pair in the direction of 1.02. Updating the local high will increase the risks of a pullback to 1.022 and even to 1.027. Nevertheless, we continue to adhere to the strategy of selling the euro on growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română