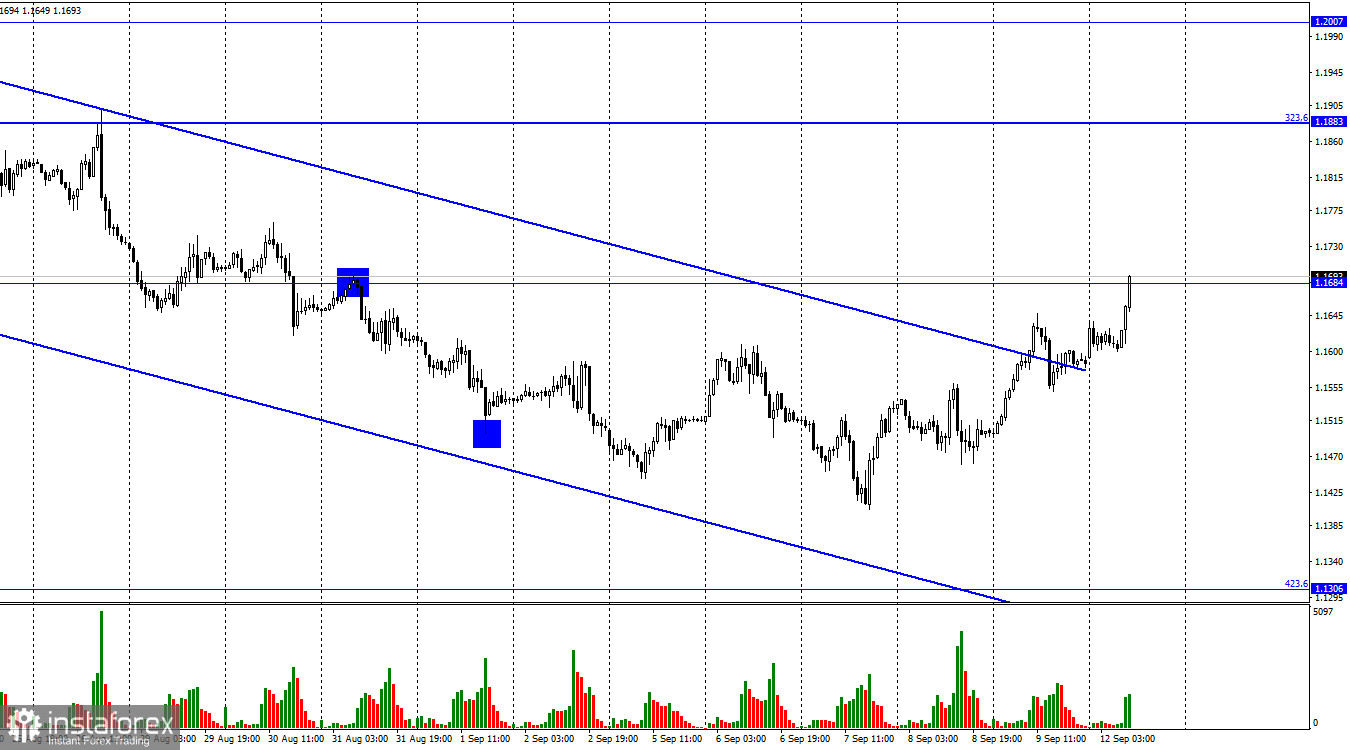

Hi, dear traders! According to the H1 chart, GBP/USD continued to move upwards and reached 1.1684. If the pair bounces off this level, it could then resume its decline towards the retracement level of 423.6% (1.1306). If GBP/USD closes above 1.1684, it could rise towards the Fibo level of 323.6% (1.1883). Earlier, the pair closed above the descending trend channel, indicating that traders are currently bullish on GBP/USD. Both the pound sterling and the euro advanced early on Monday, as a batch of UK macroeconomic data was released. However, these data releases were unlikely to trigger this upsurge. The UK GDP rose by 0.2% m/m in July, matching the expected 0.2-0.3% increase, and advanced by 2.3% y/y. In the three months to July, GDP remained unchanged. The trade deficit decreased by £3 billion, while industrial production increased by 1.1% y/y, below an expected 1.8% rise. Month-on-month, industrial production declined by 0.3%.

Overall, these data releases were neutral, matching or falling short of market expectations. They could not have given support to the pound sterling. There were no such events last week as well, with most key data being published in the EU instead. This GBP and EUR upsurge is very likely a correction, and it is unclear how long it will last. The euro is pushed upwards by the ECB rate hike, while GBP traders earlier ignored similar moves by the Bank of England. This correction could end soon, making chart signals particularly important for traders.

According to the H4 chart, GBP/USD continued to rise towards the retracement level of 161.8% (1.1709) after bullish CCI and MACD divergences had emerged. If the pair bounces off this level, it could resume its decline towards 1.1496. If the pair settles above the descending trend channel and 1.1709, it could continue its upward movement.

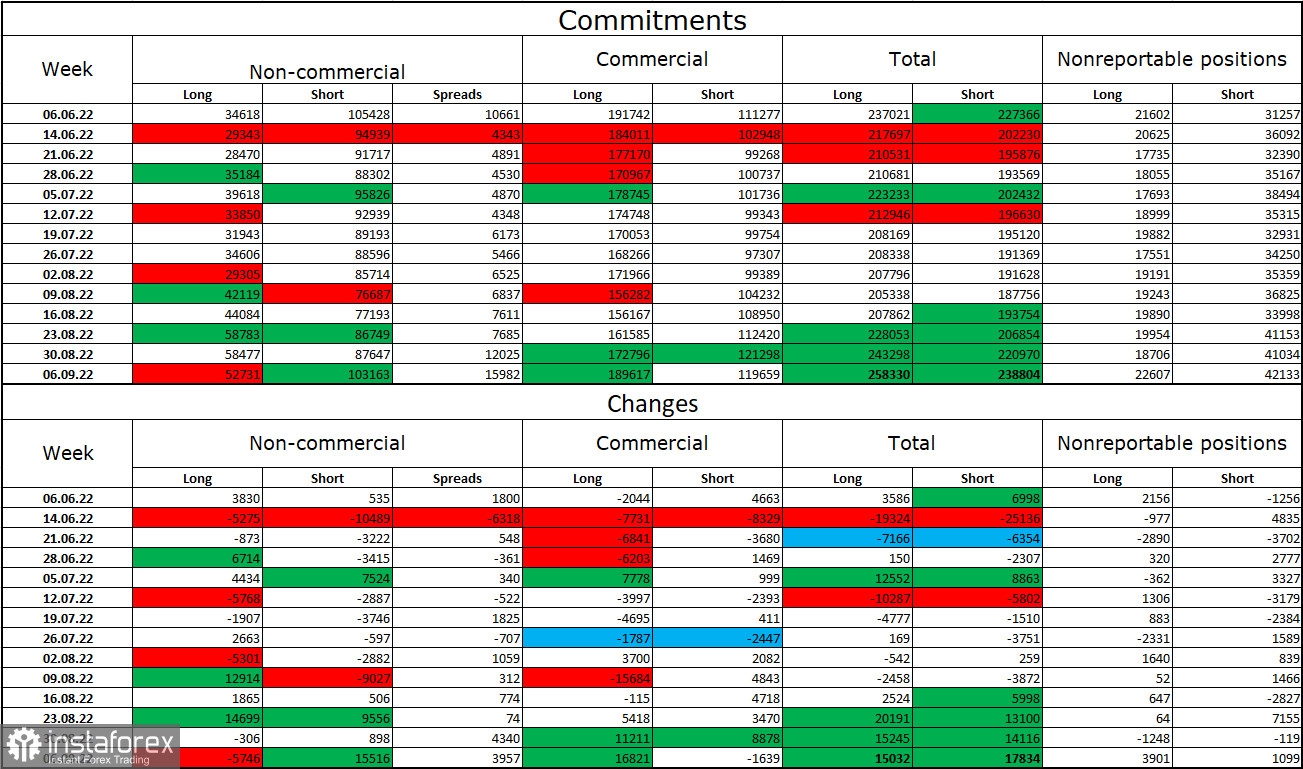

Commitments of Traders (COT) report:

Non-commercial traders became significantly more bearish in the last week covered by the report. Traders closed 5,746 Long and opened 15,516 Short positions. Market players remain bearish on GBP/USD, and Short positions continue to outnumber Long ones greatly. The latest COT report indicates that GBP is unlikely to rise further. Major players remain bearish on the pound, and it will take a lot of time for them to become predominantly bullish. GBP's upward move by 200-300 points can be easily reversed in 2-3 days.

US and UK economic calendar:

UK – GDP data (06-00 UTC).

UK – Visible Trade Balance (06-00 UTC).

UK – Industrial Production data (06-00 UTC).

There are no events in the US today, and the past events in the UK are unlikely to influence traders in the second half of the day.

Outlook for GBP/USD:

New short positions can be opened if GBP/USD bounces off 1.1709 on the H4 chart, with 1.1496 being the target. Earlier, traders were recommended to open long positions if the pair settled above the descending trend channel targeting 1.1883. These positions can be kept open if GBP/USD closes above 1.1684.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română