He who laughs last, laughs best. The EU managed to prepare by reducing the share of Russian gas imports from 40% before the armed conflict in Ukraine to 9%. The storage facilities are more than 80% full, which makes it possible to survive the cold winter, and Brussels' plans to limit prices make gas futures quotes fall. This was a real breath of fresh air for European currencies. And the pound is no exception.

For a long time, the sterling was in disgrace due to the energy crisis, the third prime minister in the last three years and double-digit inflation. In such a situation, investors treated the pound like flies to burnt toast. In fact, the British currency can be a jam for them. Instead of starting her job as head of government with a tax cut announced during the campaign, Liz Truss has prioritized curbing inflation and promised £150bn of fiscal stimulus to households to escape energy poverty, which is a game-changer.

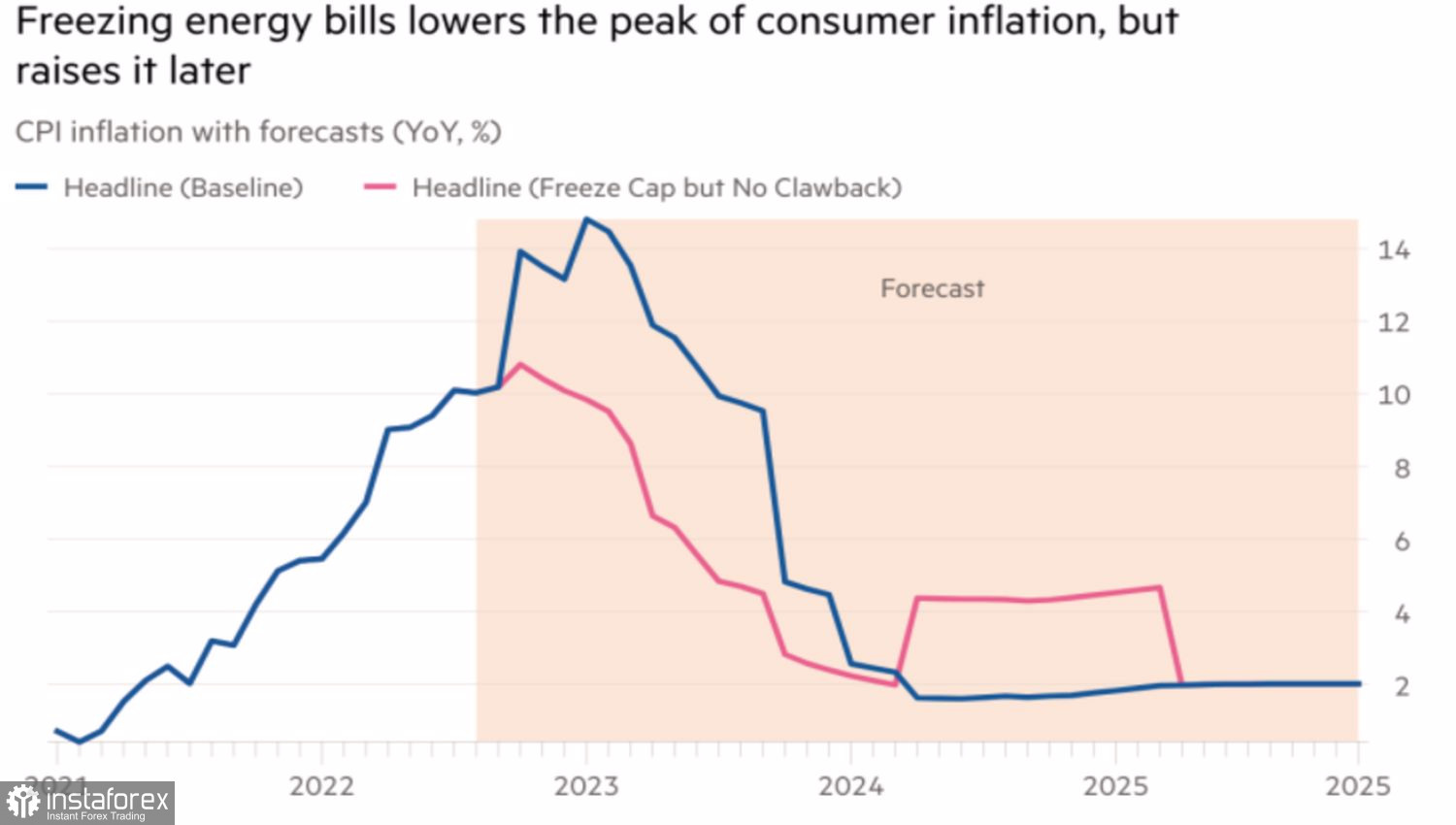

The government estimates that the aid package will cut the CPI by five percentage points. Research by Capital Economics shows that consumer prices will peak not in January, as previously expected, but in November. This peak will not be at 14.5% but at 11.5%, which is lower than the Bank of England's forecast of 13%.

BoE Actual and Projected UK Inflation Trends

However, any fiscal stimulus boosts GDP growth and drives up prices, so the £150bn package from Liz Truss is seen as pro-inflation. Yes, its impact will be manifested later, but the Bank of England must act now to prevent the growth of inflation expectations and fixing the CPI at an elevated level for a long time. As a result, Nomura expects the repo rate to soar to 3.75% in the coming months, NatWest Markets raised its forecast from 2.5% to 3.5%, and JP Morgan sees the 75 bps increase in borrowing costs in September is real.

In fact, due to political uncertainty, Andrew Bailey and his colleagues have found themselves in an even worse position than they were. They need to assess the impact of fiscal stimulus from the new government, and the death of the UK's Queen came in handy. BoE announced the postponement of its meeting from September 15 to September 22, that is, it bought time.

This week, the pound expects a busy economic calendar, including statistics on foreign trade, GDP, inflation, labor market and retail sales. However, the dynamics of GBPUSD will largely depend on gas prices in Europe and on the reaction of US stock indices to the release of data on the US CPI.

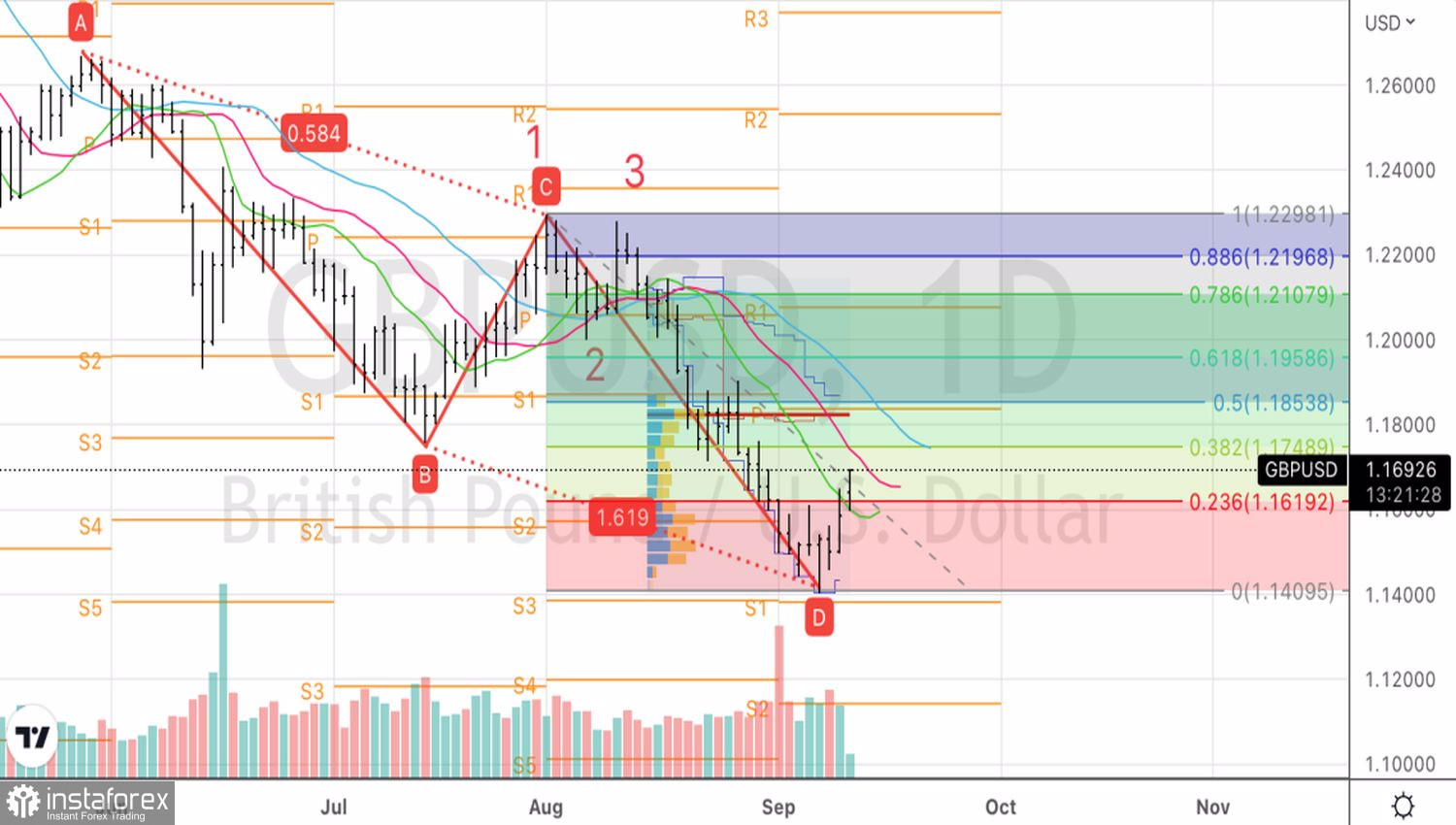

Technically, on the GBPUSD daily chart, after the pair reached the previously designated target by 161.8% according to the AB=CD pattern, a natural rebound followed. Rebound from resistances at 1.175–1.177 and 1.182–1.184 should be used for selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română