EUR/USD

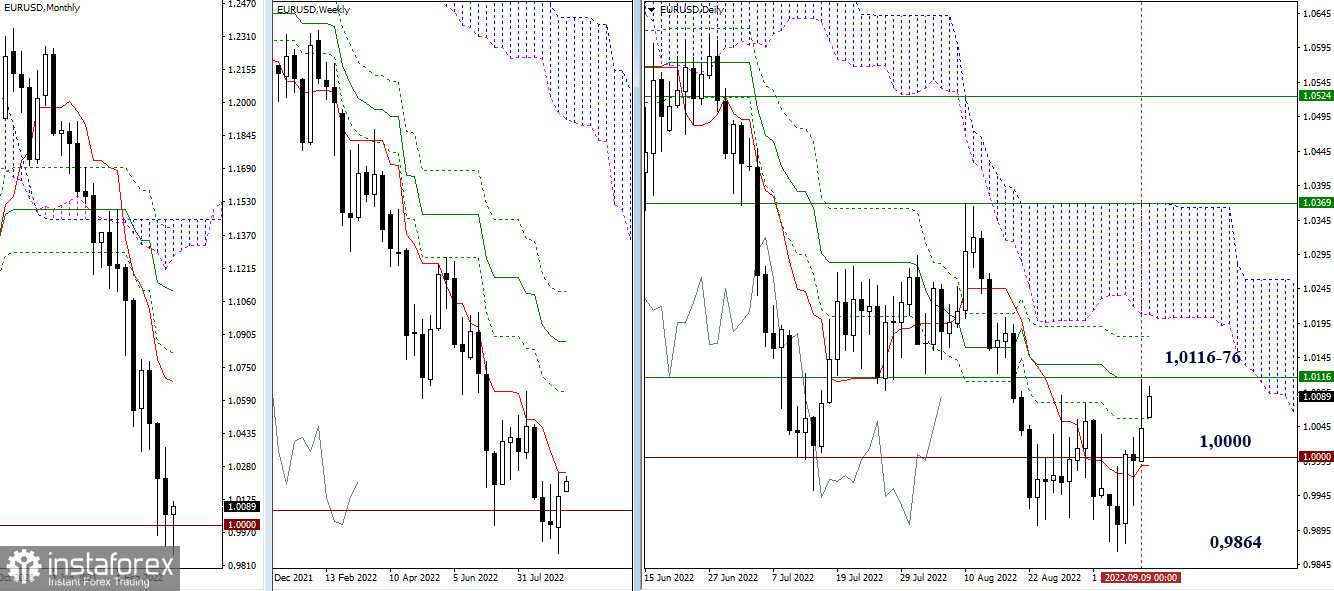

Higher timeframes

The opening of the week took place with some upward gap. Bulls are not in a hurry to complete the corrective rise. Instead, there is hope for its development, as well as a change in daily preferences. To implement these tasks, bulls need to overcome the resistance of the weekly short-term trend (1.0116) and eliminate the daily death cross (1.0116 - 1.0176 - final levels). For bears, the 1.0000–0.9989 zone (psychological level + daily short-term trend) remains as support, while the minimum extremum (0.9864) and the downward trend recovery are still the targets.

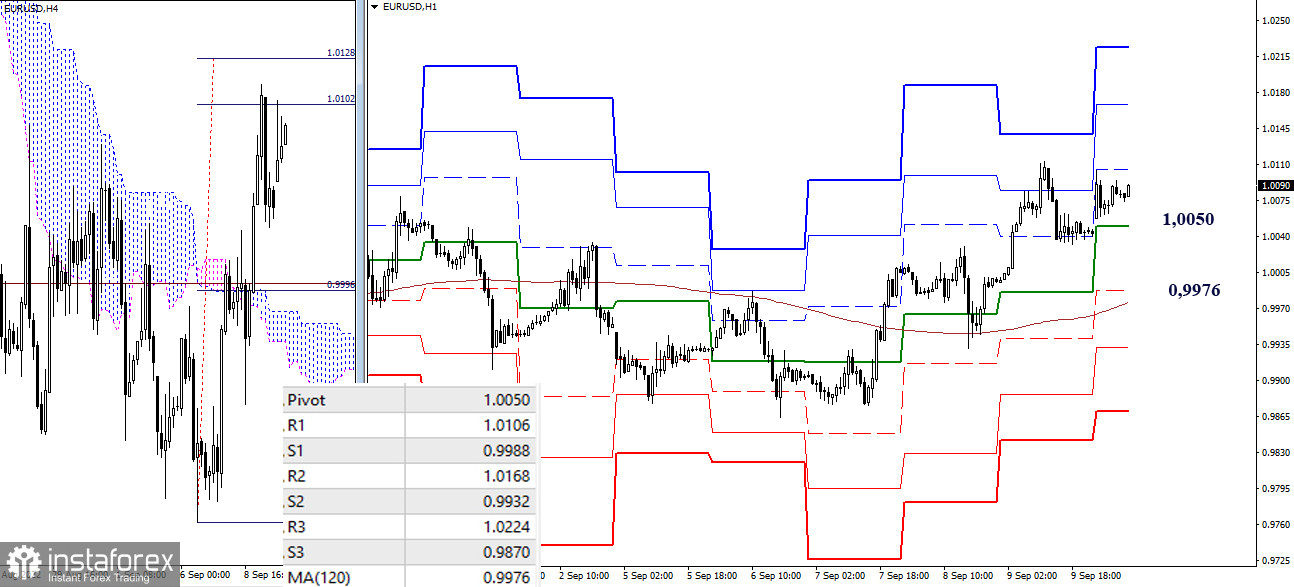

H4 – H1

As of writing, the main advantage on the lower timeframes is on the bulls' side. The reference points for the upward movement within the day today can be noted at 1.0128 (H4 target) and 1.0168 - 1.0224 (classic pivot points). The key levels of the lower timeframes are now supports, guarding bulls at 1.0050 (central pivot point of the day) and 0.9976 (weekly long-term trend). Consolidation below will change the current balance of power.

***

GBP/USD

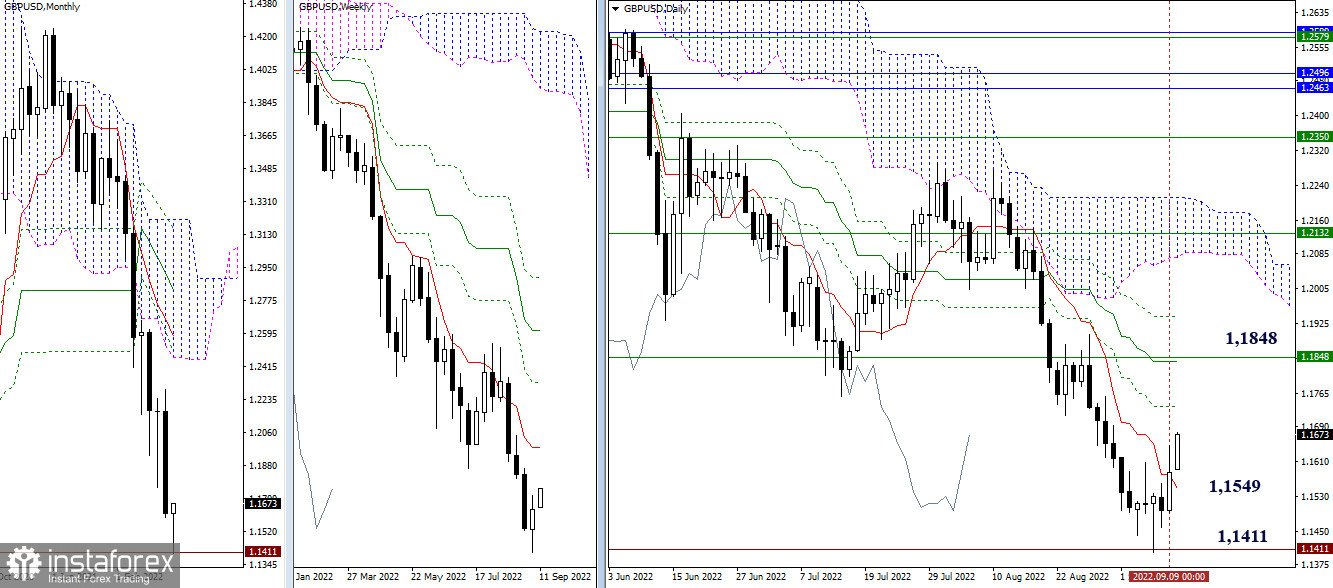

Higher timeframes

At the opening of the trading week, an ascending gap of several points is noticeable, as well as the desire of bulls to develop the current corrective movement, formed earlier after testing support at 1.1411 (minimum extremum of 2020). The bulls have already updated last week's high, we can note the resistance levels of the daily cross 1.1737 - 1.1840 - 1.1943 among the reference points, and the weekly short-term trend (1.1848) serves as support in this area.

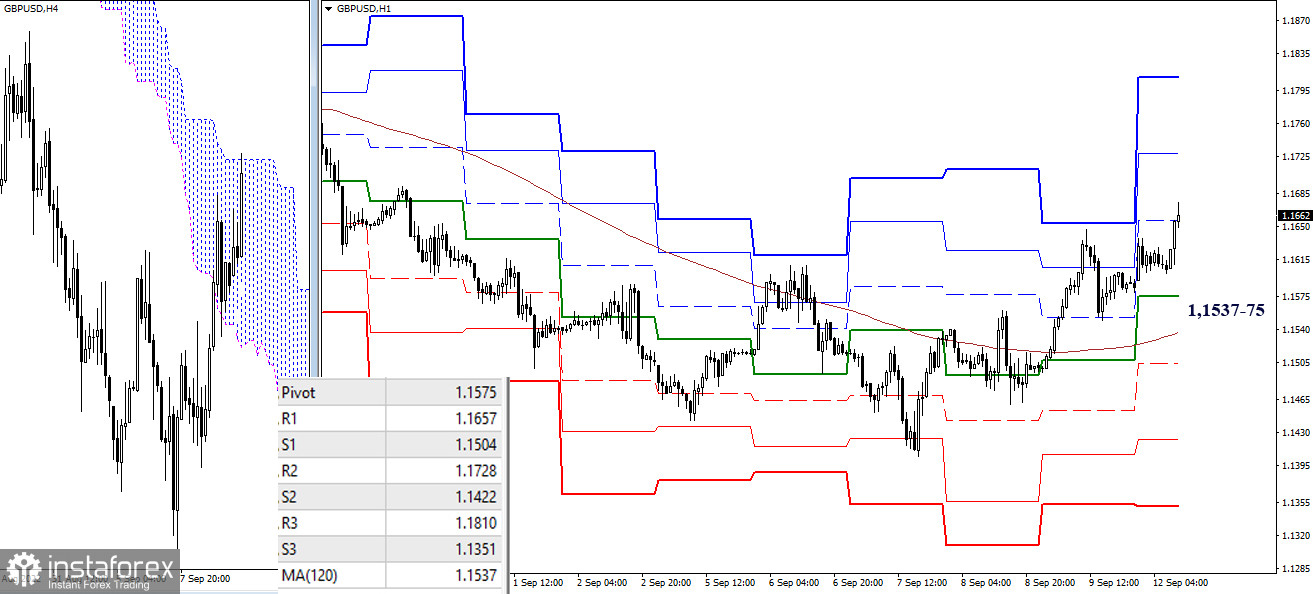

H4 – H1

Bulls currently have the advantage on the lower timeframes. They are now testing the strength of the upper boundary of the H4 cloud (1.1672). Upon breakdown, an upward target will be formed. In addition, the reference points for the rise within the day are now the resistance of the classic pivot points (1.1728 - 1.1810). The key levels form support and are currently located at 1.1575 (central pivot point) and 1.1537 (weekly long-term trend). A breakdown of 1.1575–37 and a reliable consolidation below will change the current balance of power, while the situation would be better to re-evaluate.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română