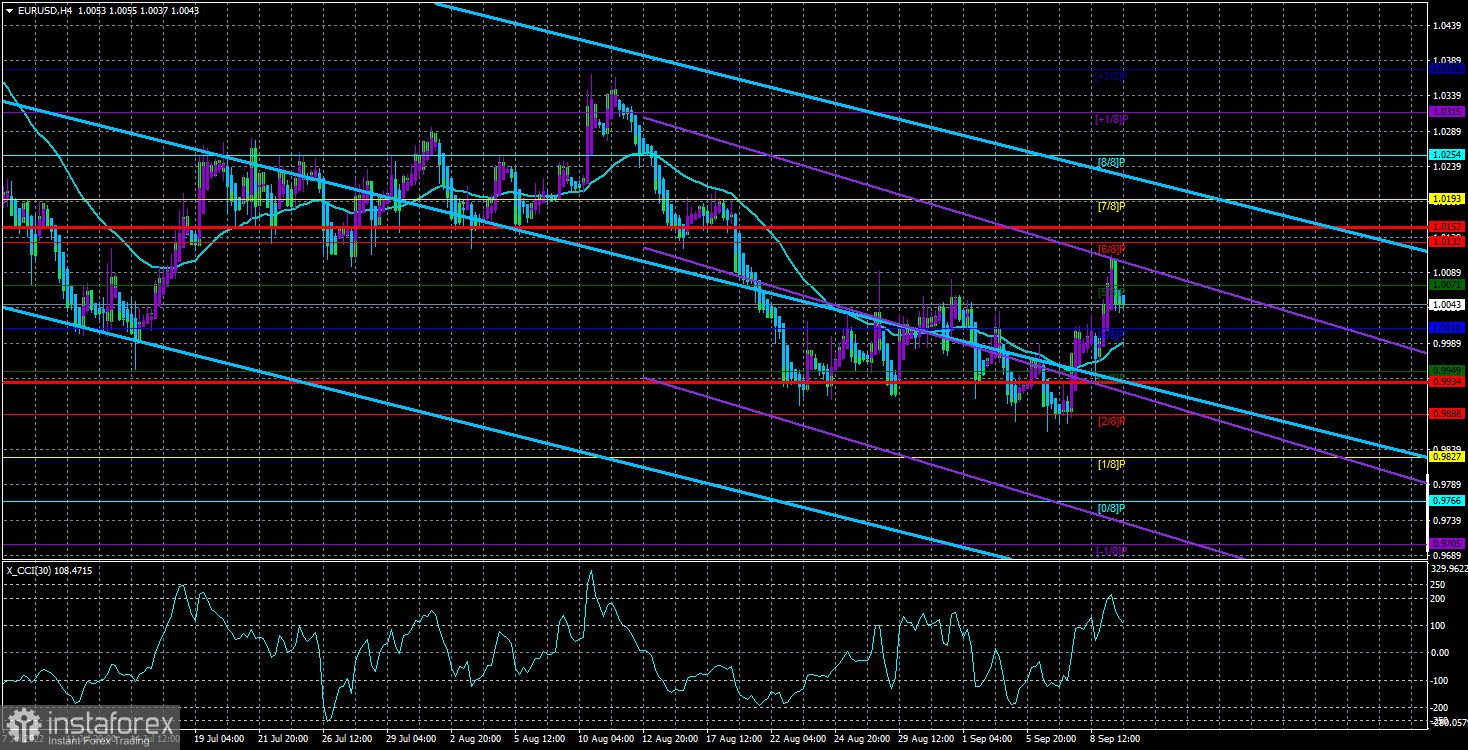

The EUR/USD currency pair grew a little more on Friday and even tried to gain a foothold above the 0.9888-1.0071 side channel, which it has been in the last few weeks. The price was fixed above it for a short time, so there is still a risk of maintaining a flat or "swing." The European currency received a long-awaited boost at the end of last week thanks to the "hawkish" attitude of the ECB and a 0.75% rate hike. From our point of view, based on these factors, the euro currency could show more solid growth. However, the euro has had big problems with growth in recent months. Although the ECB rate has increased for the second time in a row and is already at 1.25%, the fundamental background still cannot be interpreted as favorable for the euro because, at the same time, the Fed rate is 2.5% and may rise to 3-3.25% next week. That is, the US monetary policy is still tougher, which means that the demand for the dollar may remain higher than the demand for the euro currency. Also, recall that the pair continues to trade near its 20-year lows, and we did not see any sharp upward pullback, which could mean the end of the downward trend. Yes, now the price is above the moving average line, but in the conditions of "swings," the price of such consolidation is a penny. We are inclined to believe that the fall of the European currency will resume.

Separately, I want to remind you about the impending "gas crisis" in Europe. Gas supplies via the Nord Stream have been stopped, and gas prices remain high and maintain an upward trend. All this will lead to European consumers receiving energy bills 2-3 times higher this winter than last. The European government is already taking measures to compensate EU citizens, but at the same time, it is introducing austerity measures. For example, it will be possible to get sued for wasteful use of gas. The shortage of gas and its high cost can negatively affect industrial production, volume, and, as a result, GDP. It is from here that the legs of a very likely recession grow.

European inflation is likely to continue to rise.

During the next week, the first place in terms of importance will not be macroeconomic reports but speeches by ECB representatives. After Christine Lagarde openly stated that her department was ready to continue raising the rate at a high pace, the market became very interested in the question of what level the rate could rise and how serious the ECB's attitude was. Speeches by Luis de Guindos, Isabel Schnabel, and other representatives of the European regulator can provide answers to these questions. And the more "hawkish" comments sound, the more reason the euro will have to continue the meager growth we are currently seeing. Members of the monetary committee will begin speaking on Monday. They will resume on Tuesday, Wednesday, and Thursday.

But of the important publications, we can single out only industrial production on Wednesday and inflation on Friday. Moreover, industrial production was included in this list only for old times' sake – the market has not been paying due attention to this report for a long time. Thus, we should focus on inflation for August. According to experts, this indicator will continue to grow and amount to 9.1% y/y. In principle, what else can we expect from the consumer price index if the ECB has tightened monetary policy only once as of August? Thus, inflation may continue to rise in September. And the higher it grows, the more reasons Lagarde and the company will have not to stop there and continue actively fighting inflation. Such news is good for the euro currency, but it should be understood that the market, in any case, is now more inclined to buy the US dollar, which is the world reserve currency. Therefore, neither the growth of inflation nor the strengthening of the "hawkish" positions of the ECB representatives may not support the euro. We believe moderate pair growth is possible this week, but a strong correction or a new uptrend is unlikely to begin. The "swing" may remain.

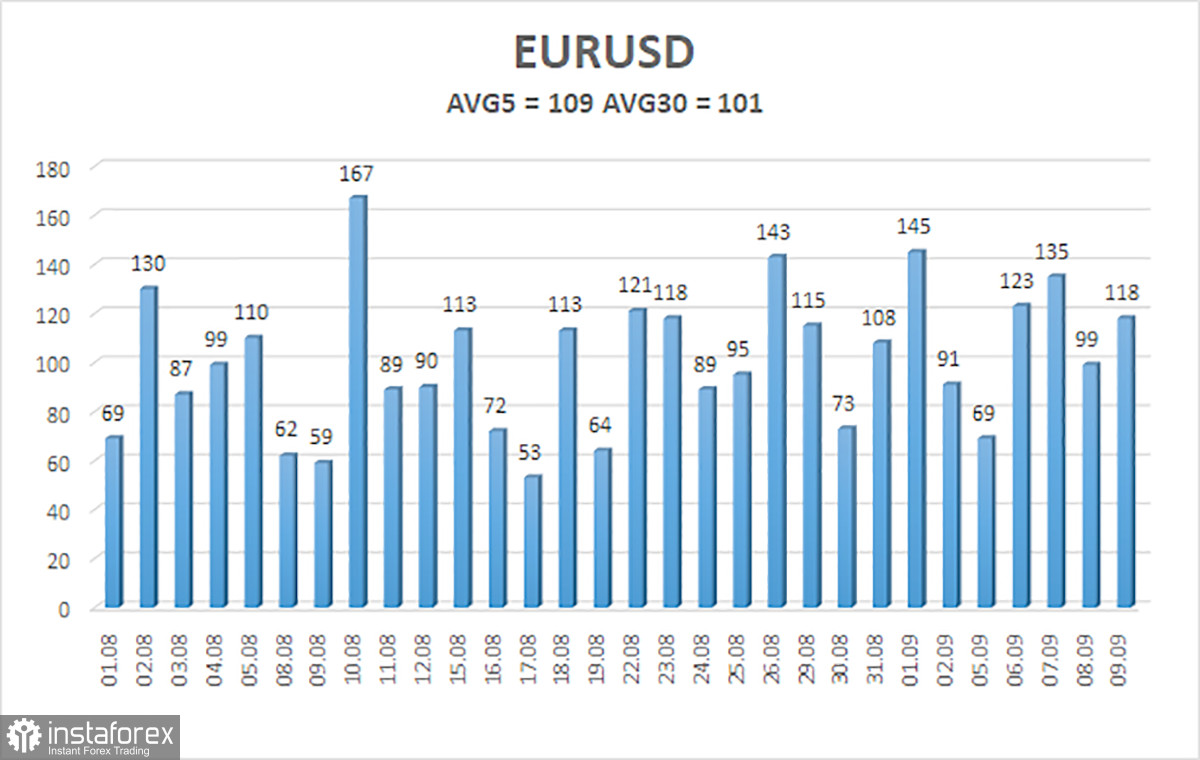

The average volatility of the euro/dollar currency pair over the last 5 trading days as of September 12 is 109 points and is characterized as "high." Thus, we expect the pair to move today between 0.9934 and 1.0152. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0010

S2 – 0.9949

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0071

R2 – 1.0132

R3 – 1.0193

Trading Recommendations:

The EUR/USD pair continues to trade in a flat or "swing" mode. Thus, now it is possible to trade on the reversals of the Heiken Ashi indicator until the price leaves the 0.9888-1.0072 channel. Formally, she continues to remain in it.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română