EUR/USD

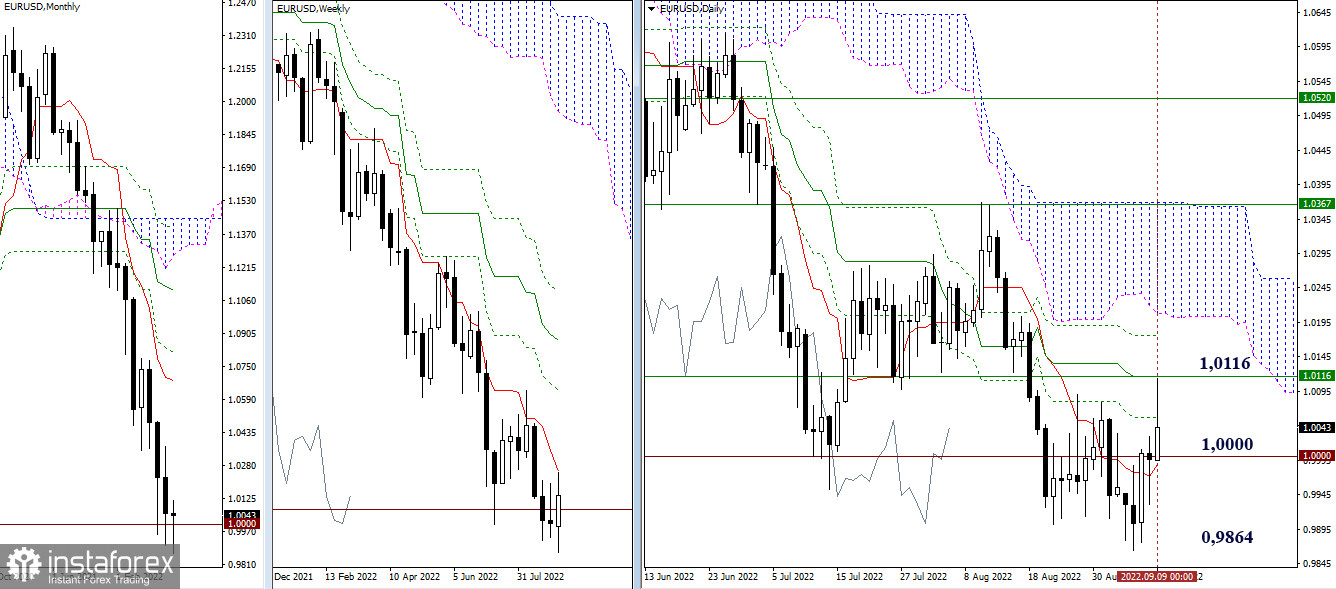

Higher timeframes

The renewal of the lowest extremum performed during the week did not lead to consolidation and recovery of the downward trend. Instead, the pair began to implement a new upward corrective movement, which resulted in a rise to the resistance line of 1.0116 (daily medium-term trend + weekly short-term trend). The tasks to increase in the near future are to break through the levels (1.0116), eliminate the daily dead cross (1.0176) and enter the daily cloud (1.0203). For bears, additional prospects will start to take on significance only after the recovery of the downward trend (0.9864 lowest extremum).

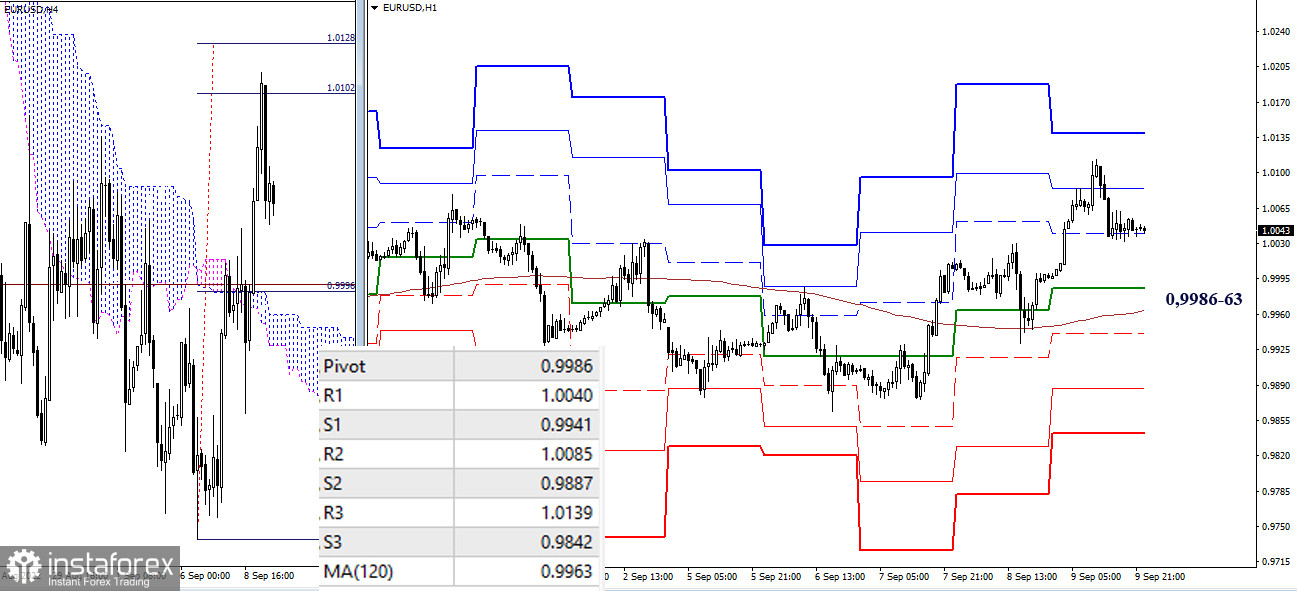

H4 - H1

The advantage on the lower timeframes belongs to bulls. If they manage to pass the resistance they met, where their efforts are now combined by the benchmarks of the higher halves (1.0116) and the target for the breakdown of the H4 cloud (1.0102-28), then more global upward benchmarks will appear. The resistance of the classic Pivot levels will remain as additional reference points. Key levels are now supports and are currently located in the 0.9986-63 area (central Pivot level of the day + weekly long-term trend).

***

GBP/USD

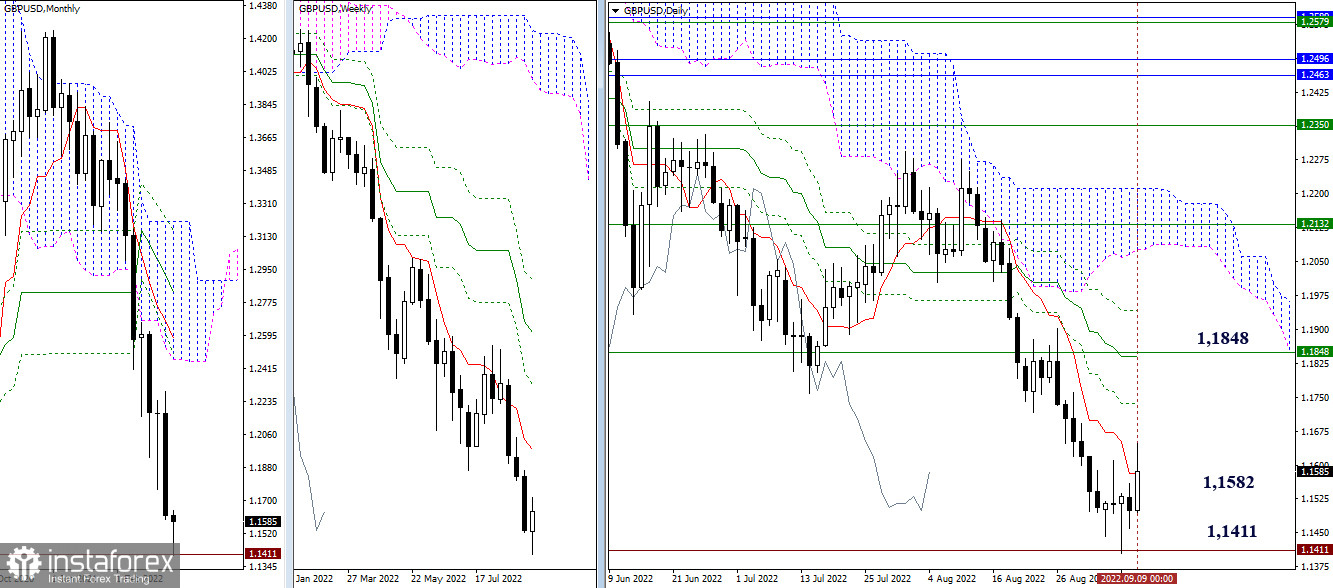

Higher timeframes

Shorts tested the 2020 low of 1.1411 last week. The result of testing was the formation of a rebound and the development of a daily correction to a daily short-term trend (1.1582). If the correction continues, the main task to push for an increase will be to find support for the weekly short-term trend (1.1848) and the elimination of the daily dead cross 1.1840 - 1.1943 (final levels).

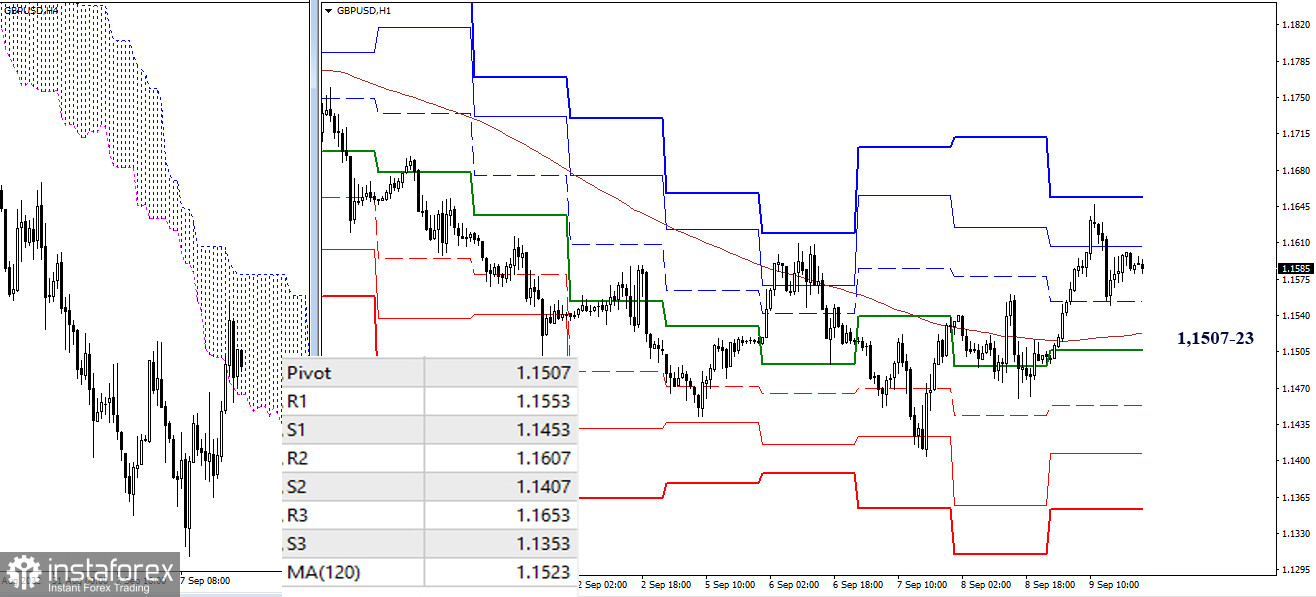

H4 - H1

The pair consolidated above the key levels of the lower halves (1.1507-23) and entered the bearish H4 cloud. The development of the upward movement will allow forming a new upward target during the breakdown of the cloud, in addition, the resistance of the classic Pivot levels serve as upward references within the day. Consolidation below the key levels (1.1507-23) will change the current balance of power and return bearish players to the market, the main goal of which will be to restore the downward trend (1.1404).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română