Long-term perspective.

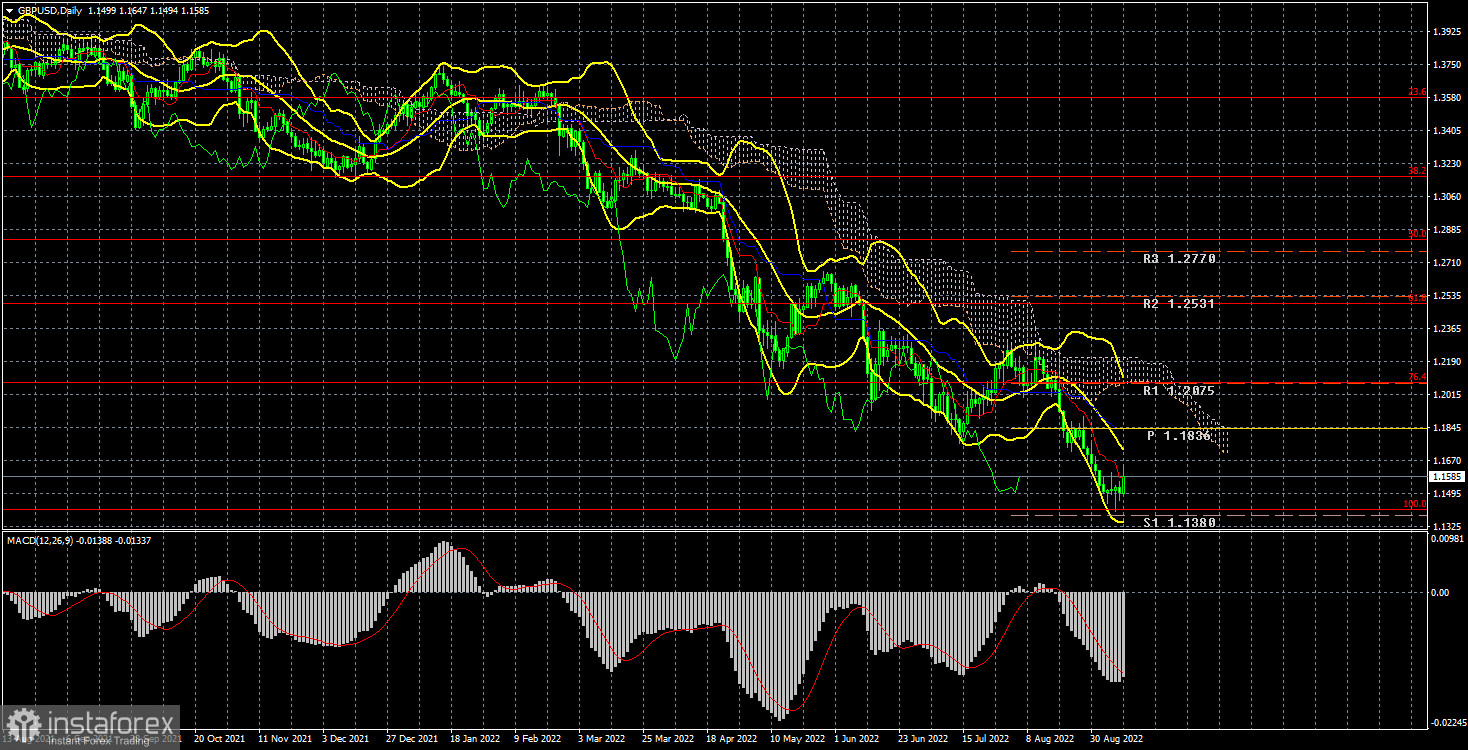

The GBP/USD currency pair has increased by 70 points during the current week. However, during the week, it also showed a downward movement, which led to an update of its 37-year lows, only by a few points. However, the fact that the British currency has reached these price levels is important. From our point of view, the fall of the pound may continue. A few weeks ago, when the pound was 400-500 points higher, we said that walking such a distance for the British currency was not a problem. There may not be any serious reasons for such a movement, if any at all. In practice, this is what happened. Although the Bank of England is trying to go shoulder to shoulder with the Fed, the pound sterling is still falling into the abyss. And that microscopic upward pullback that happened at the end of the week cannot even be considered a pullback. Of course, the downward trend will not last forever. Sooner or later, the growth of the British currency will also begin. And it will be extremely difficult to predict its beginning. The pound is falling for no apparent reason, although the fundamental and geopolitical backgrounds remain not in its favor. Therefore, it would be better to say that the pound is falling without any local reasons. And if so, then it can also start its long-term growth without local reasons. No one knows at what price levels most traders will consider that enough is enough. So far, we have a clear rebound from the level of 1.1411; theoretically, a new upward trend can begin to form from it. But as long as the price is below the critical line, we would not count on the strong growth of the British pound.

Moreover, meetings of the Bank of England and the Fed will be held in the near future, which may affect the mood of traders in the most drastic way. The pound may continue to grow if the BA strengthens its monetary pressure and the Fed begins to weaken it. But even in this case, growth is not guaranteed.

COT analysis.

The latest COT report on the British pound, released yesterday, was very eloquent. During the week, the non-commercial group closed 5,700 buy contracts and opened 15,500 sell contracts. Thus, the net position of non-commercial traders immediately decreased by 21.1 thousand, which is a lot for the pound. The net position indicator has been growing for several months. However, the mood of major players remains "pronounced bearish," which is seen by the second indicator in the illustration above (purple bars below zero = "bearish" mood). And now, it has started a new fall, so the British pound still cannot count on strong growth. How can you count on it if the market sells the pound more than it buys it? And now, its decline has resumed altogether, so the "bearish" mood of major players in the near future can only intensify. The non-commercial group has opened a total of 103 thousand sales contracts and 52 thousand purchase contracts. The difference is twofold. Net positions will have to grow for a long time for these figures to at least level up. Moreover, COT reports reflect the moods of major players, and the "foundation" and geopolitics affect their moods. If they remain the same now, the pound may be at a "downward peak" for some time.

Analysis of fundamental events.

There were practically no important events in the UK this week. Unfortunately, the most high-profile news was the news of the death of Queen Elizabeth II of Great Britain. From the macroeconomic data, we will highlight the business activity index in the service sector, which continues to balance just above 50.0, and the composite index, which fell below 50.0. The index of business activity in the construction sector fell to 49.2. There was also a speech by Andrew Bailey, who openly accused Moscow of the fact that the British economy is entering a recession, noted high gas prices, which have a very strong impact on the economy, and said that BA would continue to fight for price stability. Jerome Powell's speech was more modest, as the head of the Fed confirmed once again that US rates will continue to rise until inflation begins to show a stable and significant slowdown. Thus, we can say that we have not learned anything new from the speeches of Powell and Bailey. Both banks will continue to raise rates, and the question remains how much the US and British economies will fall in the coming years.

The trading plan for the week of September 12–16:

1) The pound/dollar pair as a whole maintains a long-term downtrend and is located below the critical line. Above the Ichimoku cloud, she failed to gain a foothold, so everything suggests that the downward movement of the pair will continue for some time. Therefore, the pair's purchases are not relevant now.

2) The pound is near its 37-year lows and may update them several more times in 2022. Since the pair is at 1.1411 (100.0% Fibonacci), an upward correction may now follow. A rebound from the critical line or overcoming the level of 1.1411 will be strong signals for a new fall in the pair.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română