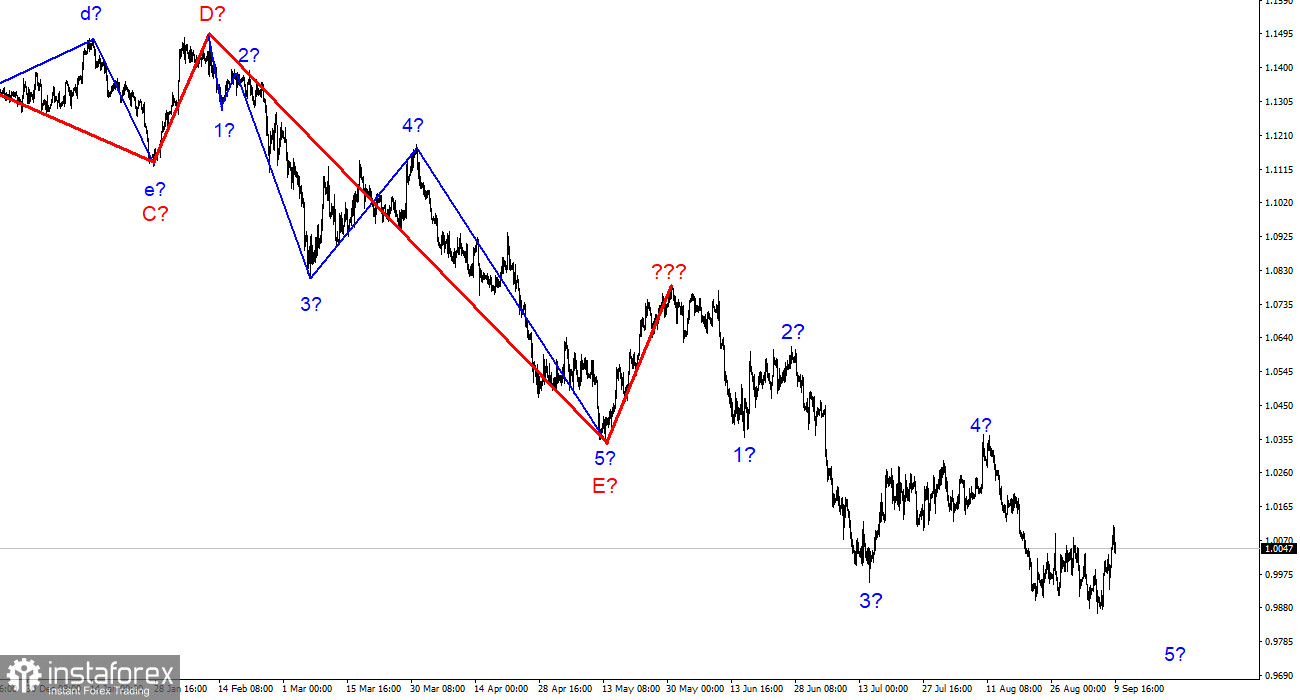

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments and does not even change, despite the fact that wave 4 turned out to be longer than I expected, and now the wave construction of wave 5 is also delayed. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. There are no grounds to assume the completion of the downward trend segment yet, despite the fairly confident growth of the euro at the end of the week. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will resume with targets located below the 1.0000 mark within the framework of wave 5. Wave 5 can take almost any length since wave 4 turned out to be much longer than wave 2 – the waves acquire a more extended form as the downward trend section is built. Nevertheless, I note that the low of wave 5 is below the low of wave 3, so this wave can complete its construction at any time. And with it, the entire downward section of the trend.

The results of the ECB meeting can be considered "hawkish."

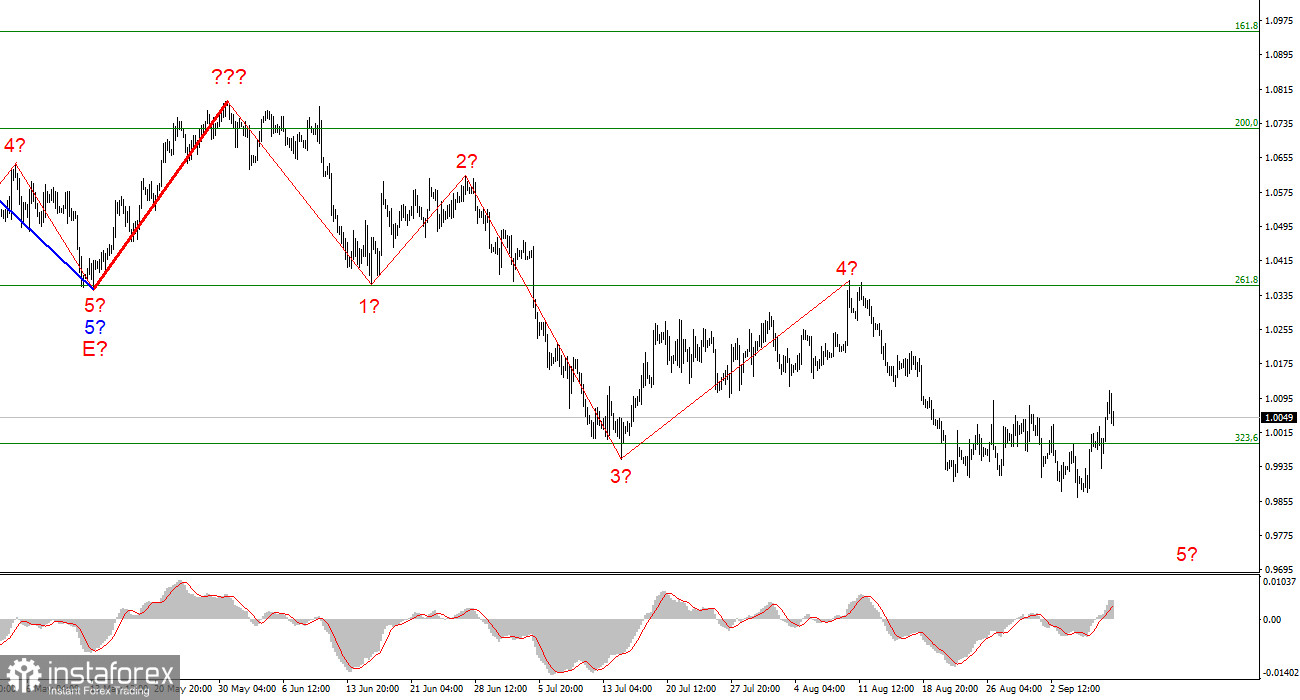

The euro/dollar instrument rose by 50 basis points on Friday. We managed to move away from the current low by 250 points. Someone may consider such an increase worthy of the name "the beginning of a new trend segment," but I cannot make such a statement. From my point of view, wave 5 may become even more complicated, as well as the entire downward section of the trend. Too many questions have been raised in recent weeks when the tool showed movements in different directions. As a result, these movements cannot be interpreted unambiguously. The whole wave pattern doesn't look like wave 5 is complete. It is more likely that in recent weeks we have observed the construction of a three-wave correction structure, which will be a wave 2-5. If this assumption is correct, the decline in quotations will resume with targets below the 95 figure.

Yesterday's results of the ECB meeting were important and interesting enough that the market played them back for more than a day. Since there was no news background, there were no good reasons for the growth of either the euro or the dollar. Nevertheless, the demand for the European currency continued to grow, which I associate with yesterday's ECB meeting and Christine Lagarde's speech. The fact that the regulator is ready to continue raising the rate may support demand for the euro. But at the same time, the market could already fully recoup this factor. I think as follows: if wave 5 is not completed and lengthens, then the increase in quotations should be completed in the coming days. If the increase in quotations continues next week, it will be possible to assume that the entire downward section of the trend has been completed. But I do not think that two ECB rate hikes can change traders' mood from minus to plus in relation to the euro currency.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. So far, I do not see signals indicating this wave's completion.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three- and five-wave standard structures from the overall picture and work on them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română