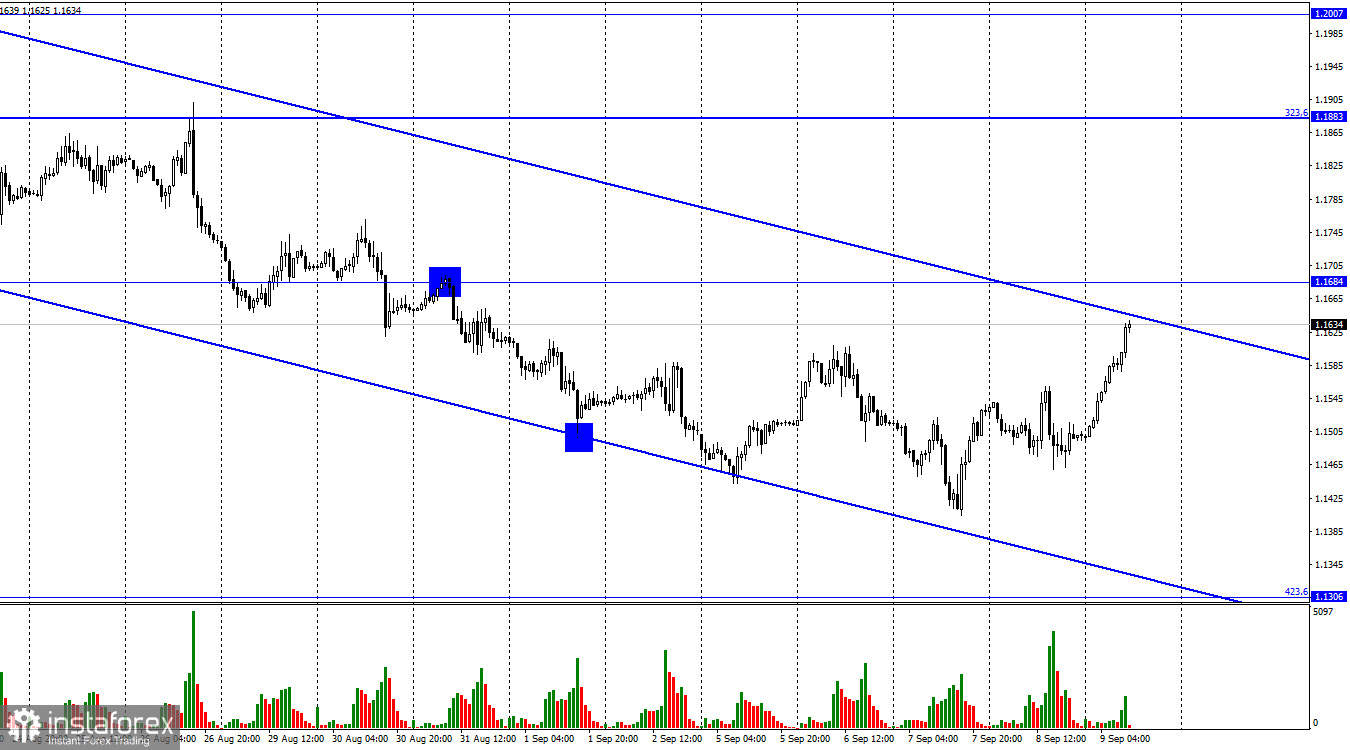

Hi, dear traders! According to the H1 chart, GBP/USD has tested the lower level of the descending trend channel as it continues to rise. A bounce off this level would send the pair downwards towards the retracement level of 423.6% (1.1306). If GBP/USD settles above the trend channel and 1.1684, it could then rise further towards the Fibo level of 323.6% (1.1883). There were few events on the economic calendar yesterday in both the UK and the US. Jobless claims data in the US was slightly below expectations. The pound sterling moved upwards following the euro, as reports came in that Queen Elizabeth II died at the age of 96.

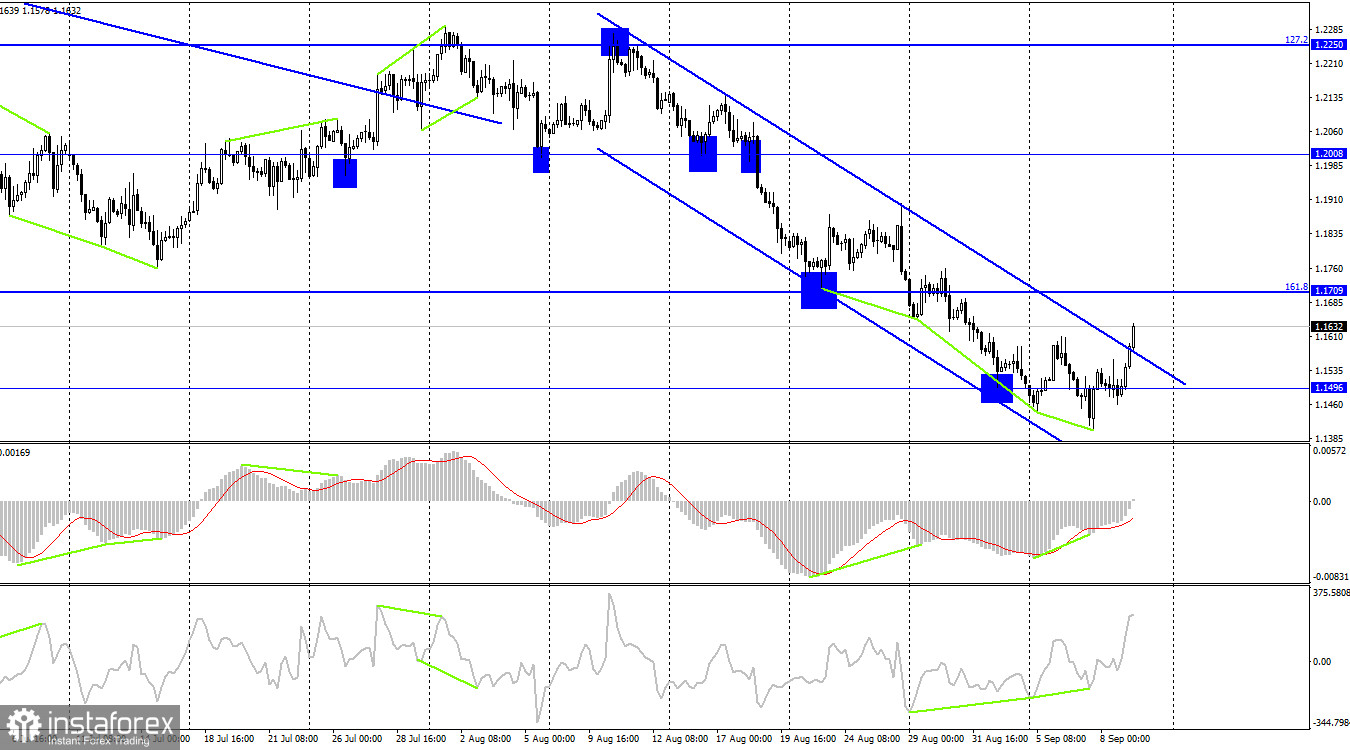

The ECB's meeting and the interest rate hike that followed had a more significant impact on GBP than a similar hike by the Bank of England. However, this upward trend might be simply a correction and has nothing to do with the ECB. The pound sterling's upward move by 240 points from its 40-year low is not particularly strong – the pound has not even managed to end the downward trend. At this point, it is important to wait until traders fully react to the ECB meeting. Then, the outlook for both EUR and GBP will be clear. According to the H4 chart, the pair could close above the descending trend channel, which would be a strong buy signal. There are no events on the economic calendar on Friday.

According to the H4 chart, the pair reversed upwards after bullish CCI and MACD divergences had emerged. It is currently rising towards the retracement level of 161.8% (1.1709). The pair has not settled above the descending trend channel so far, making this timeframe less informative than H1. The downtrend will only end once the pair closes above the trend channel at both timeframes.

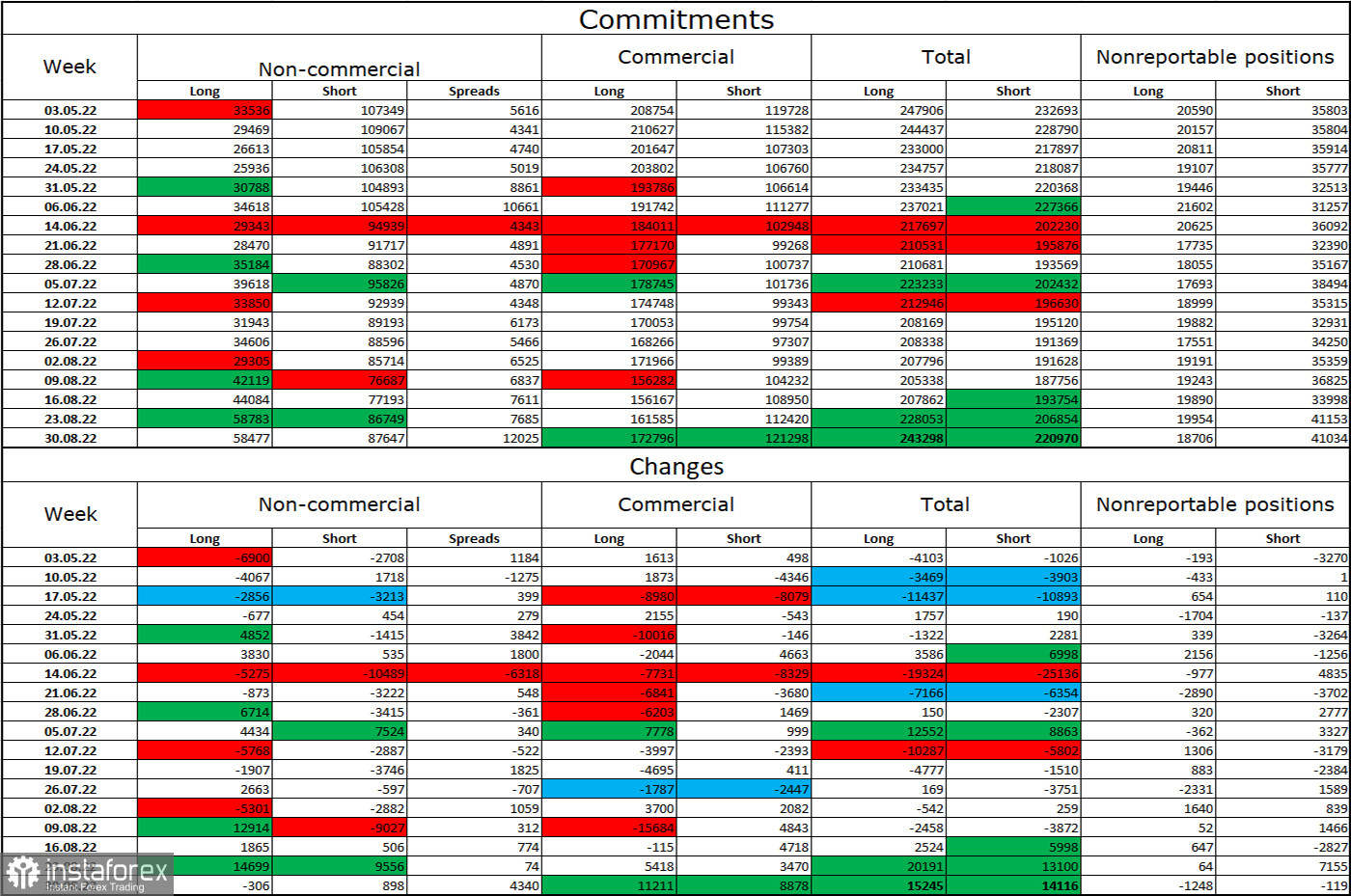

Commitments of Traders (COT) report:

Non-commercial traders became slightly more bearish in the last week covered by the report. Traders closed 306 Long and opened 898 Short positions. Market players remain bearish on GBP/USD, and Short positions continue to outnumber Long ones greatly. However, more traders are now net long on GBP/USD than before. Major players remain bearish on the pound, and it will take a lot of time for them to become predominantly bullish. GBP has begun to fall once again, and COT reports suggest that GBP is more likely to continue its decline than begin a new long-term uptrend.

US and UK economic calendar:

There are no important events on the economic calendar in both the US and the UK today.

Outlook for GBP/USD:

Traders are recommended to open new short positions if the pair bounces off the upper line of the trend channel with 1.1306 being the target. Long positions could be opened if GBP/USD settles above the descending trend channel on the H1 chart with 1.1833 being the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română