US stock index futures recovered slightly on Friday as investors increasingly accept further aggressive interest rate hikes by the Federal Reserve. Yesterday, the European Central Bank raised interest rates by 0.75%. However, this hike alone did not increase demand for risky assets. There are rumors that ECB policymakers could announce another big interest rate increase at the policy meeting in October, depending on the inflation data. Later that day, Fed chairman Jerome Powell spoke at the Cato Institute conference in Washington DC. Powell said that Fed policymakers will continue aggressively fighting inflation, reinforcing market expectations of a third large interest rate hike in late September. "The Fed has, and accepts, responsibility for price stability," he said at the Cato Institute's 40th Annual Monetary Conference. "We need to act now, forthrightly, strongly, as we have been doing, and we need to keep at it until the job is done."

Meanwhile, the Stoxx 600 strongly advanced thanks to gains in the banking sector after the unprecedented interest rate hike by the Federal Reserve. S&P 500 and Nasdaq 100 futures rose by 0.8%, and Dow Jones futures increased by 0.4%. US Treasuries decreased, while the yield on the 2-yerar note, which is sensitive to Fed policy moves, is close to its highest level since 2007.

Natural gas prices in the EU continue to slide down after the summit of EU energy ministers. European politicians are developing plans to alleviate the unprecedented energy crisis that threatens to jeopardize the region's economy this winter.

Markets are currently highly focused on policy decisions by the ECB and the Fed and are trying to predict their reaction, which depends on inflationary expectations, as accurately as possible. This is necessary for finding the best moment for going long on risky assets. However, there are no compelling reasons for investors to do so at the moment. Inflation is undermining consumer confidence, and an extremely aggressive tightening of monetary policy could lead to a recession in the EU and the US.

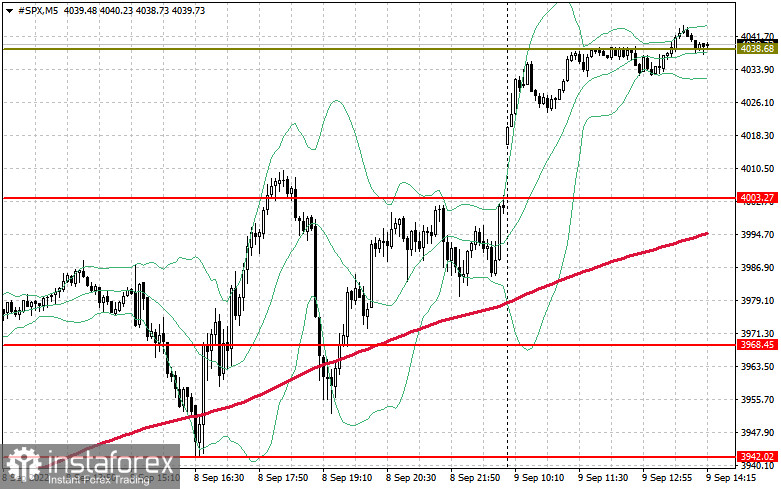

On the technical side, S&P 500 bulls now have a chance to begin an upward correction. To do so, the index must surpass $4,038. Positive macroeconomic data from the US could increase demand for equities, as anticipated Fed policy moves have already been priced in by the market. A breakout above $4,038 would put an end to the downtrend that started in the middle of summer and open the way towards key resistance at $4,064 and $4,091 further ahead. If the S&P 500 moves southward and breaks below $4,003, it could then sink to the low at $3,905. From there, it could slide down into the $3,870 area, where the pressure on the index would ease.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română