The GBP/USD pair rose to an intra-week high of 1.1647, mainly taking advantage of the weakening dollar.

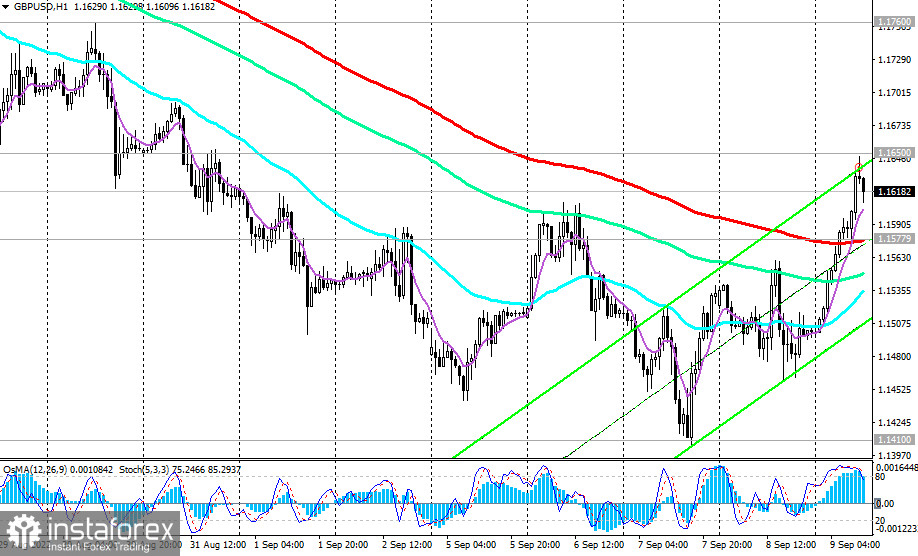

As of this writing, the GBP/USD pair is trading near 1.1618, retreating from today's high of 1.1647. Taking into account the general downward trend of the pair, the breakdown of the important short-term support level 1.1578 (200 EMA on the 1-hour chart) may become a signal for the resumption of short positions.

Thus, the current growth of GBP/USD may become a new opportunity for building up short positions.

At the same time, GBP/USD is trading above the support level of 1.1578. In the alternative scenario, the probability of growth to the resistance levels of 1.1820 (200 EMA on the 4-hour chart), 1.1910 (50 EMA on the daily chart) cannot be dismissed. If dollar buyers fail to quickly take control of the situation and overcome the dollar weakening impulse that is dangerous for them, then a breakdown of the local resistance level of 1.1650 may provoke further growth of the GBP/USD, as we noted above, towards resistance levels of 1.1820, 1.1910.

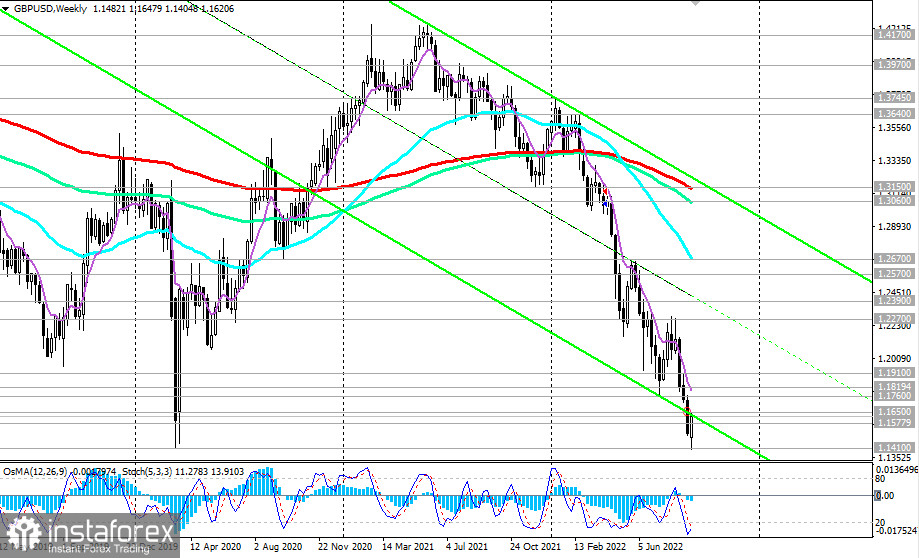

But for now, short positions remain preferable. Below the key resistance levels 1.2390 (144 EMA on the daily chart), 1.2570 (200 EMA on the daily chart), GBP/USD remains in the long-term bearish market zone.

Support levels: 1.1600, 1.1578, 1.1500, 1.1410

Resistance levels: 1.1650, 1.1700, 1.1760, 1.1820, 1.1910, 1.2000, 1.2270, 1.2390, 1.2570

Trading Tips

Sell Stop 1.1560. Stop-Loss 1.1660. Take-Profit 1.1500, 1.1410

Buy Stop 1.1660. Stop-Loss 1.1560. Take-Profit 1.1700, 1.1760, 1.1820, 1.1910, 1.2000, 1.2270, 1.2390, 1.2570

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română