ECB officials are poised to introduce another rate hike in October if the inflation outlook calls for an additional significant step. This second 75 bp increase would be in line with the Fed's recent aggression, underscoring a tougher approach taken by the ECB recently as inflation in the region hits record after record.

A reduction in the nearly €5 trillion ($5 trillion) worth of bonds purchased by the ECB during recent crises may also be discussed at an informal meeting on October.

But noticeably, Philip Lane, who in his last speech called for a "steady pace" of rate hikes, has been more hawkish during his speech to the Board of Governors this week.

The ECB also promised several future moves after Thursday's rate announcement. Christine Lagarde said it may be more than two, but less than five.

Surprisingly, euro still slipped because Fed Chairman Jerome Powell also said that the US central bank will not back down in its efforts to curb inflation.

But at the end of the day, EUR/USD closed with a bullish pin bar having been traded higher during the Asian and European sessions.

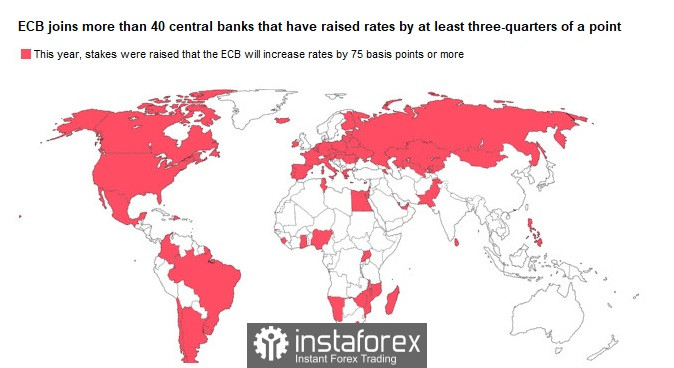

Investors have raised the stakes on further ECB tightening. They bet on another 75 basis point hike reaching 40% in October, which is a drastic change after the central bank was accused of being too slow to respond to inflation. Further decisions will be made according to fears of recession, especially since new ECB forecasts point to faster price growth along with slower economic growth. The growth forecast for next year has been cut to just 0.9%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română