Global equity markets rebounded after dollar and US Treasury yields pared losses on Wednesday. It seems that risk appetite recovered on the eve of the ECB meeting on monetary policy as many expect the central bank to raise the key interest rate by 0.75%.

Investors also paid attention to published economic statistics, such as the Q2 GDP of the Euro area, which grew by 0.8% instead of 0.6%. Its previous data was also revised upwards to 0.5%. In annual terms, the indicator added up to 4.1%, but is significantly lower than the previous figure of 5.4%. Other data showed that industrial production in Germany returned to negative in July, as evidenced by industrial output figures.

These data, as well as the decision of the ECB to consider emergency measures to curb electricity price surges, pushed the local stock market and euro up. However, dollar's fall was not really caused by them as it is more likely prompted by the warning made by Fed member Lael Brainard about the risk of too-high interest rates. If the Fed withstands pressure and continues to follow the current cycle of raising rates, a new wave of sell-offs will be seen stock markets, while demand for dollar will grow.

Talking about the upcoming ECB meeting, it is likely that the central bank will increase rates by 0.75% to curb inflation. This will push EUR/USD up to 1.1000 and support other currencies including the British pound.

But if Jerome Powell talks about continued aggressive actions by the Federal Reserve, the US stock market will collapse, while Treasury yields and dollar will grow. This will limit the rally of euro, preventing it to break through 1.1000.

Forecasts for today:

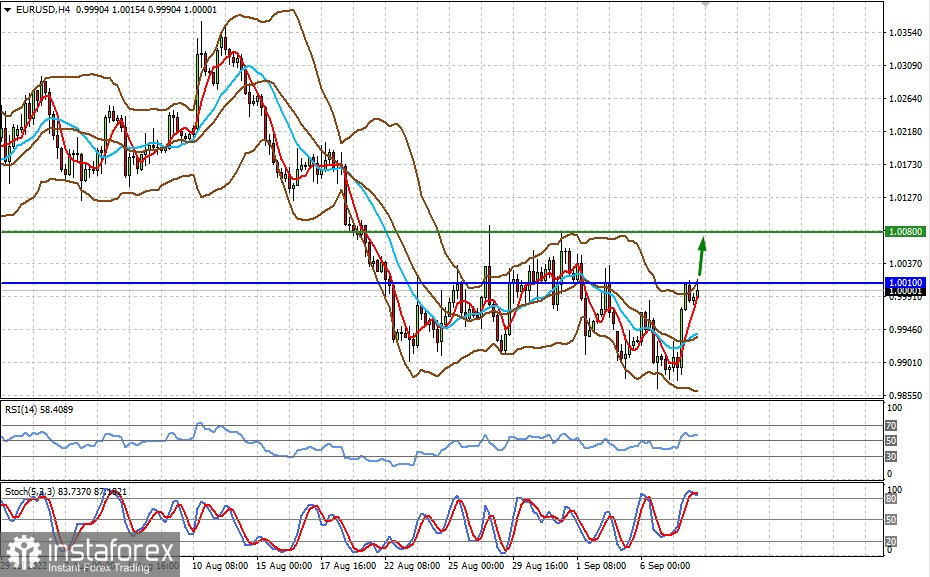

EUR/USD

The pair is consolidating below 1.0010. It could rise to 1.0080 if the ECB raises the rate by 0.75% and makes it clear that they will continue to act aggressively in the future.

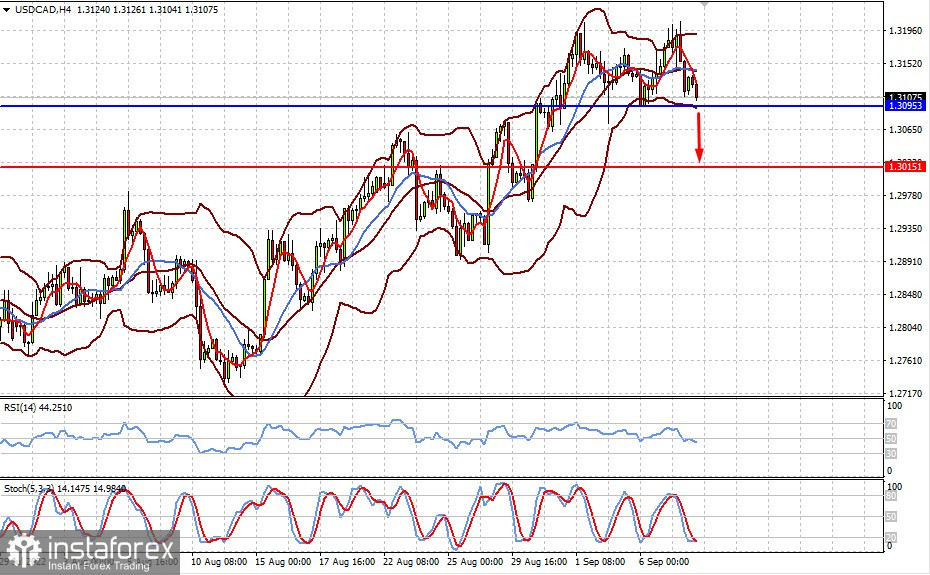

USD/CAD

The pair is consolidating above 1.3100. Continued growth in crude oil prices, as well as a tough policy of the Bank of Canada, may lead to a fall to 1.3015.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română