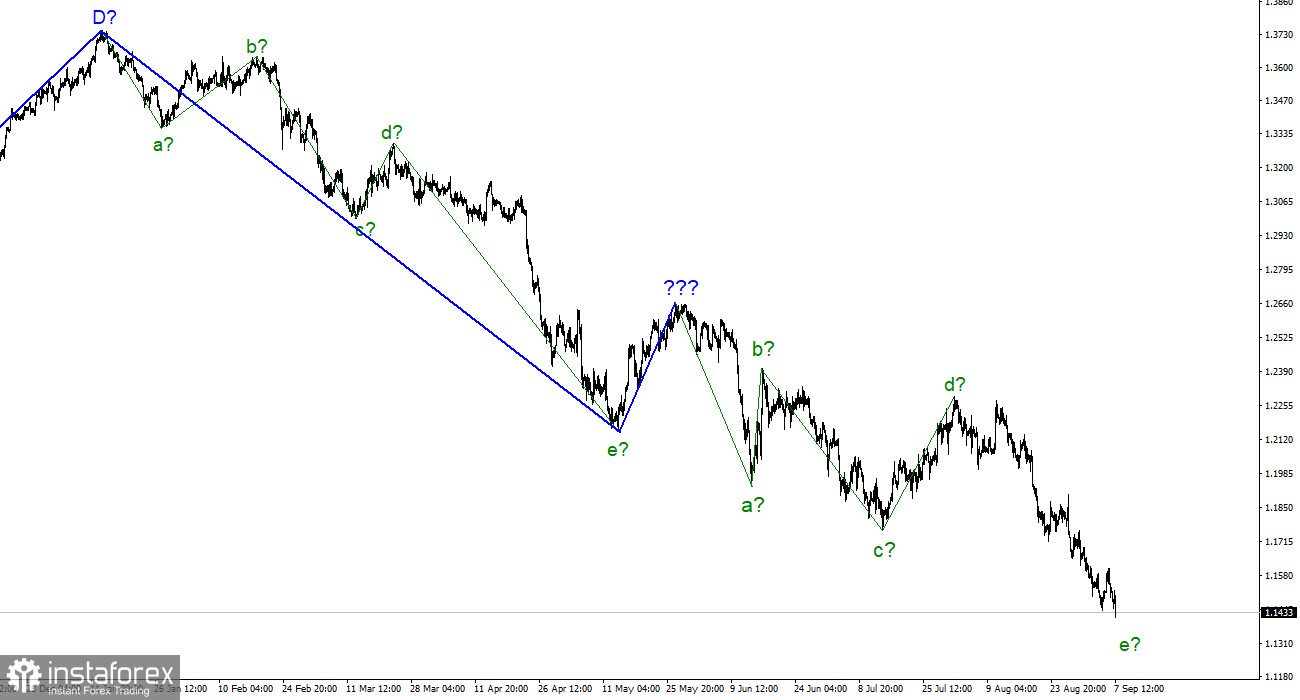

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend continues its construction. At the moment, we have completed waves a, b, c and d, so we can assume that the instrument is inside wave e. If this is true, then the decline in quotations may continue. However, I remind you that if impulse structures can become more complicated and lengthened, then corrective ones are even more so. Given the news background and the fact that the Fed will not stop raising interest rates now, the entire downward trend section may take a much longer form. A successful attempt to break through the 1.1708 mark, which corresponds to 161.8% by Fibonacci, indicates that the market is ready for new sales of the British. At the same time, the low of wave e is already much lower than the low of wave c, so wave e can end at any time. The wave markings of the euro and the pound are again very similar.

Andrew Bailey said that inflation would continue to rise

The exchange rate of the pound/dollar instrument decreased by another 100 basis points on September 7. Today, the quotes of the instrument have already fallen to the 14th figure, on which the low line has been running for almost four decades. As you can see, the British did not need important news or events to lose a few hundred more points in a week and drop to levels many of us have never seen. If the Briton was still afloat on Monday and Tuesday due to the fact that the news background was practically absent, today it fell again with a pure heart. At the beginning of the week, only the name of the new British Prime Minister, Liz Truss, became known. Some analysts considered that the appointment of a new leader of the Conservative Party had a favorable effect on the pound, but even if it was so, the pound did not rejoice for long. And today, when the speech of the governor of the Bank of England began, the demand for it began to decline again.

Bailey's most important sayings were those concerning inflation and recession. According to the head of the central bank, "short-term inflation expectations have increased significantly recently, but it is important to avoid an increase in expectations in the medium and long term." "The risk of the impact of core inflation on pricing remains high." "In the US, the economic and inflation problems are not as strong as in the UK." "The future of the British economy largely depends on the gas price." These are Bailey's key statements, and, as we can see, there is little positive in them. The Bank of England is now afraid that inflation will continue to grow and remain at its unprecedented values for a long time, despite the measures taken. Perhaps we are already talking about long years. A recession can be very severe, especially if gas prices rise.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the instrument may not reach it. Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română