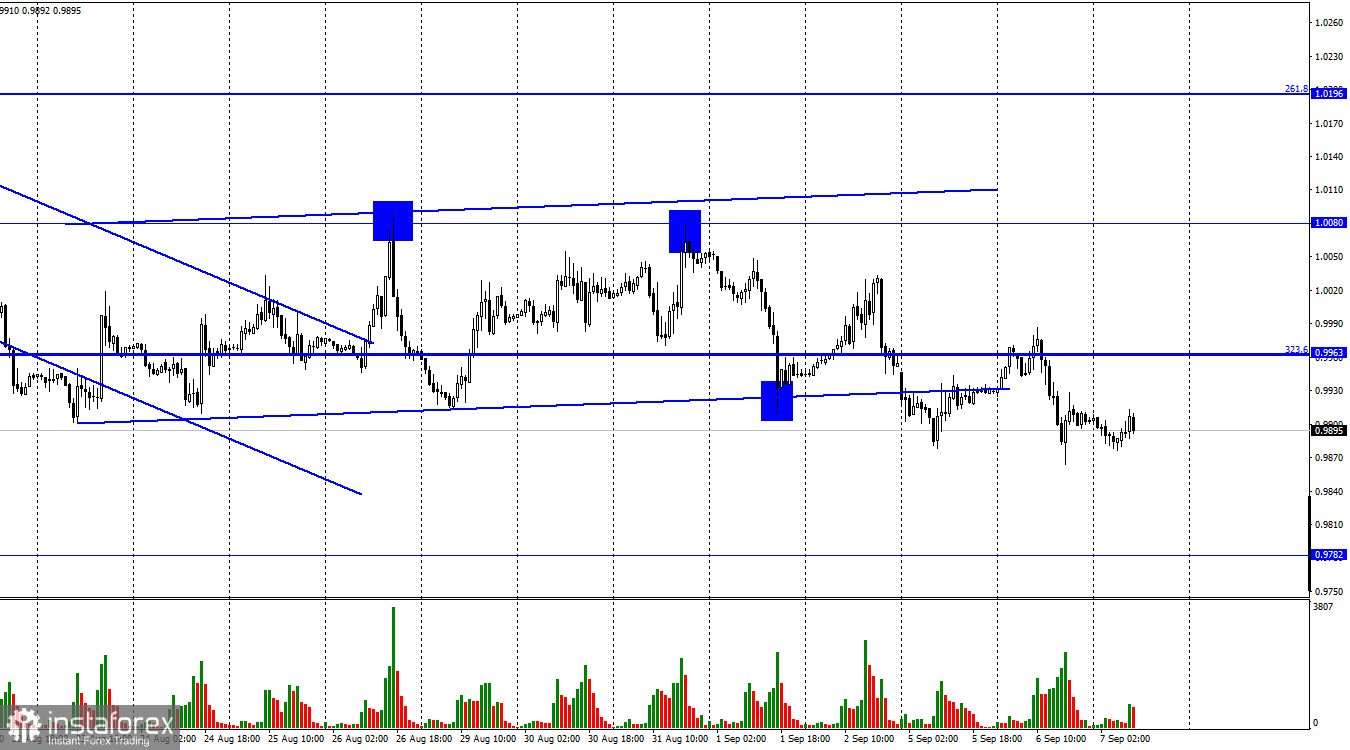

The EUR/USD pair performed a new reversal in favor of the US currency on Tuesday and began a new fall in the direction of the 0.9782 level. But it did not last long since a reversal in favor of the EU currency was already made today. Thus, traders continue to rock the market from side to side, and neither bulls nor bears have a clear advantage now. This judgment would be 100% fair if the pair were not near their low for 20 years. Therefore, the bears, of course, have full power in the market, but in recent weeks they have not increased their pressure on the European currency. The euro is not falling or falling with great difficulty. I am already so used to the fact that the euro currency is constantly declining that I don't even consider the option with its possible growth. However, today and tomorrow are important days. The GDP report for the second quarter will be released today, and the ECB meeting will be held tomorrow.

Against the background of ongoing talk about a recession in the European Union, one could expect a significant reduction in GDP in the second quarter. However, traders expect growth of 0.6% q/q, and the recession may still begin later. The European currency will not get new reasons to fall if its expectations come true. Tomorrow, it may show strong growth if the ECB, as everyone is now expecting, raises the rate by 0.75%. The only strange thing is that bull traders still do not work out this event since everyone already knows about the rate increase, which means that there are already reasons to buy the euro currency. I am afraid that instead of the growth of the European currency on Thursday, we would not see its new fall, and the results of the ECB meeting were not completely ignored. We now have closure under the side corridor, so the probability of a fall is higher than the growth probability. The high probability of an energy crisis may overshadow a good GDP and an increase in the ECB interest rate.

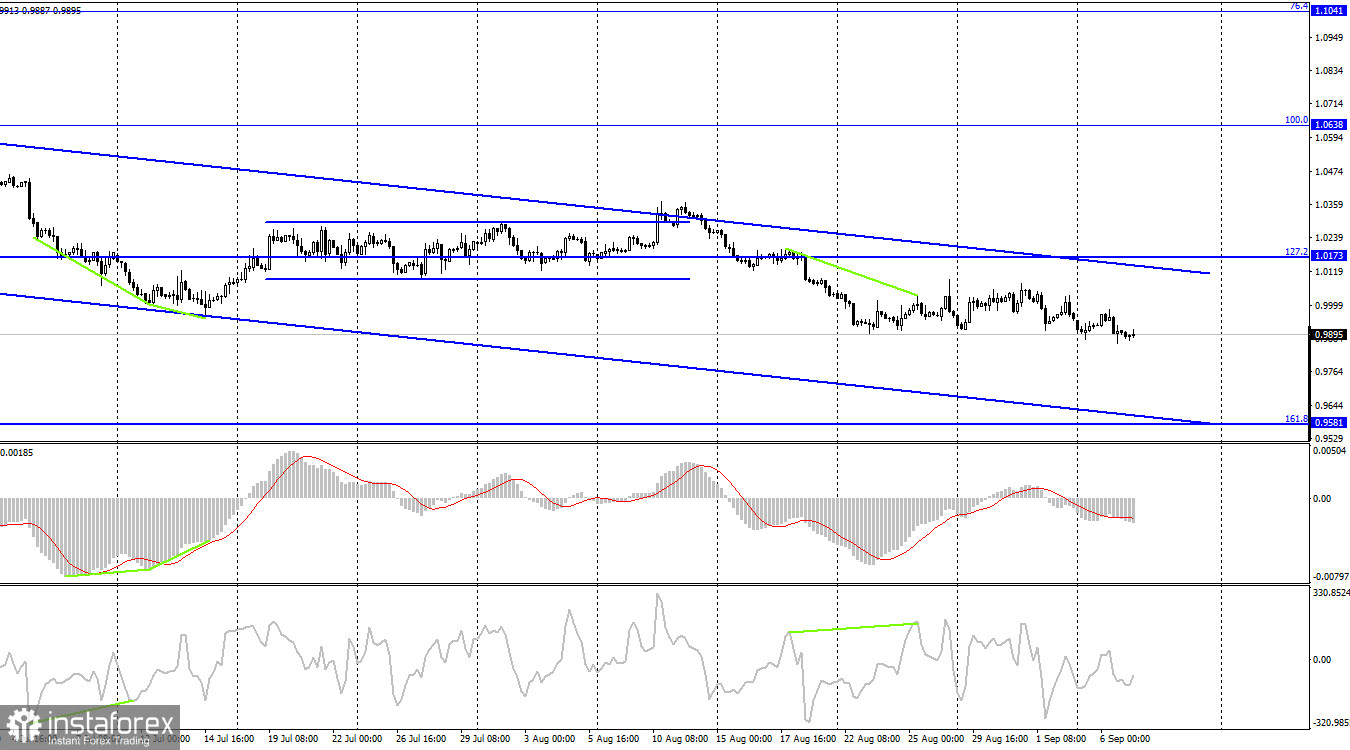

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). Thus, the process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). The downward trend corridor still characterizes the mood of traders as "bearish." No new emerging divergences are observed in any indicator today.

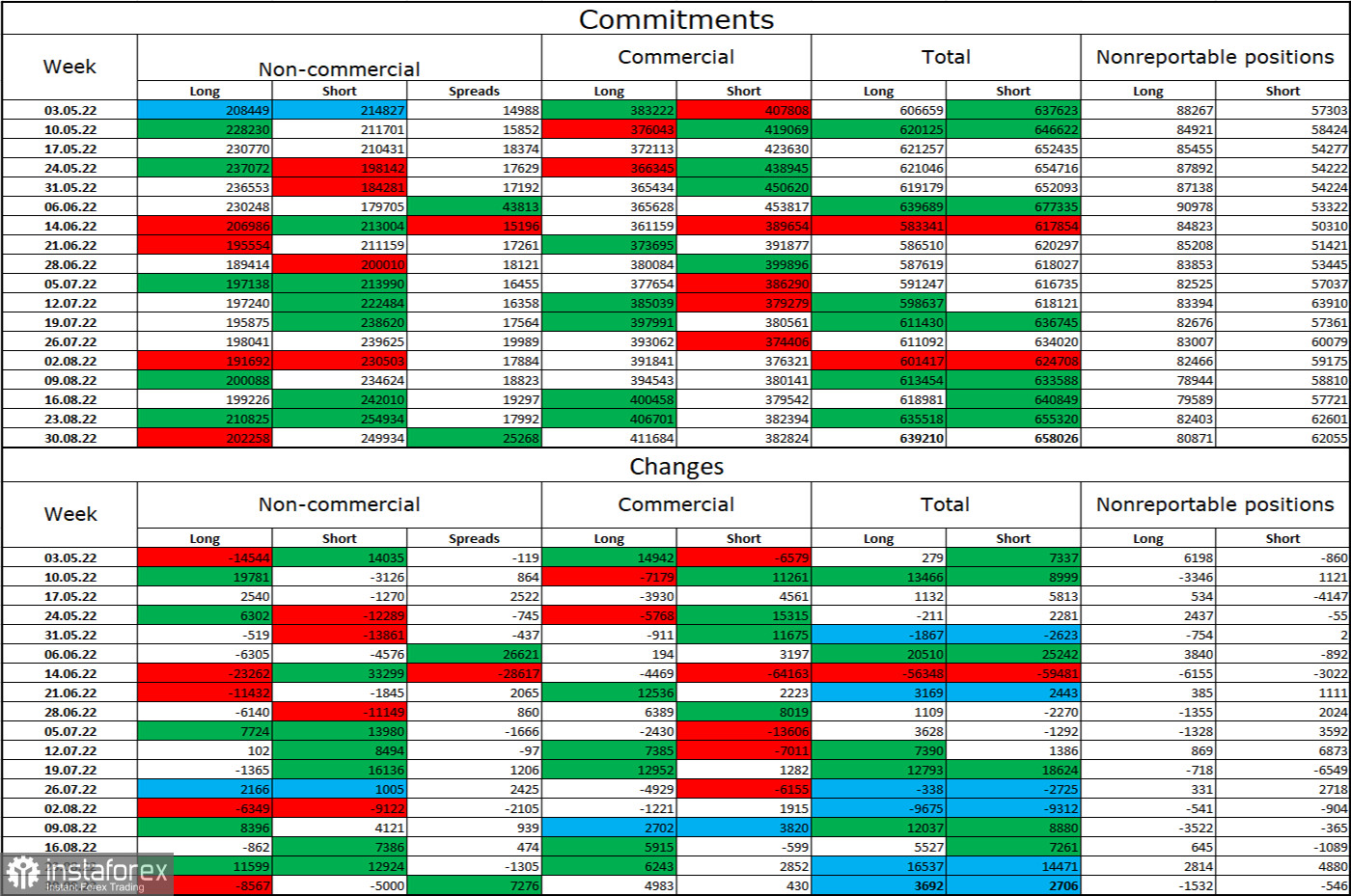

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 8,567 long contracts and 5,000 short contracts. This means that the "bearish" mood of the major players has intensified again, and the total number of long contracts concentrated in the hands of speculators now amounts to 202 thousand, and short contracts – 249 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last seven to eight weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair, judging by the COT data.

News calendar for the USA and the European Union:

EU – GDP in the second quarter (09:00 UTC).

On September 7, the most important index will be released in the European Union, but it may not affect the mood of traders if its value is 0.6%, as everyone now expects. There are no interesting entries in the calendar in the USA today.

EUR/USD forecast and recommendations to traders:

I recommended new sales when closing under a side corridor on the hourly chart with a target of 0.9782. Now, these deals can be held until closing above the level of 0.9963. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română