Bitcoin has been consolidating in the past 10 days amid record-low trading volumes. After some period of volume accumulation, the price broke below the level of $19K. So, over the past 24 hours, BTC has dropped by 6% and by 7.5% in the week. Given the current fundamental and technical background, Bitcoin's capitalization may continue to decline. The most likely scenario is the retest of $17,7K or a further fall of the quote until it tests the local low.

The number one cryptocurrency is steadily following the bearish scenario that we have been talking about for the past week. The price failed to settle above $20,8K, thus canceling the bullish scenario. So, the asset keeps moving lower after breaking through the key support area of $20,5K-$21K. BTC/USD has once again touched the support at $19,5K and broke below the level to head for the $18,7K mark. As the coin was tumbling, more than 102,000 positions worth $356 million were canceled.

On the D1 chart, BTC made a downside breakout of the key support at $19,5K and rapidly plunged to the area of $18,5K-$18,7K. On September 6, the cryptocurrency formed the bearish engulfing pattern. This pattern clearly signals the end of consolidation and the victory of sellers. The current support zone at $18,5K-$18,7K serves as the last threshold for buyers where they can prevent the retest of the local low. If bearish bias strengthens, BTC is likely to initiate another decline towards $17,7K and hit a new low.

Bitcoin's daily chart show signs of bulls gaining momentum. Thus, the RSI has closely approached the oversold zone but hesitates to leave it, which may indicate the start of the flat movement. It may also mean that the bearish pressure is easing and the volume of long positions is rising. The Stochastic Oscillator is struggling to leave the oversold zone. The metric shows another formation of the bullish crossover. Yet, given the overall state of the market, the bullish momentum is unlikely to be activated. Despite some positive signs on the daily chart, Bitcoin will most likely slide further.

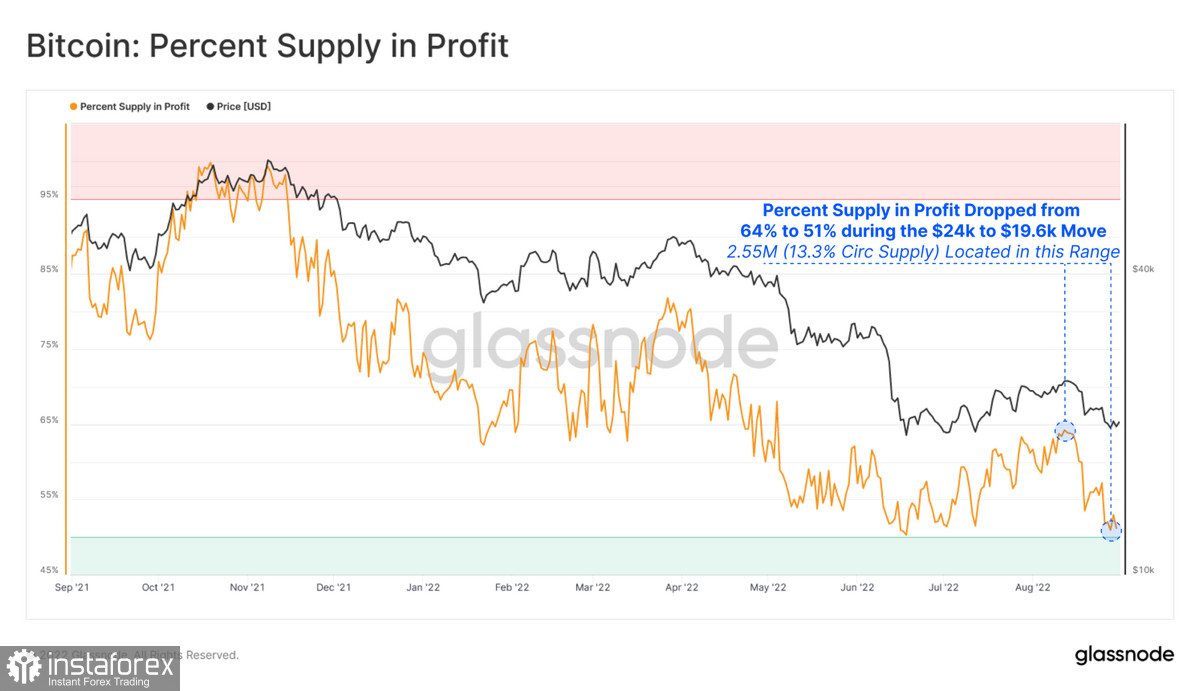

Short-term investors may act as the main catalyst for pushing the price of Bitcoin to $17,7K. According to Glassnode data, many short-term investors bought the asset when it was consolidating near $20K. After a drop below $20K and then below $19K, the number of losing trades on BTC has considerably increased by 13%. 60% of losing trades have been opened by short-term investors. There is a high risk that speculators will get rid off BTC and reduce its trading volume, thus triggering a fall to the local low and beyond.

Another factor proving the future negative scenario is the strong correlation of Bitcoin with the S&P 500 index and the US dollar. As we can see, both BTC and S&P are steadily heading for the bottom. In the meantime, DXY continues its rally supported by Fed's monetary policy. This confirms the fundamental character of the downtrend in Bitcoin. Therefore, the cryptocurrency may soon retest the local low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română