During the whole of Tuesday the pound was doing nothing but losing its positions. The overall scale of the decline is quite impressive. A little over a hundred points. And this despite the fact that the final data on business activity indices in the United States turned out to be significantly worse than forecasts. In particular, the index of business activity in the service sector fell from 47.3 points to 43.7 points. Although the preliminary estimate showed a decrease only to 44.8 points. The composite index of business activity, instead of falling from 47.7 points to 45.5 points, fell to 44.6 points. In general, the data once again confirmed the fact that the US economy is sliding into recession. And confident and fast. However, the dollar continued to rise. Apparently, this is a consequence of the preparation of market participants for tomorrow's meeting of the Board of the European Central Bank, during which the refinancing rate may be raised by 75 basis points. So we see a classic movement in the opposite direction from the expected result, followed by a sharp jump. Purely speculative behavior. Ahead of the significant event, this is not uncommon. Rather, even the norm. And it is quite possible that today the dollar may continue to strengthen its position, though not as briskly as yesterday.

Composite PMI (United States):

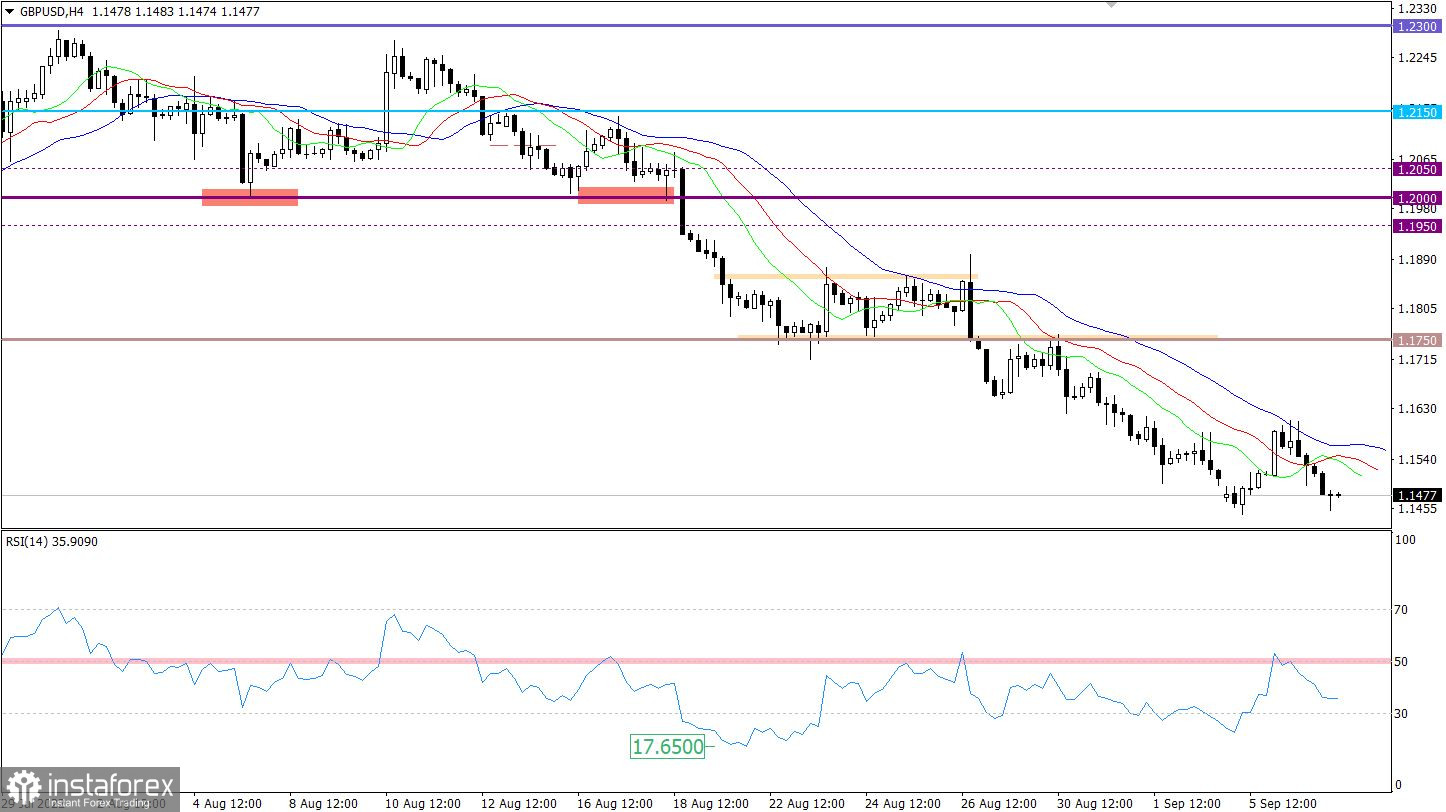

The GBPUSD currency pair, after a short rollback, again rushed down towards the local low of 2020. This move indicates the continuing downside mood among traders in the market.

The technical instrument RSI H4 bounced off the 50 middle line, as a result, the indicator continued to move in the lower 30/50 area, which corresponds to a downward trend. RSI D1 is moving in the oversold zone, which indicates a growing level of overheating of short positions.

The moving MA lines on the Alligator H4 and D1 indicator are directed downwards, which corresponds to the direction of the main trend.

Expectations and prospects

In order for a signal to prolong the long-term downward trend, the quote needs to be firmly held below 1.1400 in the daily period.

Otherwise, the scenario of a price rebound from the 2020 low area with a subsequent range of 1.1450/1.1600 cannot be ruled out.

Comprehensive indicator analysis in the short-term, intraday and medium-term periods is focused on a downward cycle - a signal to sell the pound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română