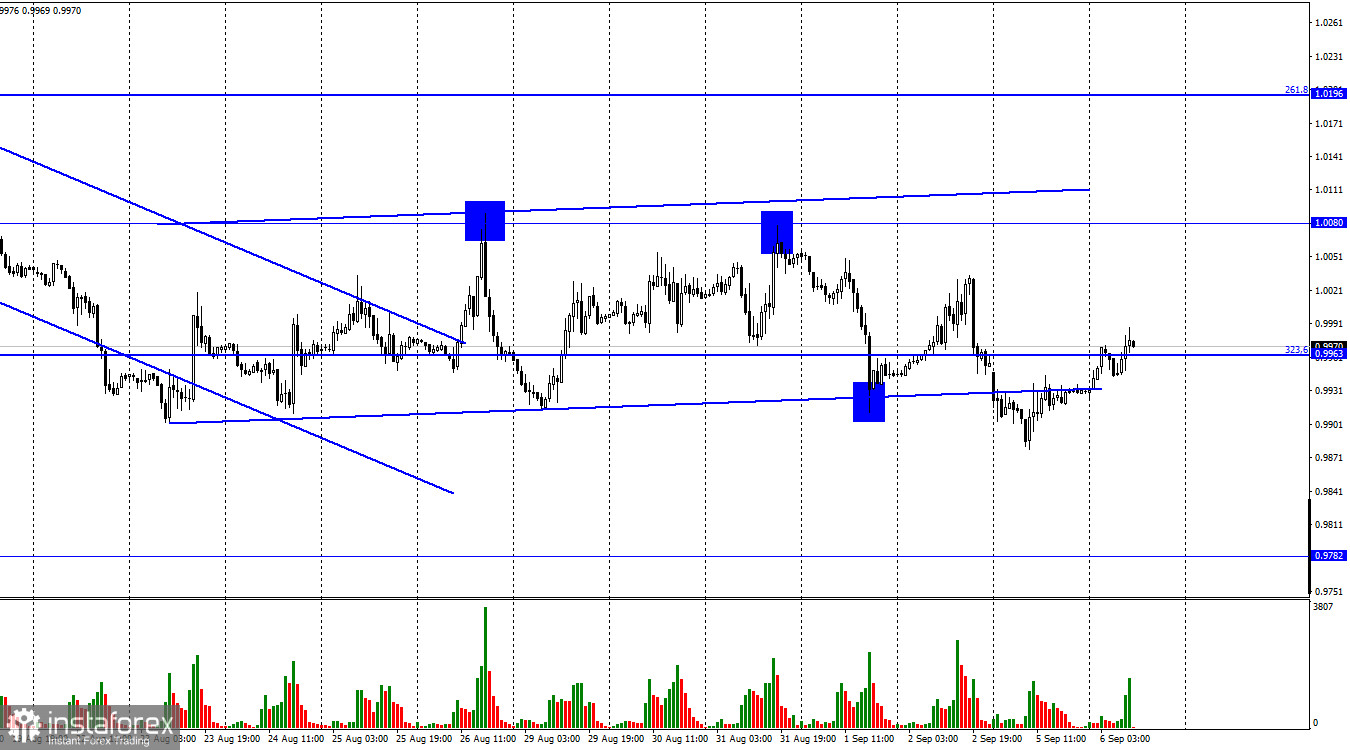

On Monday, the EUR/USD pair reversed in favor of the European currency and returned to the Fibonacci retracement level of 323.6% at 0.9963. The pair closed the session below the sideways channel. So, it may continue to decline today and tomorrow towards the level of 0.9782. I don't think there will be strong growth at least until Thursday when the ECB announces its rate decision. At the same time, traders may behave unusually ahead of the central bank's meeting as they may want to guess the outcome. Yet, there is nothing to guess as most of the ECB officials have already supported the second rate hike. The only thing that stays unclear is the scope of the rate hike: it can be either 0.50% or 0.75%. The information background on Monday and Tuesday was not favorable for buying the euro. Yesterday, the Eurozone Services PMI dropped to 49.8 and the composite PMI declined to 48.9. Today, the business activity index of the construction industry fell to 44.2.

In addition, the EU released retail sales data on Monday which contracted by 0.9% on a yearly basis. The reading came mostly in line with traders' expectations. But overall, the fresh data cannot be called positive. Markets are still concerned about the gas crisis in Europe which will have a long-lasting impact on the European economy and its currency. Although the European Commission is developing a plan on how to support households, energy bills have almost doubled and are set to rise further. Russian gas supplies to Europe have been stopped. Hopes that Moscow will resume the operation of the Nord Stream pipeline are fading away with every day. Russia names the faulty gas turbine as the main reason for the shutdown. It blames Western sanctions that made it impossible to deliver the turbine. So, there is a risk that Russia will never resume the gas flow to Europe.

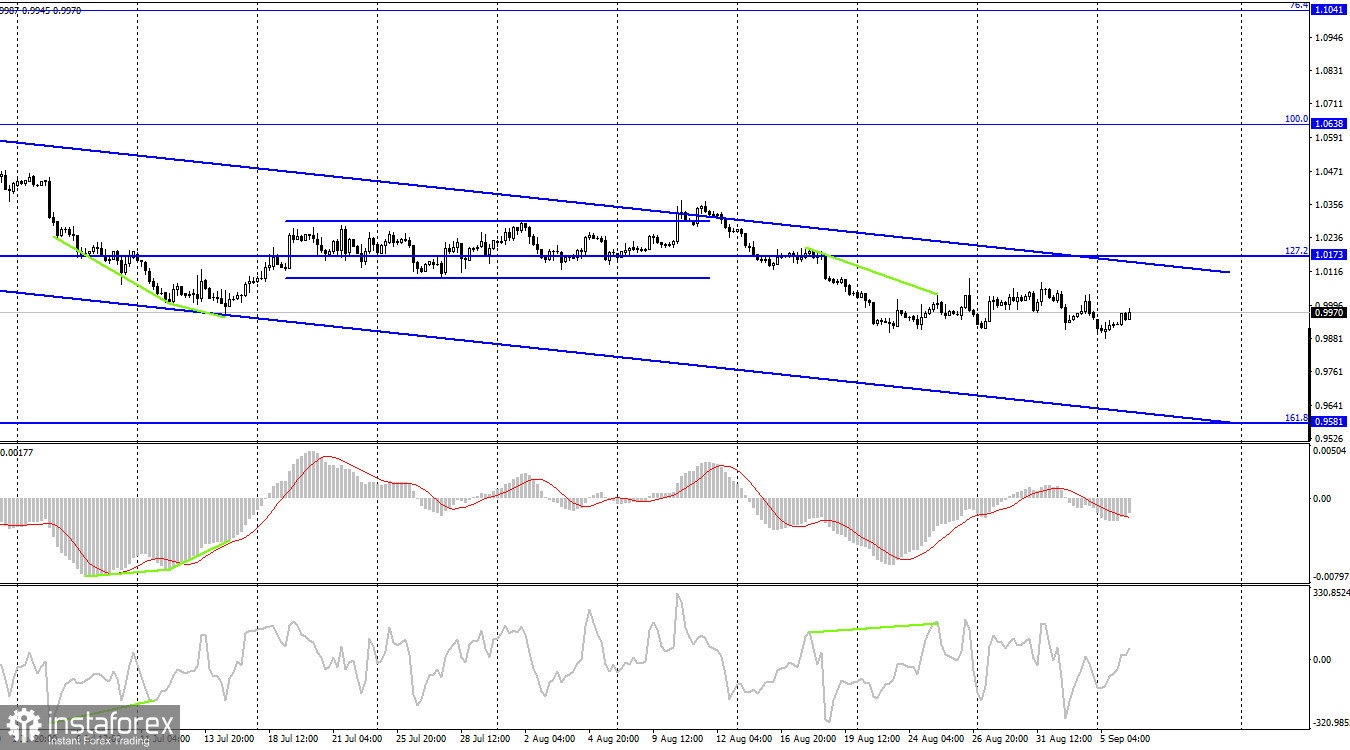

On the 4-hour chart, the pair reversed in favor of the US dollar and settled below the Fibonacci retracement level of 127.2% at 1.0173. Therefore, it may extend its decline towards the next Fibonacci level of 161.8% at 0.9581. The descending trend channel confirms the bearish sentiment of the market. None of the indicators shows any divergencies coming.

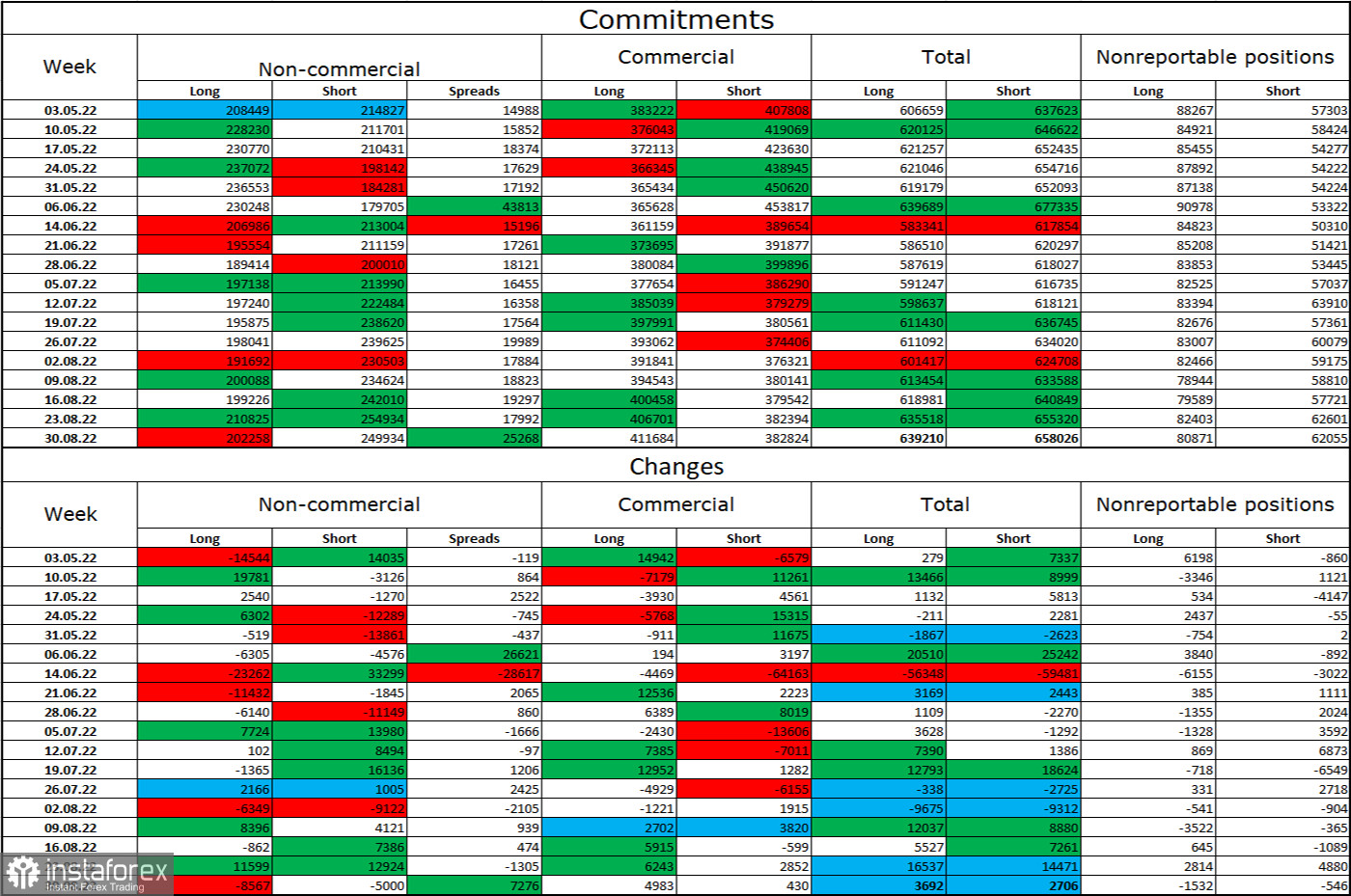

Commitments of Traders report:

Last week, traders closed 8,567 long contracts and 5,000 short contracts, indicating that large market players became more bearish on the pair. The total number of existing long contracts is 202,000 while the number of short contracts is 249,000. The difference is not big although euro bears still prevail in the market. In the last few weeks, the likelihood of an uptrend in the euro was getting higher. Yet, recent COT reports showed that bulls failed to gain a strong foothold in the market. The euro failed to develop a proper upside movement in the past 7-8 weeks. Therefore, I can hardly see any chances for strong growth. Given the COT data, I think EUR/USD will continue to depreciate.

Economic calendar for US and EU:

EU – Construction PMI (07-30 UTC).

US – ISM Non-Manufacturing PMI (14-00 UTC).

On September 6, the most important index will be published in the afternoon. The ISM data may seriously influence the market sentiment. Meanwhile, the EU economic calendar has no other important entries.

EUR/USD forecast and trading tips:

I would recommend selling the pair when the price closes below the sideways channel on H1 with the target at 0.9782. At the moment, these trades can be kept open until the pair closes above 0.9963. Buying is possible when the quotes settle firmly above the descending channel on the 4-hour chart with the target at 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română