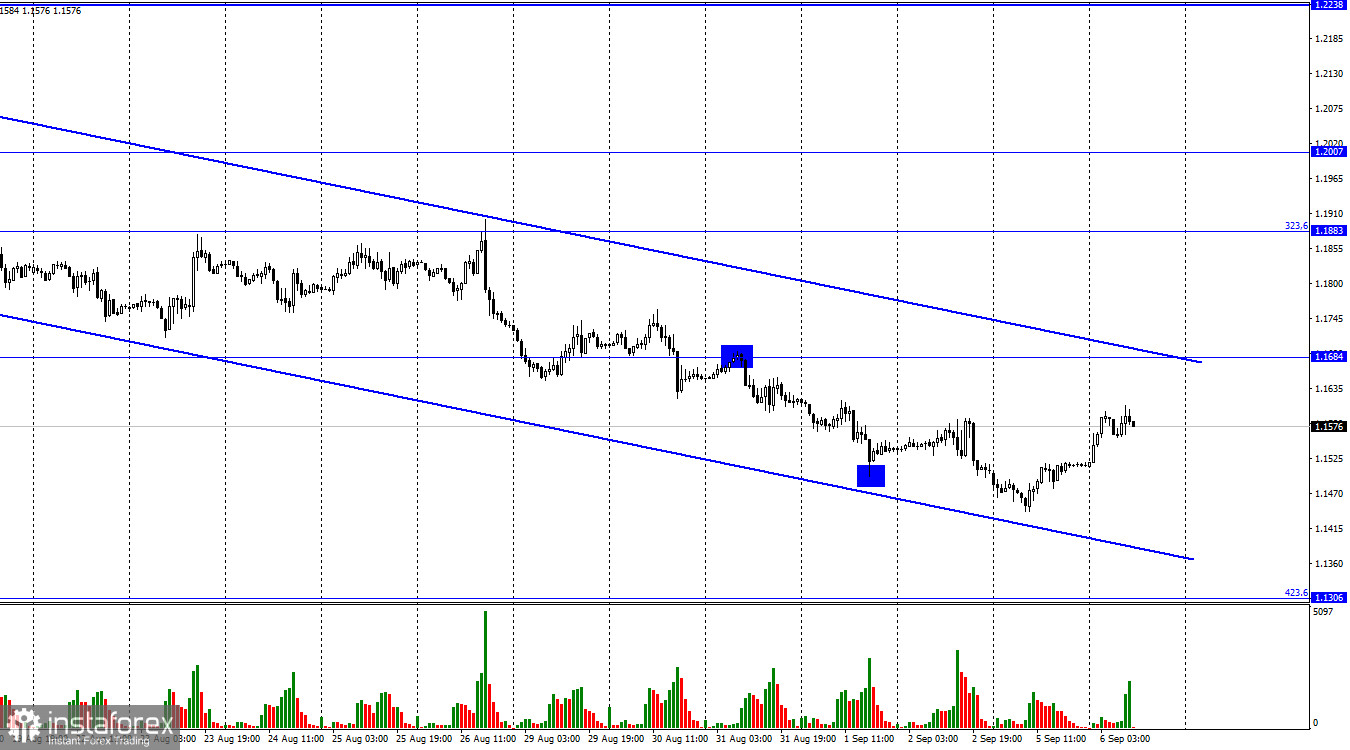

According to the hourly chart, the GBP/USD pair reversed in favor of the British and shows an increase in the level of 1.1684. However, this growth occurs within a downward trend corridor, which means that traders can expect a reversal in favor of the US currency soon and a resumption of the fall in the direction of the corrective level of 423.6% (1.1306). Only the consolidation of the pair's rate over the descending corridor will allow us to expect the growth of the British. In the UK yesterday, the information background was quite weak. The index of business activity in the services sector decreased to 50.9, and the composite index – to 49.6. Today, the index of business activity in the construction sector rose to 49.2, and this growth cannot be considered a positive moment since, below 50.0, any index value is considered negative. Thus, I think that the decline of the British will resume. It remains to drop by 150 points to its lows in almost 40 years, and I do not think those bear traders will suddenly retreat from the market. The fall may resume as early as this afternoon.

Traders are very fond of buying the dollar in the American session. In addition, the ISM business activity index will be released, which continues to remain at a high value, which may cause new dollar purchases. There is also an acute gas problem in the UK. Electricity and gas bills continue to rise, and the British government is developing assistance programs for British citizens who are forced to face bills that have doubled. And doubling growth is not the limit. Many experts predict a three-fold increase in the cost of heating and electricity compared to the same period a year ago. However, the UK is still less dependent on Russian gas than the European Union, and the pound sterling is falling more closely with the dollar than the euro. Thus, I believe the gas problem is not yet decisive for traders. I recommend relying on graphical analysis to a greater extent now since both charts have downward trend corridors.

On the 4-hour chart, the pair reversed in favor of the British after forming a "bullish" divergence at the MACD indicator. The pair's growth can be continued in the direction of the upper line of the descending trend corridor, which characterizes the mood of traders as "bearish." Fixing above it will increase the likelihood of further growth of the British dollar, but I think that the process of falling in the direction of 1.1111 will be resumed more likely.

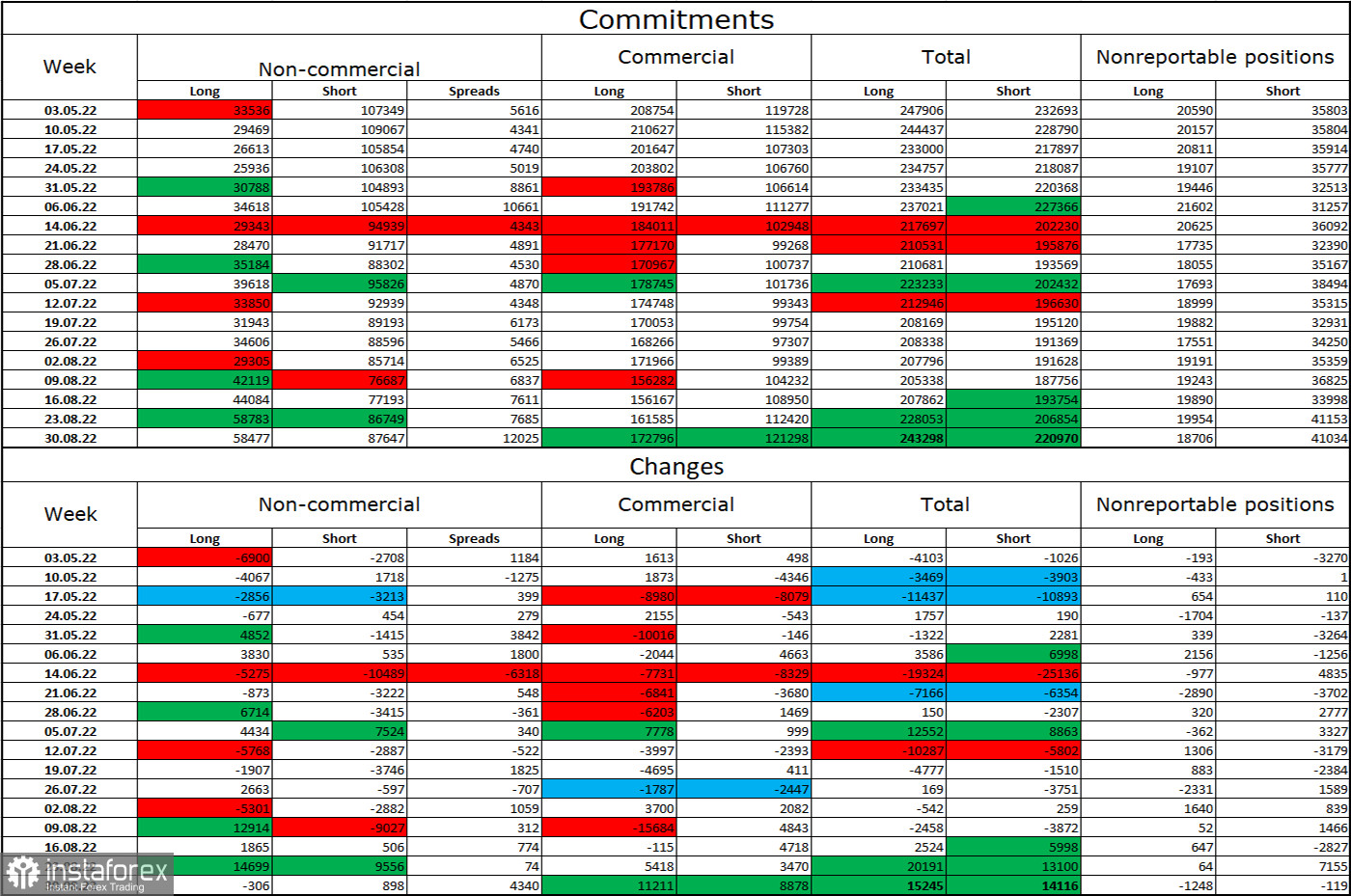

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become a little more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 306 units, and the number of Short contracts increased by 898. Thus, the general mood of the major players remains the same – "bearish," and the number of short contracts still exceeds the number of long contracts, but much less than before. The big players stay in the pound sales for the most part, and their mood is gradually changing towards "bullish," but this process is still very far from completion. The pound itself has resumed falling, and COT reports so far make it clear that the Briton is more likely to continue it than to start a long upward trend now.

News calendar for the USA and the UK:

UK – index of business activity in the construction sector (08:30 UTC).

US - ISM Purchasing Managers' Index for the non-manufacturing sector of the USA (14:00 UTC).

On Tuesday, the calendars of economic events in the United States and Britain contain one interesting entry each. The British business activity index has already been released, but the more important American ISM index remains. Thus, the influence of the information background in the rest of the day may be present.

GBP/USD forecast and recommendations to traders:

I recommended selling the British at a close under 1.1684 on the hourly chart with a target of 1.1496. This level has been worked out. New sales of the British – at the close under 1.1496 with a target of 1.1306. I recommend buying the British when the pair's rate is fixed above the descending trend corridor on the hourly chart with a target of 1.1883.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română