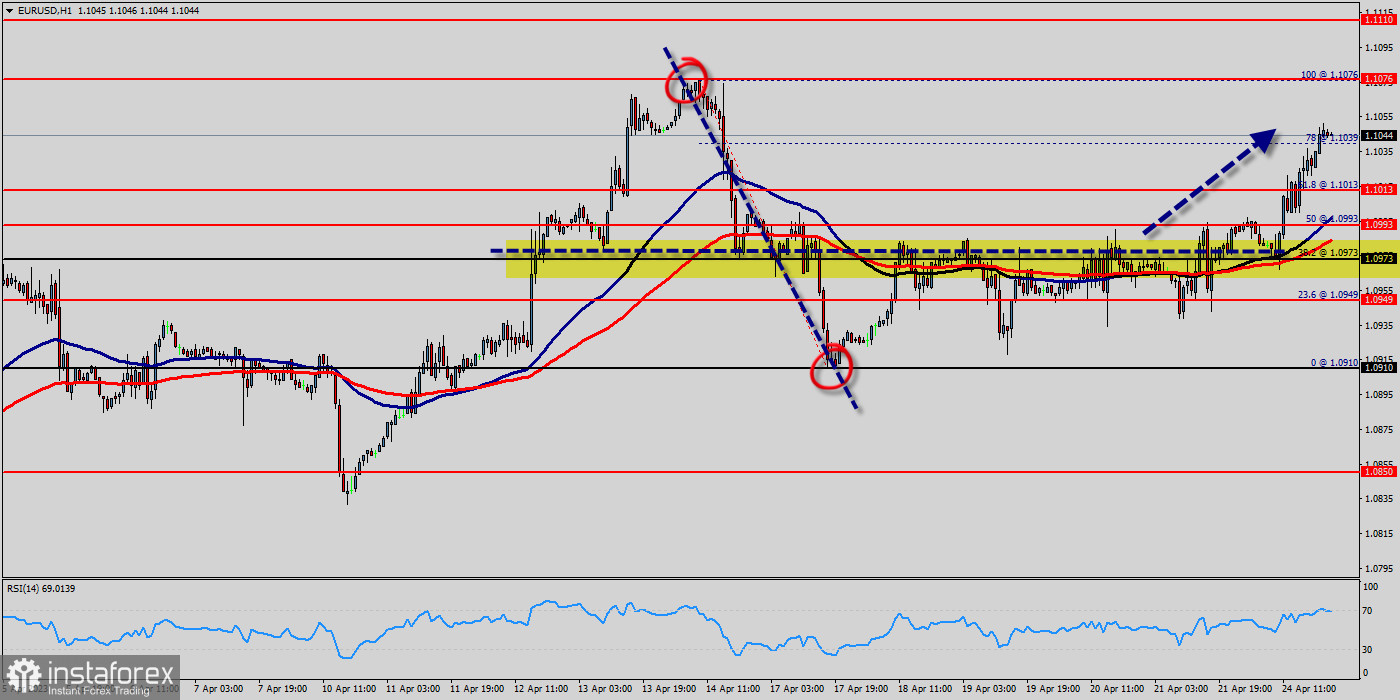

The expected trend for today: Bullish. The EUR/USD pair rallied upwards strongly yesterday to breach the bearish channel's resistance and settles above it, opening the way to turn to the upside on the intraday and short-term basis, starting bullish correction for the raise measured from 1.0995 to 1.1045, noting that the first main station is located at 1.1076, which breaching it represents the key to achieve additional gains that reach 1.1076.

Therefore, the bullish bias will be suggested for today, supported by the EMA100 that carries the price from above, taking into consideration that breaking 1.1076 will stop the expected rise and push the price back to the main bearish track again. A medium term topped could be in place already, on bullish convergence condition in daily RSI.

Intraday bias is now on the upside for 38.2% retracement of 1.0973 to 1.1076. The EUR/USD pair traded higher and closed the day in the positive territory around 1.1076.

On the hourly chart, EUR/USD is still trading above the moving average line MA (100) H1 (1.1013). Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend.

This suggests that the pair will probably go above the daily pivot point (1.0973) in the coming hours. The EUR/USD pair will demonstrate strength following a breakout of the high at 1.1076.

The situation is similar on the four-hour chart. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the EUR/USD pair remains above MA100 H1, it may be necessary to look for entry points to buy for the formation of a correction.

Probably, the main scenario is continued growth towards 1.1110. The expected trading range for today is between 1.0973 support and 1.1110 resistance. Uptrend scenario : An uptrend will start as soon, as the market rises above support level 1.1013, which will be followed by moving up to resistance level 1.1076.

Further close above the high end may cause a rally towards 1.1076 and 1.1110. Nonetheless, the weekly resistance level and zone should be considered at 1.1110.

Alternative scenario : On the downside, break of 1.0973 minor support will turn intraday bias neutral first. The breakdown of 1.0973 will allow the pair to go further down to the prices of 1.0910 and 1.0850.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română