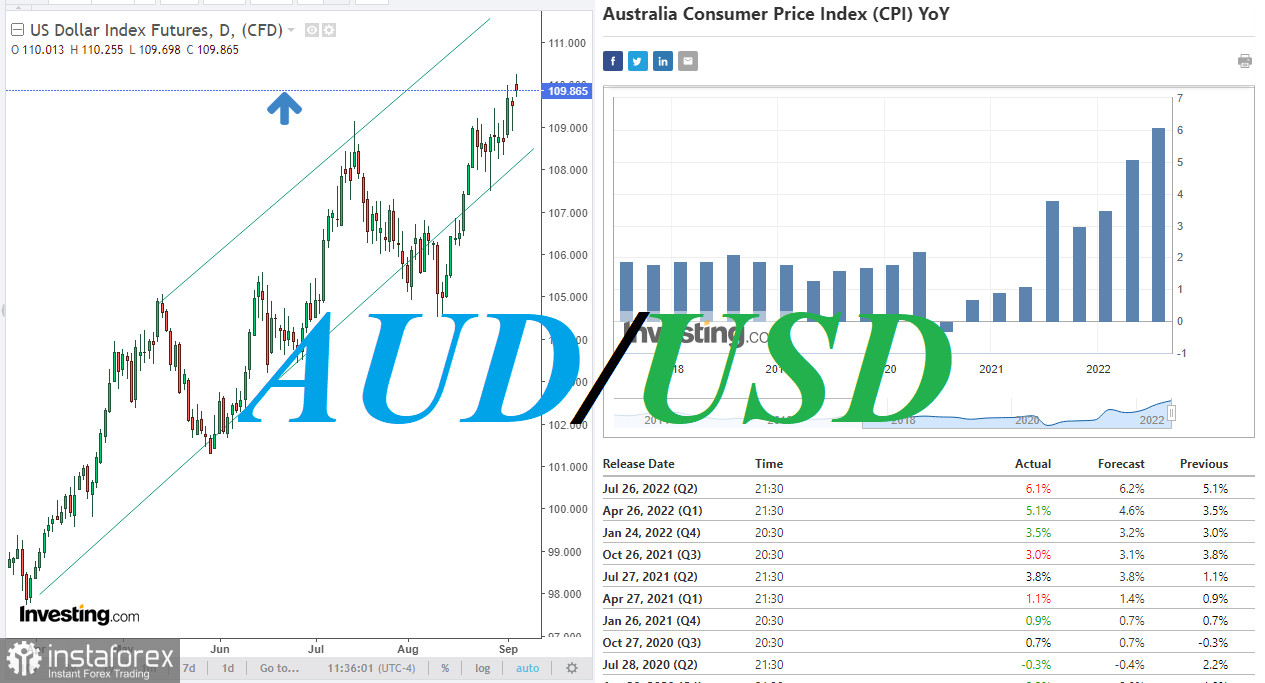

Despite the absence of American investors in today's market (Labor Day is celebrated in the USA and Canada, and the banks of countries and US exchanges do not work on this day), dollar bulls were able to push its DXY index even higher: it updated the peak since October 2002, touching marks like 110.25. Despite the fact that dollar bulls decided to consolidate some long positions closer to the beginning of the US trading session, at the time of release of this article, DXY futures were trading near 109.87, maintaining the potential for further growth. Therefore, most likely, the growth of the DXY index and the strengthening of the dollar will continue, at least until blatant negative macro data begins to come from the US.

In this regard, it is worth paying attention to Tuesday's release of the US PMI in the services sector of the economy (from ISM, Institute of Supply Management). According to the forecast, a slight relative decline in the indicator is expected, to 55.5 from 56.7 in July. Despite the relative decline, this is a high figure. A result above 50 indicates an increase in activity and is considered as a positive factor for the USD.

Economists and market participants will also pay attention to other components of the ISM report, such as employment, the index of new orders in this important area of the US economy. If the report as a whole is positive, then the dollar is likely to receive a new impetus to growth.

Among the important events of Tuesday is also the Reserve Bank of Australia meeting. It will announce its decision on the interest rate. So, high volatility in the market will be observed both in the first and in the second half of the trading day.

RBA leaders are widely expected to raise interest rates to 2.35% from the current 1.85%. Despite such an abrupt rise for the RBA, according to some economists, the RBA was late in tightening monetary policy, and "the previous RBA forecast that no rate hike would be needed until 2024 was wrong." According to them, "now the rate hike should be much more significant than if they started earlier." It is possible that the RBA intends to act in such a way as to tame the high inflation that is raging in Australia, as, indeed, in other economically developed regions of the world.

So, in the 2nd quarter of 2022, annual inflation in Australia jumped to 6.1%. Although this is much lower than, for example, in the US or the UK, the Australian CPI of 6.1% is much higher than two years ago, when inflation in the country was near zero and the RBA was ultra-soft on monetary policy, reducing the interest rate from 0.25% to 0.1%.

Well, it will now be interesting to see what RBA officials have to say in accompanying comments tomorrow regarding the bank's monetary policy outlook.

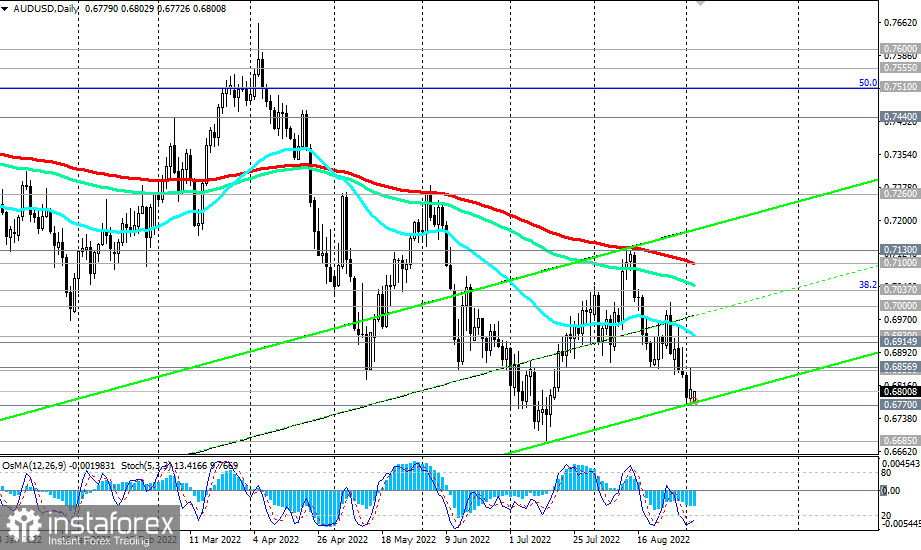

If the rhetoric of their accompanying statements is tough, then the strengthening of the AUD is not ruled out, even when paired with the US dollar. But it is still difficult to say how firm this strengthening will be. The US dollar is totally strengthening throughout the currency market, and the volume of international financial settlements in US dollars is an order of magnitude greater than similar settlements in AUD. Moreover, the leaders of the Federal Reserve declare their commitment to a tough stance on curbing inflation in the US.

As for the AUD/USD pair, it was trading near the 0.6800 mark, slightly above the local low of 0.6772, reached at the very beginning of this month. Below the key resistance levels of 0.7260, 0.7100, AUD/USD is in the bear market zone, falling inside the descending channel on the weekly chart. A breakdown of the local support level of 0.6770 will determine the continuation of the AUD/USD downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română