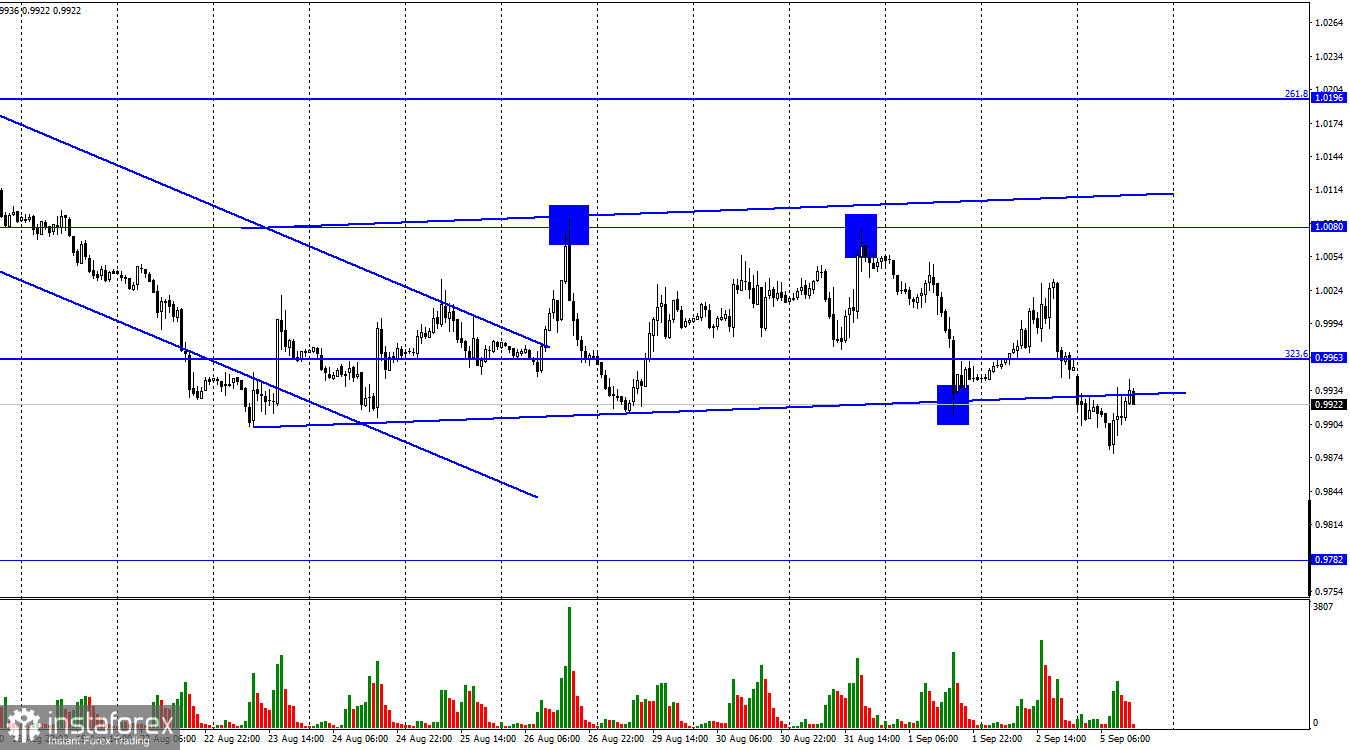

Hello, dear traders! On Friday, the EUR/USD pair again fell to the lower line of the sideways channel. Today, it closed below this line. Therefore, the probability of the further euro's decline towards 0.9782 level has increased. Notably, it has been within the sideways channel for about two weeks. However, the bears are currently increasing the pressure, which may lead to a new euro's decline. Moreover, traders had reasons to sell the euro again both on Friday and Monday. On Friday, positive US labor market data were released. It turned out that nonfarm payrolls totaled 315,000 in August, which was slightly above traders' expectations. The unemployment report was disappointing. It rose from 3.5% to 3.7%. However, the reaction of traders was almost unambiguous, they focused on new purchases of the US dollar. That indicates that nonfarm payrolls are more significant to traders than unemployment or wages reports. Moreover, today the Service PMI (49.8 at expectations of 50.2), Composite PMI (48.9 at expectations of 49.2) and retail sales (-0.9% y/y with -0.7% expected) were published in the EU.

I believe the European reports cannot be considered as important as the American ones. However, traders had a right to continue selling the euro taking them into account. Therefore, the euro has been trading near its lows for two decades and the situation remains very complicated and even critical. Traders did not draw their attention to the ECB promises to raise the rate several times in 2022. However, they focused on the energy crisis. Although gas prices have stabilized slightly over the past days, they are likely to keep rising as the Nord Stream pipeline is no longer delivering gas to Europe. Moscow said it could take a long time to resolve the problem as anti-Russian sanctions complicate repairs. There are speculations that gas will no longer be delivered to the EU via the Nord Stream pipeline. This aspect could have a very negative impact on the European economy which is extremely dependent on gas in the coming years.

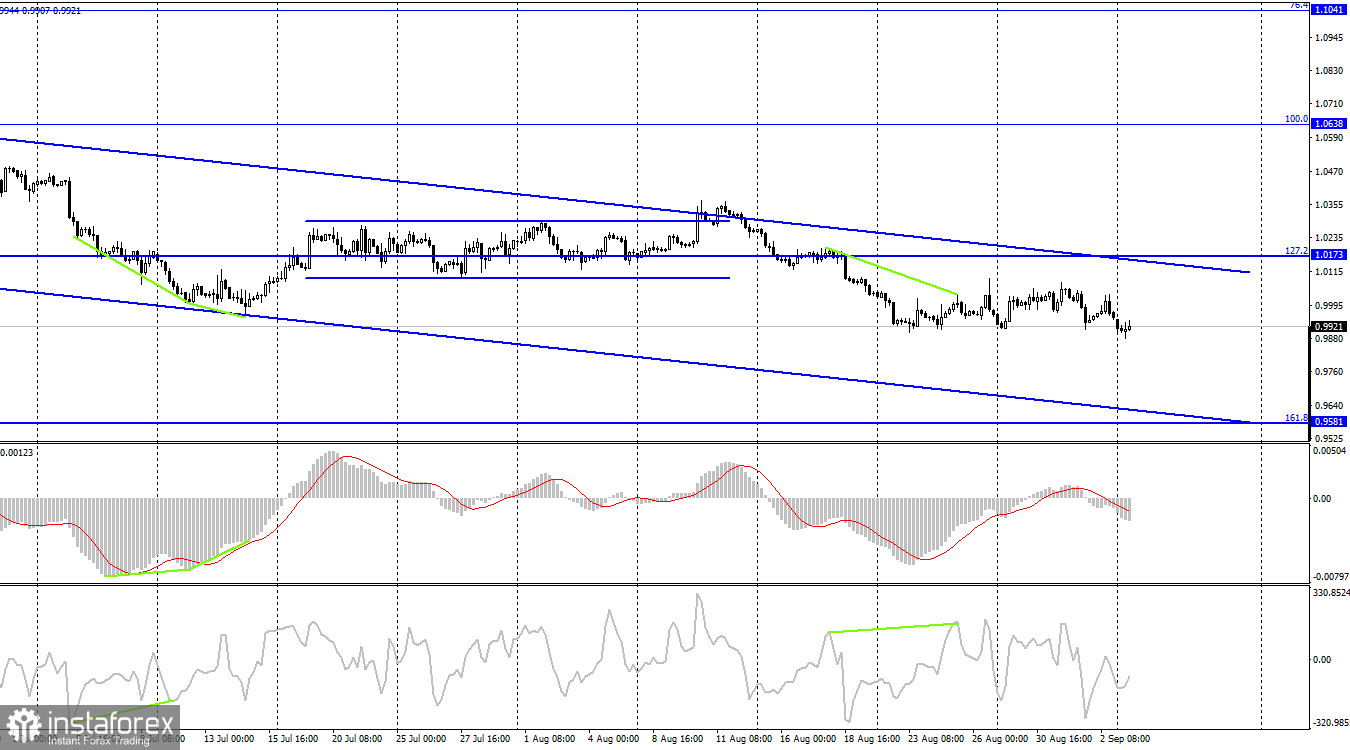

On the 4H chart, the pair performed a reversal in favor of the US dollar and consolidated at 1.0173, below the correction level of 127.2%. Thus, the decline may continue towards the 161.8% Fibonacci level at 0.9581. A downward trend channel still characterizes traders' sentiment as bearish. No indicator has new emerging divergences today.

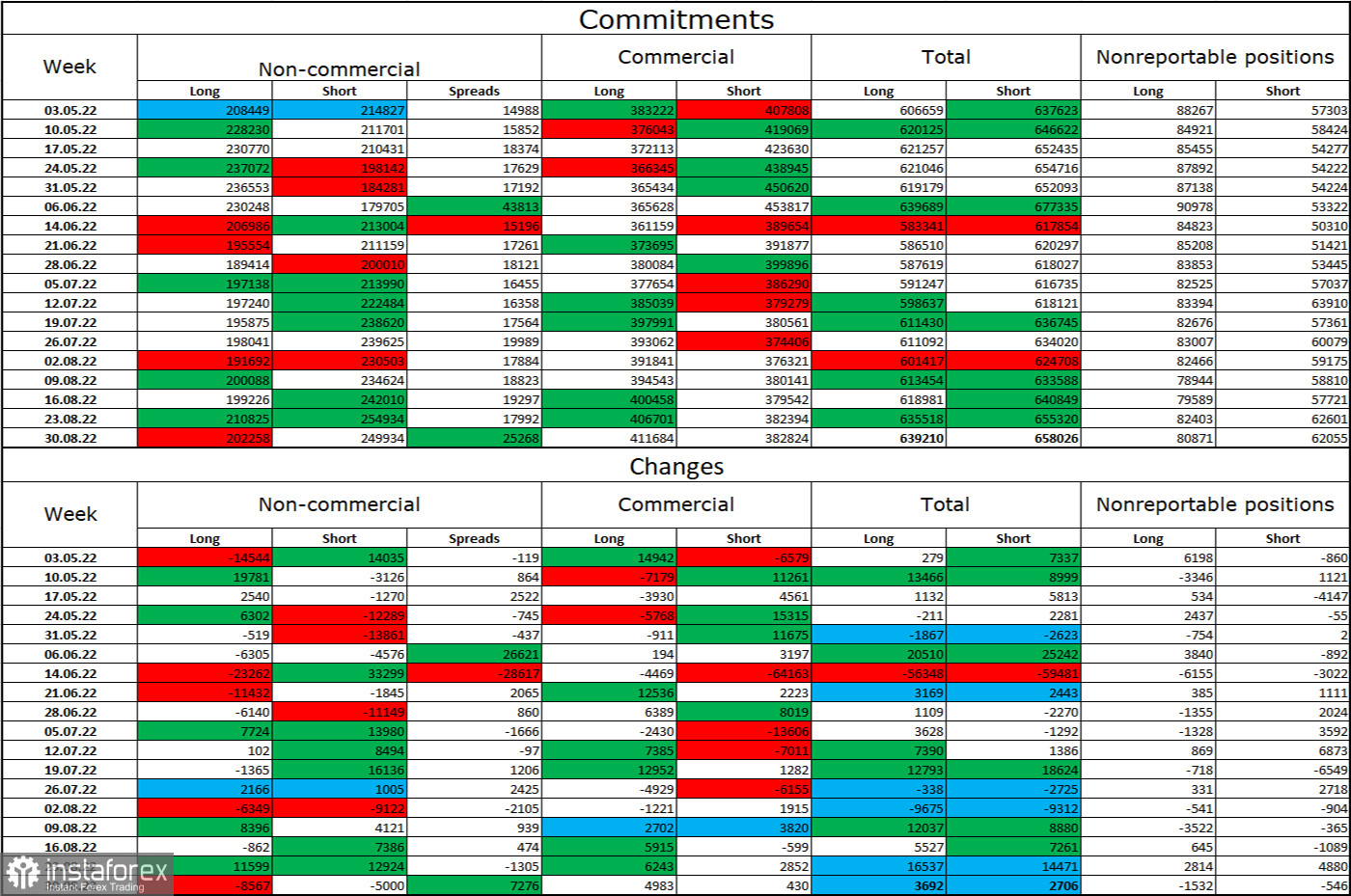

COT report:

Speculators closed 8,567 long contracts and 5,000 short contracts last reporting week. This means that the bearish sentiment of major players has strengthened again. Moreover, the total number of long contracts held by speculators is now 202,000, while the number of short contracts totals 249,000. The difference between these figures is still not too significant. However, bulls do not have an advantage. The euro has been gradually rising over the last few weeks. Nevertheless, the latest COT reports show that the bulls do not strengthen their positions. The euro has failed to show a steady growth during the last 7-8 weeks. Therefore, it is unlikely to rise dramatically in the near future. I believe the EUR/USD pair will continue falling according to the COT report.

US and EU economic news calendar:

EU - Services PMI (08-00 UTC).

EU - Composite PMI (08-00 UTC).

EU - Retail Sales (09-00 UTC).

On September 5, all the reports were released. Only the EU economic calendar contained some significant data. Today, the news background affected traders' sentiment slightly in the morning. Moreover, there will be no news in the afternoon.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair at the close below the sideways channel on the hourly chart with a target of 0.9782. These trades can be held now. I recommend buying the euro at consolidation above the descending channel on the 4H chart with the target 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română