EUR/USD

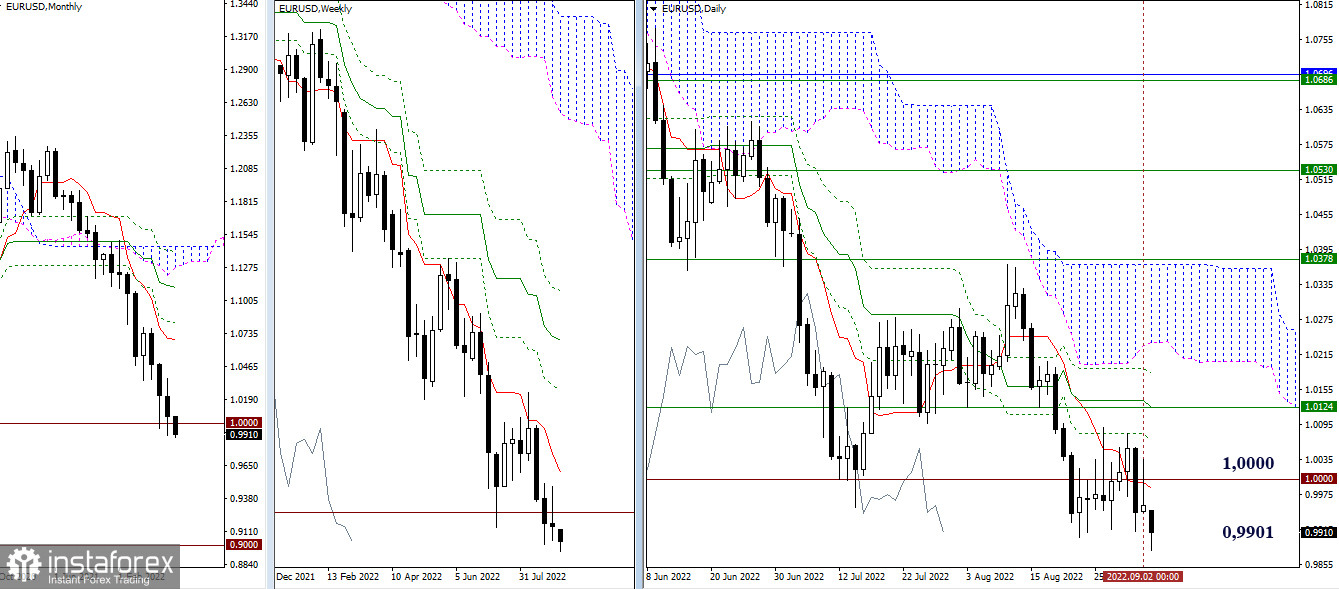

Higher timeframes

Bears dominate the market at the opening of today's trading, updating the low of 0.9901. In the case of consolidation and restoration of the downward trend, the reference points for the decline can be considered the levels of 0.9000 (psychological level) and 0.8225 (minimum extremum of 2000). If the bears cannot hold below 0.9901 and return to the consolidation zone, then after gaining the boundaries of 0.9984 (daily short-term trend) and 1.0000 (psychological level), we can expect that bulls will try to go beyond the existing zone uncertainty and develop a full-fledged corrective movement. The targets of the further rise will be the elimination of the daily death cross (1.0066 - 1.0124 - 1.0181) and gaining support from the weekly short-term trend (1.0124).

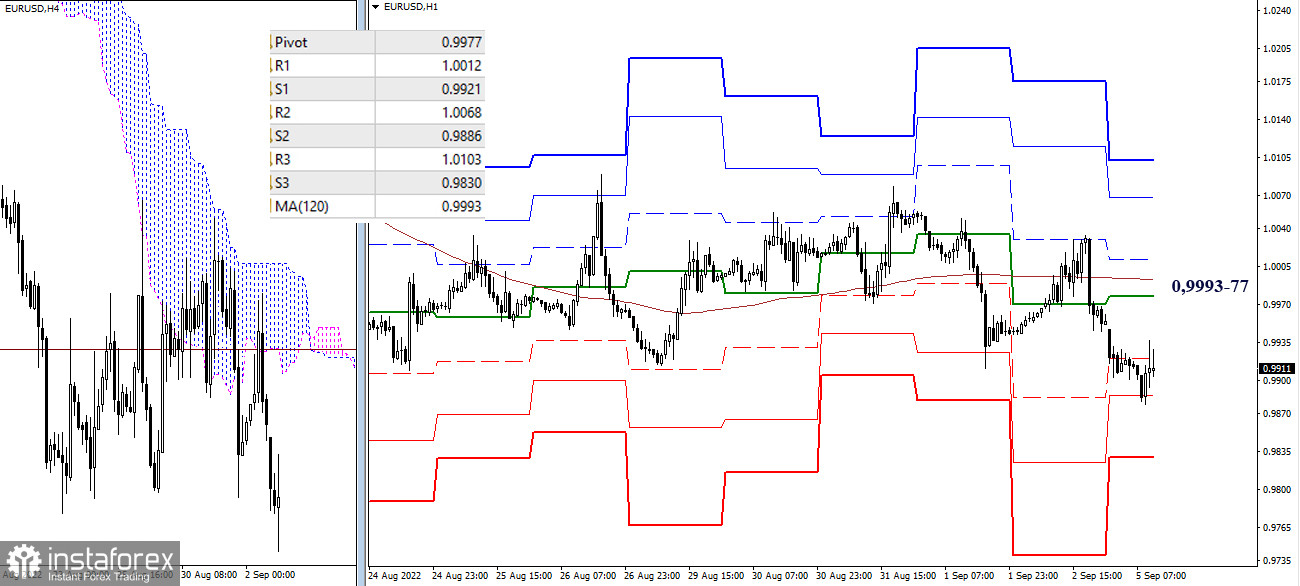

H4 – H1

Bears also hold the advantage on the lower timeframes as the market is currently operating below key levels. By now, the S2 support (0.9886) has been tested, the reference point is the S3 support (0.9830). Key levels today join forces in the area of 0.9993–77 (central pivot point + weekly long-term trend). Consolidation above will change the current balance of power, returning the advantage to the bulls. Upward targets within the day are now at 1.0012 - 1.0068 - 1.0103.

***

GBP/USD

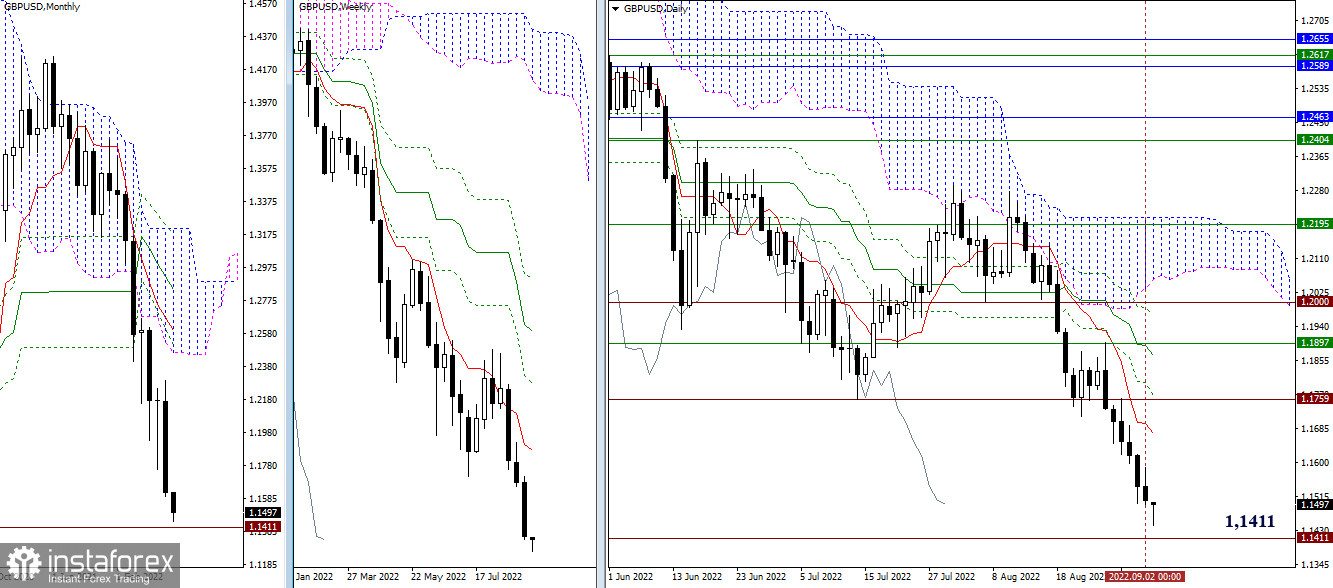

Higher timeframes

Bears started the new working week with a new low (1.1495) and a decline into the zone of attraction and influence of the historical support at 1.1411. The formed result of interaction with the level of 1.1411 will most likely determine the prospects for further developments in the current situation.

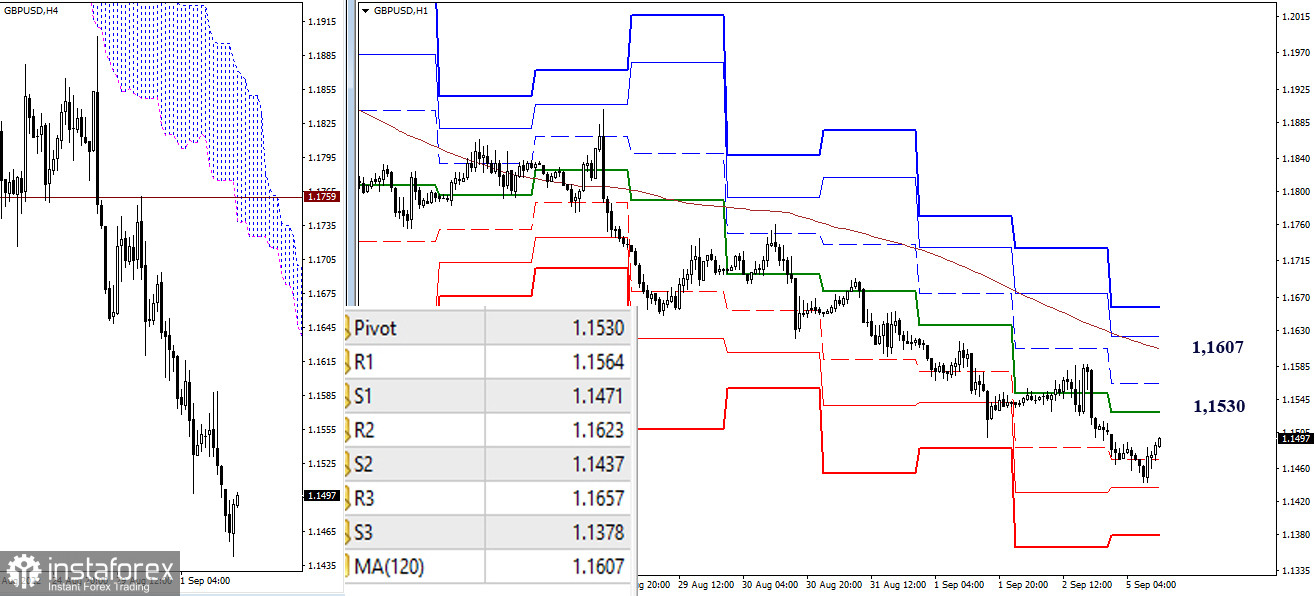

H4 – H1

In the lower timeframes, the advantage is on the side of the bears. Two of the three supports of the classic pivot points (1.1471 – 1.1437) have been tested, leaving S3 (1.1378) in reserve for a decline. The nearest reference point for the current upward correction is the central pivot point (1.1530), then the intermediate resistance can be noted at 1.1564 (R1), but the key value belongs to the resistance of the weekly long-term trend (1.1607).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română